- United States

- /

- Banks

- /

- NasdaqGS:UVSP

Univest Financial (UVSP) Margin Gains Reinforce Value Narrative Despite Modest Growth Outlook

Reviewed by Simply Wall St

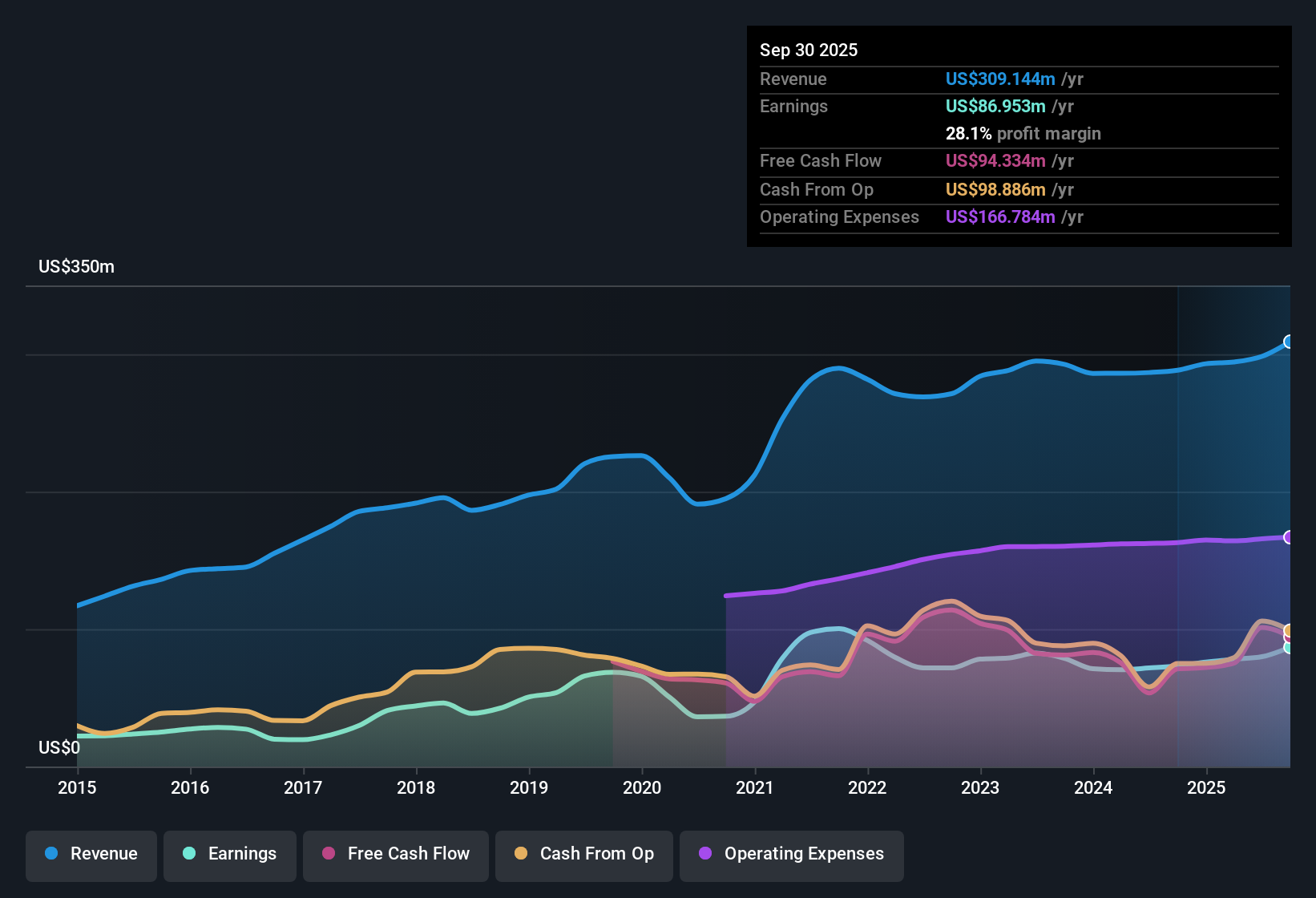

Univest Financial (UVSP) has posted a net profit margin of 28.1%, up from 25.4% a year ago, and reported profit growth of 18.7% over the past year, well above its five-year average annual earnings growth rate of 2.5%. The company’s outlook includes forecast annual earnings growth of 2.1% and revenue growth of 5.8% per year, both trailing respective US market averages. Investors are weighing a strong margin story and steady, if modest, long-term growth potential as they digest these results.

See our full analysis for Univest Financial.Next, we compare these latest numbers with wider community narratives to reveal where the consensus stands strong and where the new results might attract attention.

See what the community is saying about Univest Financial

Analyst Price Target: Only 5% Above Market

- Univest Financial's analyst consensus price target is $32.50, just 5% above the current share price of $30.95. This suggests analysts view the shares as fairly valued with limited upside in the near term.

- Analysts' consensus view is that population growth and regional development may lift commercial activity, loan, and deposit growth, but elevated credit risk and slow digital transformation could limit outperformance.

- Exposure to regional infrastructure projects is expected to increase future loan demand and revenue, supporting margin strength.

- However, intensifying deposit competition and rising funding costs could compress net interest margins as competitors advance more rapidly in digital transformation.

PE Ratio Discount vs Peers and Industry

- Univest is trading at a price-to-earnings ratio of 10.3x, which is notably lower than both the US Banks industry average (11.2x) and its direct peer group (20.3x), highlighting its relative value.

- According to the consensus narrative, the combination of "good value" and strong margin performance stands out against peers. However, modest growth forecasts suggest that a re-rating depends on improving longer-term profit expansion.

- While margins and profitability quality are strong, top-line growth forecasts of 2.1% earnings growth per year trail industry averages, limiting broader rerating for now.

- Analysts note that share buybacks and prudent expense growth are positive for shareholder returns, but the absence of aggressive M&A or rapid digital adoption may restrain valuation gains compared to faster-moving banks.

DCF Fair Value Sits Nearly 50% Above Market

- Univest's shares are currently trading at $30.95, well below the DCF fair value estimate of $46.98, representing the largest valuation gap identified, though analysts remain cautious about upgrading targets at this time.

- The consensus narrative recognizes this disconnect and suggests that while valuation is appealing, continued slow earnings growth and only modest price target upside may prevent the market from closing the gap in the near future.

- Ongoing share buybacks and profitability support the value case, but persistent risks from credit events and slow deposit growth may slow the pace at which this valuation gap is addressed.

- Consensus suggests that fair value could move higher only if Univest accelerates digital adoption and better capitalizes on regional opportunities.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Univest Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and build your own narrative in just a few minutes by clicking Do it your way.

A great starting point for your Univest Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Univest Financial faces limited long-term earnings growth and may struggle to outpace peers because of slow digital adoption and modest expansion outlooks.

If you want companies with stronger momentum and proven, consistent progress, check out stable growth stocks screener (2101 results) and target firms that deliver reliable results every year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UVSP

Univest Financial

Operates as the bank holding company for Univest Bank and Trust Co.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives