- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH): Assessing Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

Bank of Hawaii (BOH) shares came under slight pressure today, dipping after a period of relative stability over the past week. This move has some investors curious about how the bank’s fundamentals stack up in the current environment.

See our latest analysis for Bank of Hawaii.

After a choppy start to the year, Bank of Hawaii’s share price has softened lately, but the underlying trend says more about longer-term resilience. While the stock is down 7.2% year-to-date by share price, its total return over the past year is a healthy 5.7%, and investors with a five-year view have seen gains of nearly 48% when including dividends. Momentum may be muted in the short term, but patient holders have been rewarded.

If you’re looking to expand your search beyond the banking sector, now’s a timely chance to explore fast growing stocks with high insider ownership.

But with Bank of Hawaii trading at a notable discount to analyst targets and showing solid underlying growth, is the market overlooking its potential? Or is all future upside already reflected in today’s price?

Most Popular Narrative: 7.8% Undervalued

The most closely watched narrative pegs Bank of Hawaii’s fair value above the current share price, suggesting there is a gap investors are not yet bridging. Anticipated growth in earnings and revenues is seen as central to this valuation, setting the backdrop for a potential re-rating if expectations are met.

Ongoing digital transformation and sustained investments in digital banking platforms are expected to enhance operational efficiency, improve customer acquisition and retention, and support controlled expense growth, boosting long-term net margins.

What is behind this bullish outlook? The narrative leans on a mix of operational upgrades and steady margin expansion. However, the key story lies in a bold forecast for future profits. Want to see which growth drivers and financial turning points could unlock that upside? Find out what gives weight to these projections inside the full narrative.

Result: Fair Value of $70.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Bank of Hawaii’s concentration in local real estate and the potential for rising funding costs could challenge the bullish outlook if conditions worsen.

Find out about the key risks to this Bank of Hawaii narrative.

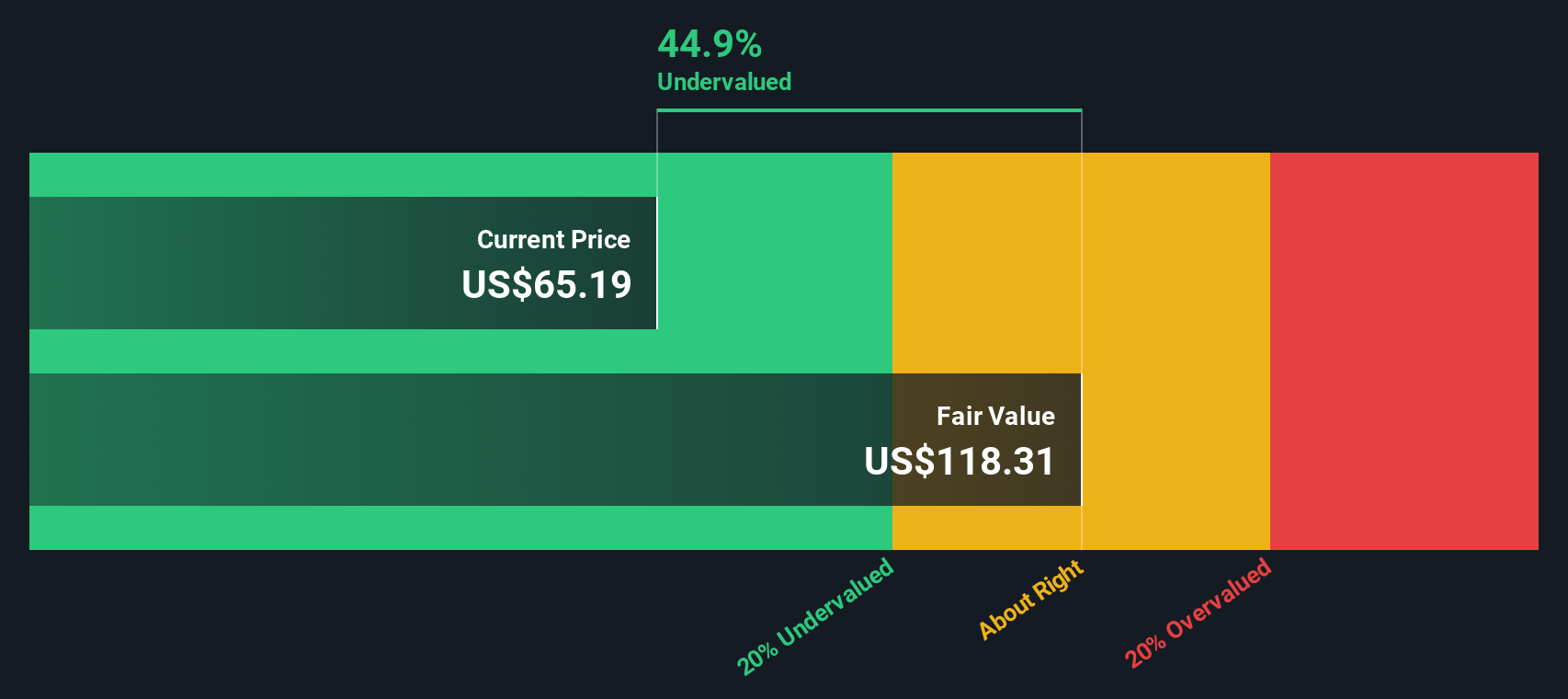

Another View: Our DCF Model Suggests Deeper Value

While analyst price targets see Bank of Hawaii as only modestly undervalued, our SWS DCF model offers another perspective. By projecting out future cash flows, this approach implies a fair value nearly 37% above the current share price. Could the market be missing a bigger opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bank of Hawaii Narrative

If you want to challenge the consensus or prefer your own research, you can dive into the numbers and build your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Hawaii.

Looking for more investment ideas?

Why limit your options to just one sector? Seize this opportunity to get ahead by tapping into other high-potential stocks hand-picked by our screeners.

- Unlock the smartest AI breakthroughs by joining investors tracking these 25 AI penny stocks in artificial intelligence and automation technologies.

- Grow your portfolio income with these 19 dividend stocks with yields > 3%, featuring companies delivering reliable dividends and strong yield potential.

- Take a bold step into tomorrow by reviewing these 26 quantum computing stocks, which highlights pioneering quantum computing companies redefining innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives