- United States

- /

- Banks

- /

- NYSE:BAP

Assessing Credicorp's (NYSE:BAP) Valuation After Recent Momentum and Market Interest

Reviewed by Simply Wall St

See our latest analysis for Credicorp.

Crecicorp's share price has quietly built momentum this year, with a 42.7% return since January highlighting investors’ increased confidence. Over the last twelve months, total shareholder return stands at 48%, and three- and five-year total returns show even stronger compounding, which points to long-term value growth.

If you're thinking about branching out, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

This raises a key question: does Credicorp's strong track record and recent climb mean the shares are still undervalued, or has the market already factored in its growth prospects, leaving little room for upside?

Most Popular Narrative: 3.4% Undervalued

With Credicorp's fair value estimated at $271.65, just above its last close of $262.52, the current market price appears slightly below what the leading narrative argues is justified.

Ongoing investments in digital platforms, AI, and end-to-end automation are boosting operational efficiency, enabling scalable service delivery with lower marginal costs, which is expected to further improve the group's net margin as revenue from digital channels grows.

What’s fueling that target price? The narrative pulls back the curtain on an audacious plan: digital disruption, fatter margins, and a future earnings forecast that shifts expectations. The secret drivers behind the fair value might surprise you. Get the whole story straight from the source.

Result: Fair Value of $271.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on Peru and ambitious expansion into higher-risk lending could challenge Credicorp’s margin stability if economic or regulatory surprises arise.

Find out about the key risks to this Credicorp narrative.

Another View: What Does the Market Multiple Say?

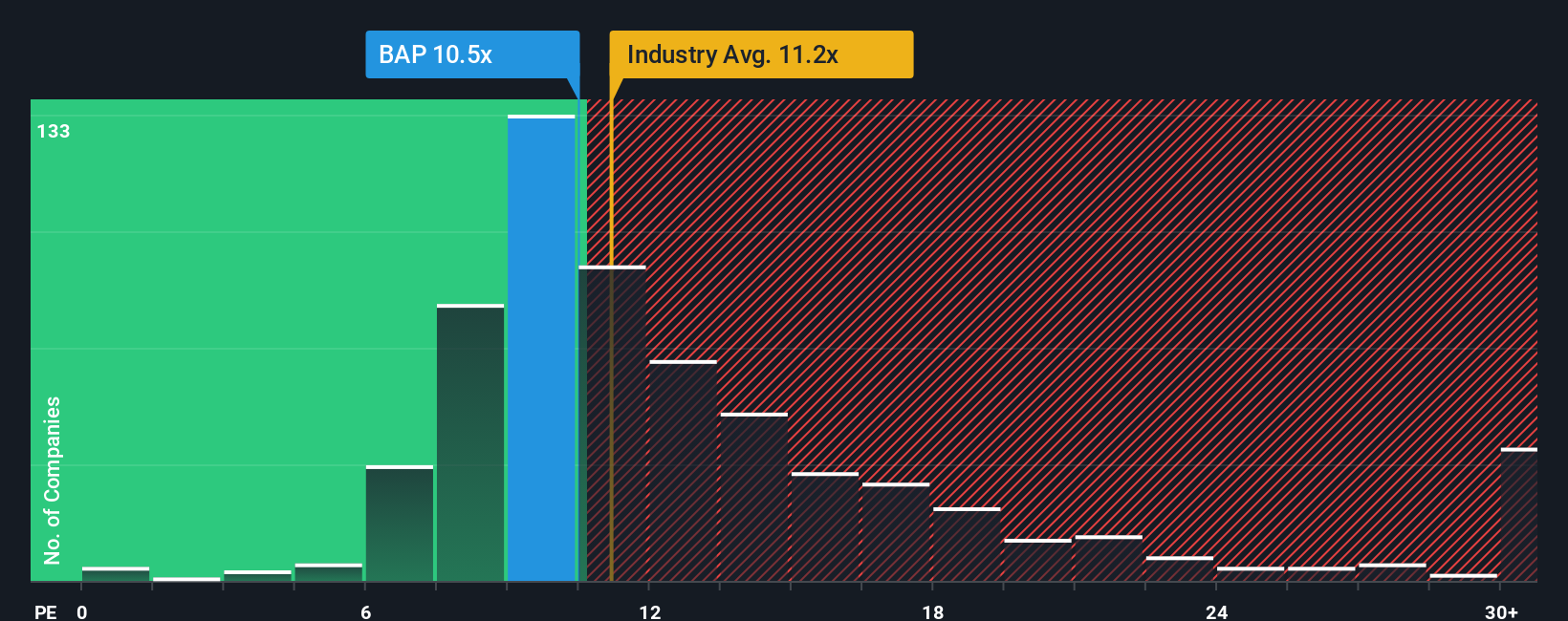

Looking at Credicorp's current price-to-earnings ratio of 11.2x, it is almost identical to the US Banks industry average, suggesting investors are valuing the stock in line with its peers. Compared to the peer group average of 14.6x and a fair ratio of 12.5x, however, there appears to be some room for positive re-rating if sentiment shifts.

Does this narrow gap mean the market is playing it safe, or could an upside surprise be in store if Credicorp continues to outperform?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credicorp Narrative

If you see things differently or want to dig into the data your own way, creating your own perspective takes less than three minutes. Do it your way

A great starting point for your Credicorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Give your portfolio an edge by checking out more unique stock ideas tailored to different strategies and growth themes.

- Uncover hidden value and tap into potential market winners by exploring these 881 undervalued stocks based on cash flows, which highlights companies currently priced below their intrinsic worth.

- Secure dependable passive income streams by reviewing these 14 dividend stocks with yields > 3%, offering yields over 3% and financial resilience in every market cycle.

- Stay ahead of cutting-edge technology trends by targeting these 27 AI penny stocks, with innovation that could transform industries and drive the next wave of growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAP

Credicorp

Provides various financial, insurance, and health services and products in Peru and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives