- United States

- /

- Banks

- /

- NYSE:C

Citigroup (C): Assessing Valuation After Capital Structure Moves and Leadership Changes

Reviewed by Simply Wall St

Citigroup (C) just moved a key piece on its balance sheet, redeeming $1.5 billion of Series W preferred stock while simultaneously issuing fresh senior notes and reshuffling leadership to support growth in core franchises.

See our latest analysis for Citigroup.

The balance sheet moves, along with fresh senior note issuance and leadership hires in Japan and prime services, come as momentum clearly builds, with a roughly mid 50 percent year to date share price return and a similarly strong one year total shareholder return backing the story.

If Citi’s run has you thinking about where else capital is rotating in financials, this could be a good moment to scan fast growing stocks with high insider ownership for the next set of potential outperformers.

With Citi trading just below most analyst targets despite a strong rerating, investors now face a key question: is this still a discounted restructuring story, or has the market already priced in the next leg of growth?

Most Popular Narrative: 53.3% Undervalued

According to ChadWisperer, the narrative fair value of roughly $230 sits well above Citi’s last close near $109. This frames a bold upside case built on structural earnings power rather than a simple cyclical rebound.

The Citi Token Services platform, expanding into more markets and applications like tokenized deposits and crypto custodial solutions, is expected to unlock entirely new, high margin revenue streams by redefining cross-border payments and liquidity management for its vast institutional client base. Simultaneously, sustained share gains in Investment Banking, propelled by strategic talent investments and a focus on high growth sectors like tech and healthcare, will add significant fee income.

Curious how stablecoins, double digit earnings growth and a future profitability step change combine into that punchy fair value target, the narrative’s detailed forecasts connect all the dots but keep one crucial assumption hidden in plain sight.

Result: Fair Value of $230 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stablecoin regulation could stall or tighten unexpectedly, and Citi’s multi-year transformation might slip on execution and delay the anticipated earnings inflection.

Find out about the key risks to this Citigroup narrative.

Another Angle on Value

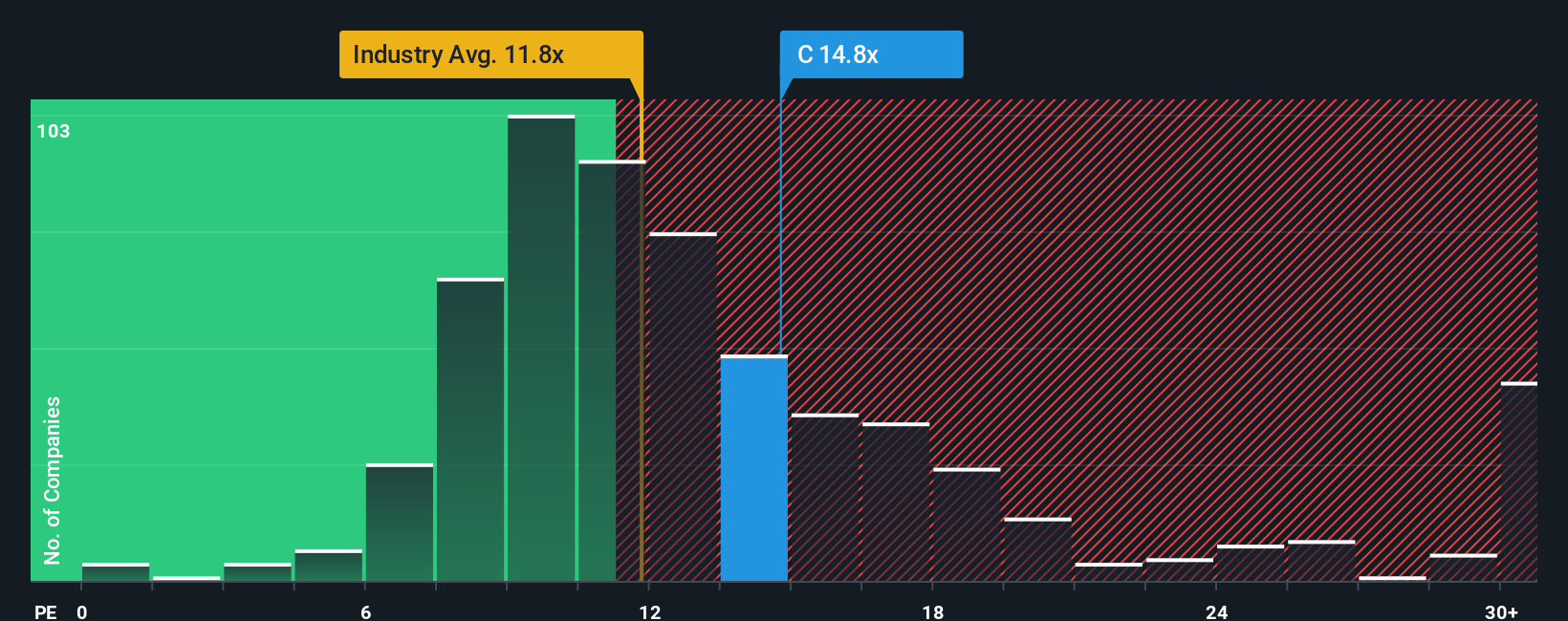

Look past the narrative of fair value and Citi already appears on the pricey side, trading on 14.5x earnings versus 13.1x for peers and 11.6x for the wider US banks, while our fair ratio sits higher at 16.8x. Is this a margin of safety or just thinner upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citigroup Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citigroup.

Looking for more investment ideas?

If you stop with Citi, you could miss out on other potential setups. Use the Simply Wall Street Screener to explore additional opportunities.

- Capitalize on potential mispricings by targeting quality businesses trading at a discount through these 908 undervalued stocks based on cash flows before the crowd catches on.

- Tap into the AI infrastructure wave by hunting scalable innovators shaping data, automation, and productivity with these 26 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers and growing yields via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026