- United States

- /

- Banks

- /

- NYSE:ASB

Associated Banc-Corp (ASB): Assessing Valuation After Dividend Hike and Minneapolis Flagship Branch Launch

Reviewed by Simply Wall St

Associated Banc-Corp (ASB) raised its quarterly dividend and unveiled a new, larger branch in downtown Minneapolis. These moves highlight confidence in business momentum and an ongoing focus on growth and shareholder value.

See our latest analysis for Associated Banc-Corp.

Amid recent news of a higher dividend and a flagship branch opening in Minneapolis, Associated Banc-Corp's share price has climbed 8.4% year-to-date, with some short-term volatility but solid momentum building. While the latest 1-year total shareholder return is slightly negative at -1%, the five-year total return stands out at over 100%, showing real long-term value creation despite brief ups and downs.

If these bank moves have you wondering what else the market has to offer, it could be a smart time to broaden your perspective and explore fast growing stocks with high insider ownership

With ASB shares still trading at a notable discount to analyst price targets, but recent gains reflecting renewed optimism, investors now face a key question: Is Associated Banc-Corp truly undervalued, or is future growth already reflected in the price?

Most Popular Narrative: 12% Undervalued

When stacked against the most widely followed narrative's fair value estimate, Associated Banc-Corp's last close price appears much lower. This sets the stage for a focused look at the numbers that matter most to analyst consensus.

Ongoing organic customer acquisition, demonstrated by record primary checking household growth, and effective new RM hiring is fueling strong core deposit inflows. This supports lower funding costs, reduces reliance on wholesale funding, and enhances net interest margin. These trends are likely to increase revenue and improve net margins.

Curious what bold financial forecasts are hiding behind this valuation? The secret sauce is in the assumptions about revenue and profit growth that drive this price target. Eager to see the numbers that challenge expectations? Hit the narrative for the surprising financial projections behind the headline fair value.

Result: Fair Value of $29.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Midwest commercial real estate weakens or competition for deposits intensifies, Associated Banc-Corp's growth story could face unexpected pressure.

Find out about the key risks to this Associated Banc-Corp narrative.

Another View: The Valuation Multiple Story

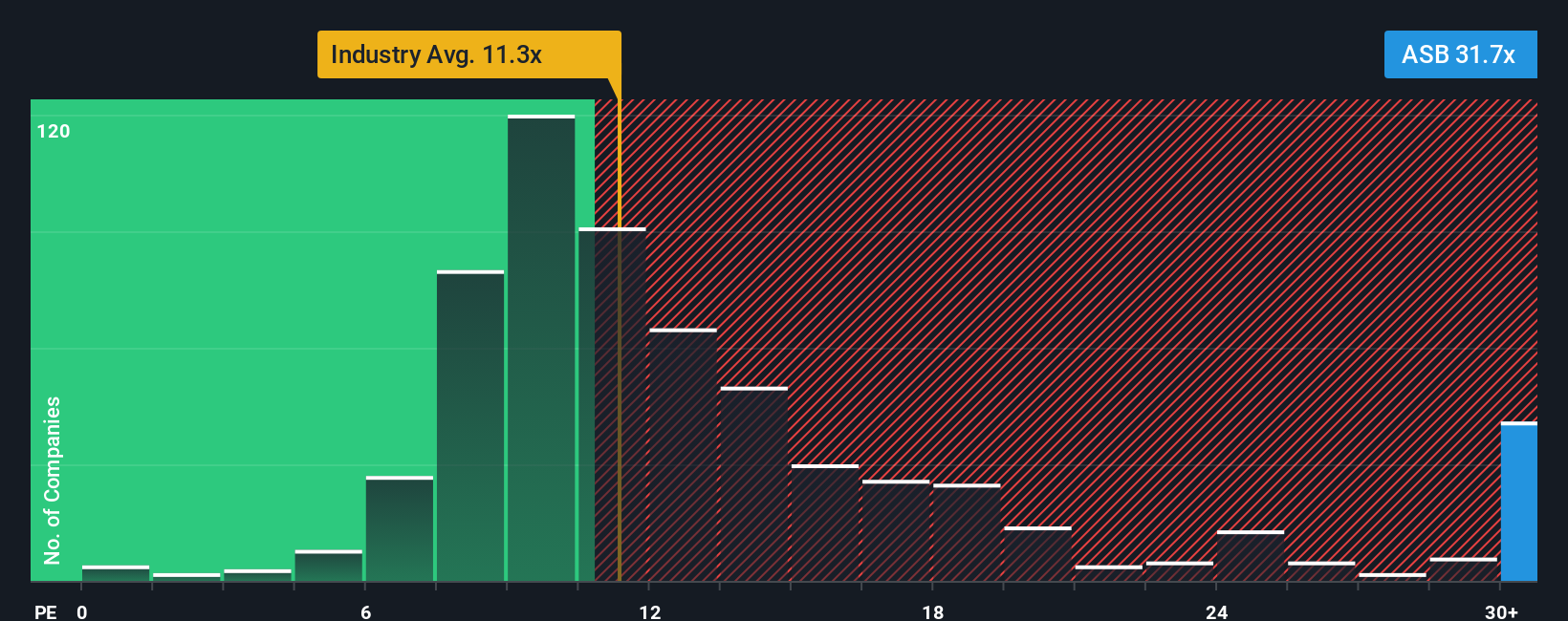

While the narrative points to undervaluation, the market's go-to ratio paints a different picture. Associated Banc-Corp trades at a 25.5x P/E, well above both the US banks industry average of 11x and the peer average of 22.8x, and notably higher than the fair ratio of 16.2x. This gap suggests that, at least by typical benchmarks, the current price bakes in a lot of optimism. It could pose valuation risk if growth does not materialize as expected. What does this gulf between models imply for investors weighing their next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Associated Banc-Corp Narrative

If you'd rather dive into the numbers and reach your own conclusions, you can assemble a personal narrative from the data in just a few minutes. Do it your way

A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let this momentum stop with one stock. Make smarter, faster investing moves by checking out handpicked ideas you won’t want to miss:

- Capture higher yields by screening for steady income possibilities with these 16 dividend stocks with yields > 3%, offering payout potential well above market average.

- Spot the early growth stories shaping tomorrow’s tech landscape and see which companies dominate breakthroughs in automation via these 24 AI penny stocks.

- Tap into tomorrow’s hidden gems by zeroing in on value-packed opportunities through these 870 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives