- United States

- /

- Banks

- /

- NYSE:ASB

A Fresh Look at Associated Banc-Corp (ASB) Valuation Following Recent Shifts in Investor Sentiment

Reviewed by Simply Wall St

Associated Banc-Corp (ASB) shares have seen mixed results lately, with some short-term declines balanced by gains over the past month. Investors are watching for catalysts that might clarify the next direction for the stock.

See our latest analysis for Associated Banc-Corp.

Momentum around Associated Banc-Corp has varied, with the stock’s recent 1-month share price return of 4.3% reflecting some renewed investor optimism after a slower stretch. Looking at the broader picture, the 1-year total shareholder return is up 1.8%, indicating a longer-term pattern of steady if modest progress for investors.

If you’re curious about where else financial momentum is taking shape, consider broadening your search and uncovering opportunities with fast growing stocks with high insider ownership

With shares still trading about 12% below analyst consensus targets and fundamentals showing double-digit growth in both revenue and net income this year, investors must ask whether the stock is undervalued now or if future gains are already accounted for.

Most Popular Narrative: 11.5% Undervalued

Associated Banc-Corp’s most popular narrative points to a higher fair value than the recent closing price, reflecting underlying optimism around business growth and future profitability. This sets the stage for the bold financial projections driving the narrative's upside expectations.

The company's strategic pivot toward growing commercial and industrial (C&I) lending, replacing lower-yielding residential balances with higher-yielding, relationship-focused assets, is driving record net interest income and margin expansion. This positions the balance sheet for sustained profitability growth and is likely to positively impact revenue and net margins.

Want a peek behind the numbers? The narrative hinges on ambitious projections for top-line growth and margin expansion, anchored by plans that may surprise you. Discover what could fuel that next move and why some forecasts look out of reach.

Result: Fair Value of $29.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as regional economic headwinds and tighter competition for deposits could quickly dampen the positive outlook and challenge future growth assumptions.

Find out about the key risks to this Associated Banc-Corp narrative.

Another View: How Valuation Ratios Tell a Different Story

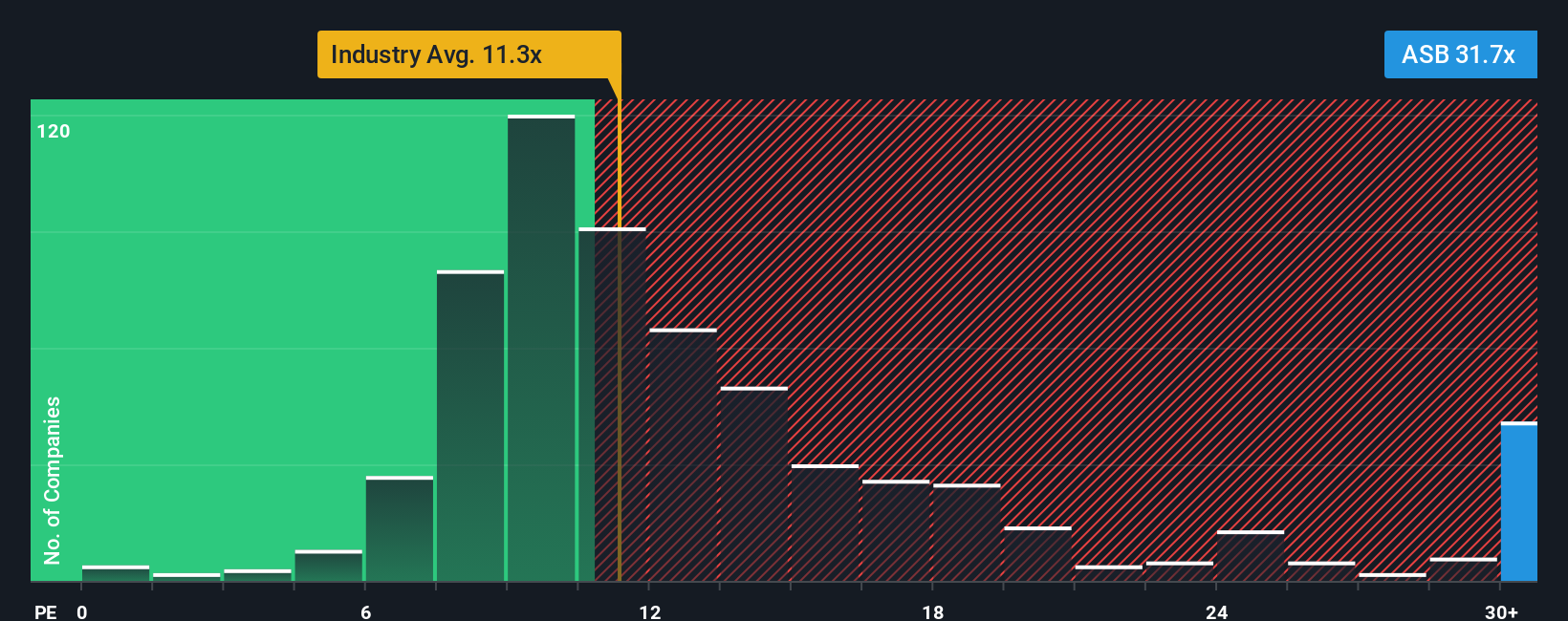

Looking at valuation through the lens of the price-to-earnings ratio, a more cautious picture emerges. Associated Banc-Corp currently trades at 25.8x earnings, well above both its peer average (19x) and the broader US Banks industry (11.4x). This gap suggests less margin of safety and may signal valuation risk as investors weigh if the current price already reflects future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Associated Banc-Corp Narrative

If you think there’s more to the story or want to dive deeper into the numbers yourself, you can quickly build your own narrative and perspective. Do it your way.

A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop here when some of the market’s most exciting opportunities are only a click away? Supercharge your watchlist and stay ahead of the curve with investment ideas tailored to your interests.

- Spot high-potential turnarounds by checking out these 3565 penny stocks with strong financials with strong finances making waves in undervalued corners of the market.

- Amplify your portfolio’s dividend income by tapping into these 14 dividend stocks with yields > 3% delivering consistently attractive yields above 3%.

- Explore the future of healthcare by looking into these 30 healthcare AI stocks offering innovations at the intersection of medicine and AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026