- United States

- /

- Banks

- /

- NYSE:C

Citigroup (C) Partners With Ant International For Enhanced FX Solutions In Aviation Industry

Reviewed by Simply Wall St

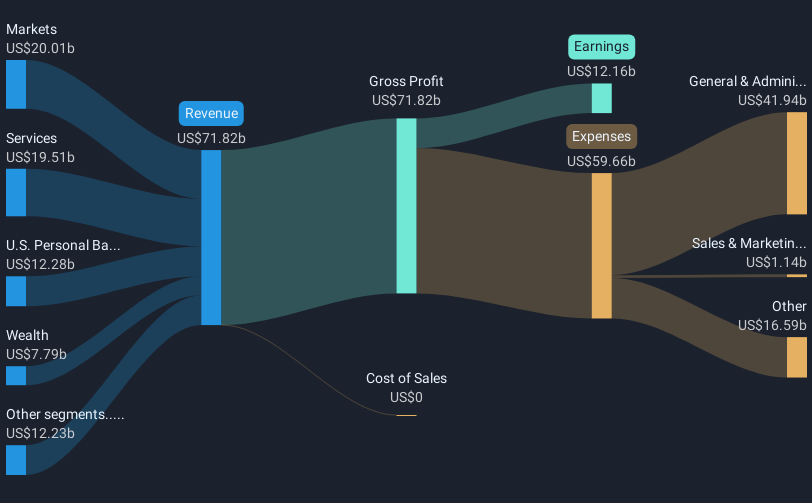

Citigroup (C) recently initiated a pilot FX risk management solution with Ant International, targeting the aviation industry’s payment challenges. Over the last quarter, Citigroup’s share price rose by 48%, significantly outperforming the broader market rise of 15% over the past year. This impressive performance can be partly attributed to the company’s strong earnings report, where net income increased from the previous year, and its active share buyback strategy. Additionally, the inclusion of Citigroup in various Russell indices and multiple dividends announcements likely provided further momentum to the stock’s gains.

Buy, Hold or Sell Citigroup? View our complete analysis and fair value estimate and you decide.

The recent announcement of Citigroup's pilot FX risk management solution with Ant International highlights its ongoing efforts to address challenges in the aviation industry's payment systems. This initiative could have positive implications on Citigroup's revenue and earnings forecasts, as it aligns with the company's strategic focus on innovation and client acquisition, potentially enhancing operational efficiency and widening profit margins.

Over a five-year period, Citigroup's shareholders enjoyed a total return of 118.37%. This longer-term performance underscores the company's ability to generate value through market cycles, despite the challenges it faces due to economic and geopolitical uncertainties. Over the past year, Citigroup outperformed the broader market, delivering returns above the market's 15% increase.

When examining the current share price of US$93.45 relative to the consensus price target of approximately US$99.12, there remains a modest discount of approximately 6%. The company's recent achievements and strategic initiatives may influence analysts’ projections, potentially resulting in upward revisions to revenue and earnings estimates. Nonetheless, it's important to continuously assess the impact of macroeconomic factors, regulatory changes, and trade challenges that could alter these forecasts.

Evaluate Citigroup's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives