- United States

- /

- Banks

- /

- NYSE:BKU

A Look at BankUnited’s (BKU) Valuation After New CFO Appointment and Earnings Beat

Reviewed by Simply Wall St

BankUnited (BKU) has announced James G. Mackey as its new Chief Financial Officer, while former CFO Leslie N. Lunak will remain as executive advisor until early 2026. This leadership change comes as the company’s recent quarterly earnings surpassed forecasts.

See our latest analysis for BankUnited.

After a steady start to the year, BankUnited’s 7% gain in the last month suggests momentum is building, as investors respond positively to stronger earnings and the fresh outlook from a new CFO. The total shareholder return sits at 3% for the past year, with a notable 59% five-year total return reflecting the bank’s longer-term value creation despite the ups and downs along the way.

If news of leadership change and solid gains has you curious about other opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With BankUnited’s shares inching closer to analyst targets but still trading at a notable discount to intrinsic value, the key question is whether there is room for further upside or if the market has already anticipated the bank’s next phase of growth.

Most Popular Narrative: 3.7% Undervalued

With BankUnited’s fair value estimated at $42.02, just above the most recent close of $40.48, the narrative suggests modest undervaluation and room for gains if analyst assumptions play out.

Management's disciplined pricing, focus on business mix, and ongoing improvement in deposit cost structure have produced margin expansion even in a stable rate environment. This suggests room for further net interest margin and earnings growth as legacy low-yield loans reprice.

What is behind this strategic optimism? Could a simple change in funding costs spark significant margin growth? The narrative’s future scenario, banking on shifting loan yields, stable costs, and sharply better profitability, is not what the market expects. Find out what key assumption elevates this valuation call and why it could trigger a major market rethink.

Result: Fair Value of $42.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persisting credit quality issues in office-related commercial real estate or a sudden slowdown in deposit growth could quickly derail these optimistic projections.

Find out about the key risks to this BankUnited narrative.

Another View: Price Ratios Tell a Different Story

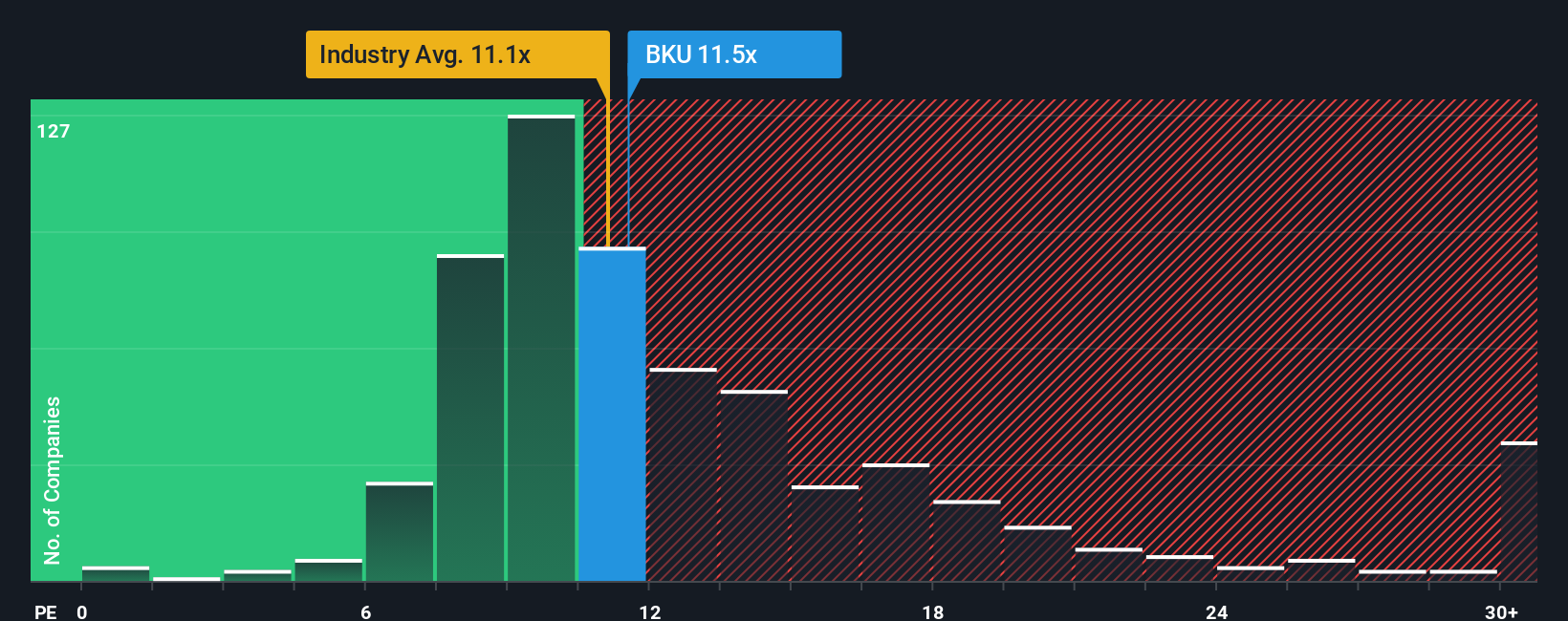

Looking through the lens of price-to-earnings, BankUnited trades at 11.5x, slightly above the US Banks industry average of 11.1x but below its peer group at 12.4x. However, this sits higher than the fair ratio of 10.8x, suggesting valuation may already reflect much of the upside. Is the current premium justified, or does it signal limited room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BankUnited Narrative

If you see things differently or want to follow your own reasoning, you can dig into the numbers and shape your own story in just a few minutes with Do it your way

A great starting point for your BankUnited research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. Make your next move count by checking out these handpicked lists before the market leaves you behind.

- Spot companies paying out healthy returns. Tap into these 16 dividend stocks with yields > 3% and grow your income with yields over 3%.

- Capitalize on tomorrow's tech trends by zeroing in on these 24 AI penny stocks that are leading AI-driven innovation in their industries.

- Take advantage of undervalued gems. See these 865 undervalued stocks based on cash flows for stocks with cash flows signaling real upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankUnited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKU

BankUnited

Operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives