- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Is There Now an Opportunity in UMB Financial After Digital Banking Expansion?

Reviewed by Bailey Pemberton

- Wondering whether UMB Financial is a hidden gem or already fairly priced? If you care about value, you’re in the right place to unpack where the stock stands right now.

- UMB Financial’s share price has dipped by 0.5% over the past week and slipped 0.4% over the past month, bringing its year-to-date return to -3.0%. Despite this, the stock has delivered a notable 34.8% gain over three years and an impressive 72.4% return over five years.

- Recent headlines surrounding UMB Financial have highlighted its ongoing digital banking investments and expanded presence in commercial lending. These developments may be driving some of the longer-term positive sentiment. At the same time, industry chatter about regulatory shifts is bringing both risks and opportunities into sharper focus for investors.

- Based on our checks, UMB Financial is undervalued in 4 out of 6 factors, giving it a value score of 4. We will walk through the usual valuation yardsticks next, but stick around, because there’s a better way to put it all together by the end of this article.

Find out why UMB Financial's -9.5% return over the last year is lagging behind its peers.

Approach 1: UMB Financial Excess Returns Analysis

The Excess Returns model is a valuation approach that measures how much profit a company generates above its cost of equity. This helps to determine how efficiently the company turns shareholder investments into gains, and whether those gains are sustainable as the business grows.

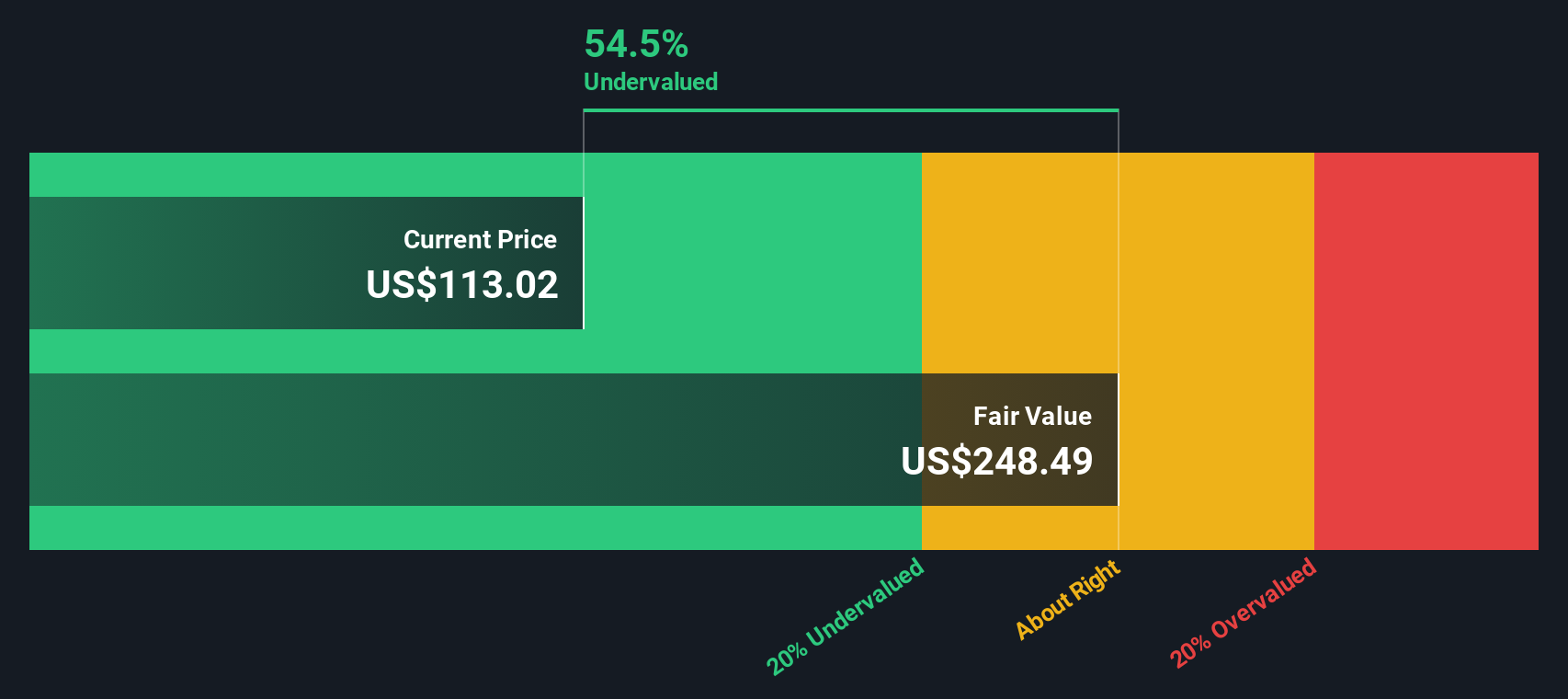

For UMB Financial, the latest analysis shows a Book Value of $94.13 per share and Stable Earnings Per Share (EPS) of $12.10, based on the weighted future Return on Equity estimates from eight analysts. The company’s Cost of Equity stands at $7.45 per share, and its Excess Return, or how much it earns beyond that cost, is $4.65 per share. The average Return on Equity is measured at an impressive 11.30%. In addition, the expected Stable Book Value is $107.08 per share, projected by nine analysts using future growth assumptions.

Plugging these factors into the Excess Returns model gives UMB Financial an estimated intrinsic value of $232.81 per share. With the current share price trading at a 53.4% discount to this valuation, the model suggests the stock is significantly undervalued at present levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests UMB Financial is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: UMB Financial Price vs Earnings

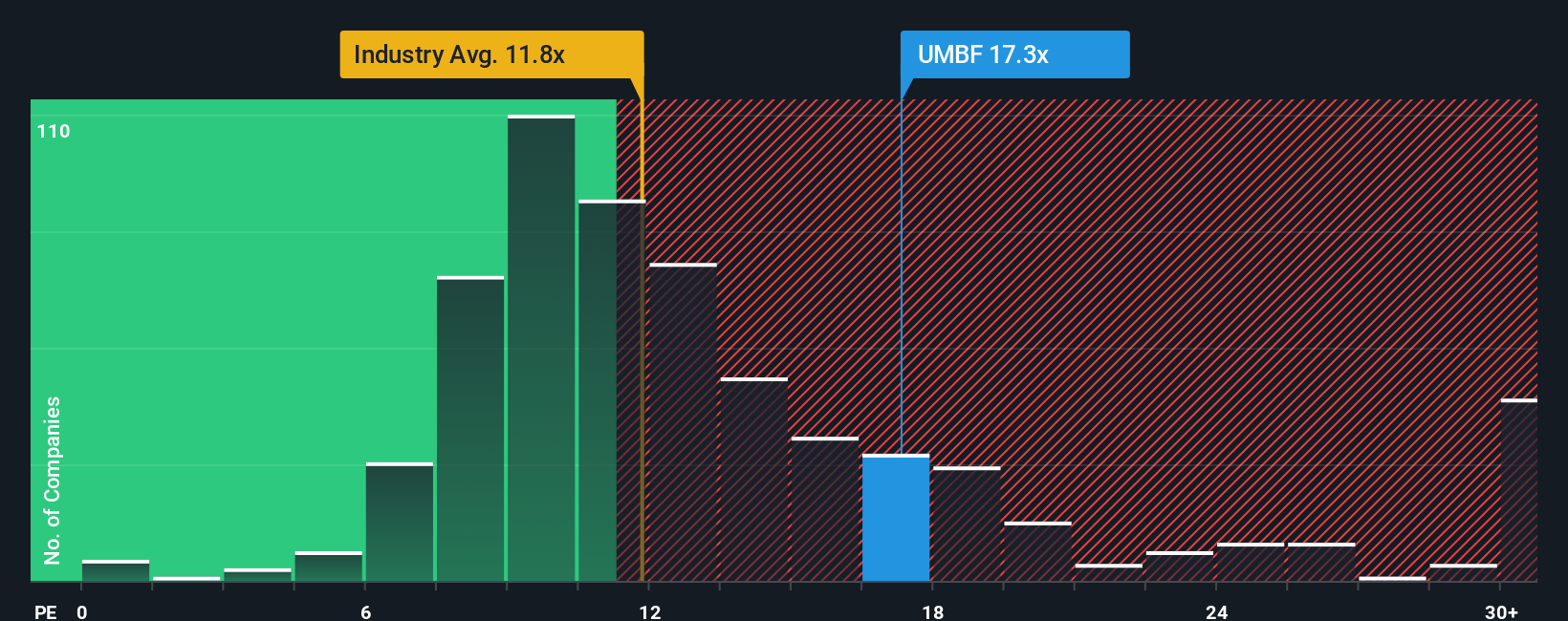

For established, profitable companies like UMB Financial, the Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics. It tells investors how much they are paying for each dollar of the company’s earnings, making it straightforward to compare across businesses with positive bottom lines.

The "right" PE ratio is shaped by expectations for a company’s future growth and the risks it faces relative to its industry. Higher growth or lower perceived risk usually justifies a higher PE multiple, while slower expected growth or higher uncertainty may pull the ratio down.

UMB Financial currently trades at a PE ratio of 13.8x. By comparison, the average PE for its industry is 11.2x and peers trade at an average of 12.7x. While this places UMB Financial above both benchmarks, it is important to consider whether these averages account for the company’s specific strengths and risks.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio, calculated as 15.1x for UMB Financial, is tailored to the company’s actual earnings growth, risk profile, margins, market cap, and industry context. This approach offers a more nuanced view than simply lining up the company against its sector or individual competitors, as it adjusts for the unique combination of factors that shape its long-term valuation.

Given that UMB Financial’s current PE ratio of 13.8x is below its Fair Ratio of 15.1x, the stock appears undervalued on this metric alone, even though raw peer and industry comparisons might suggest otherwise.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UMB Financial Narrative

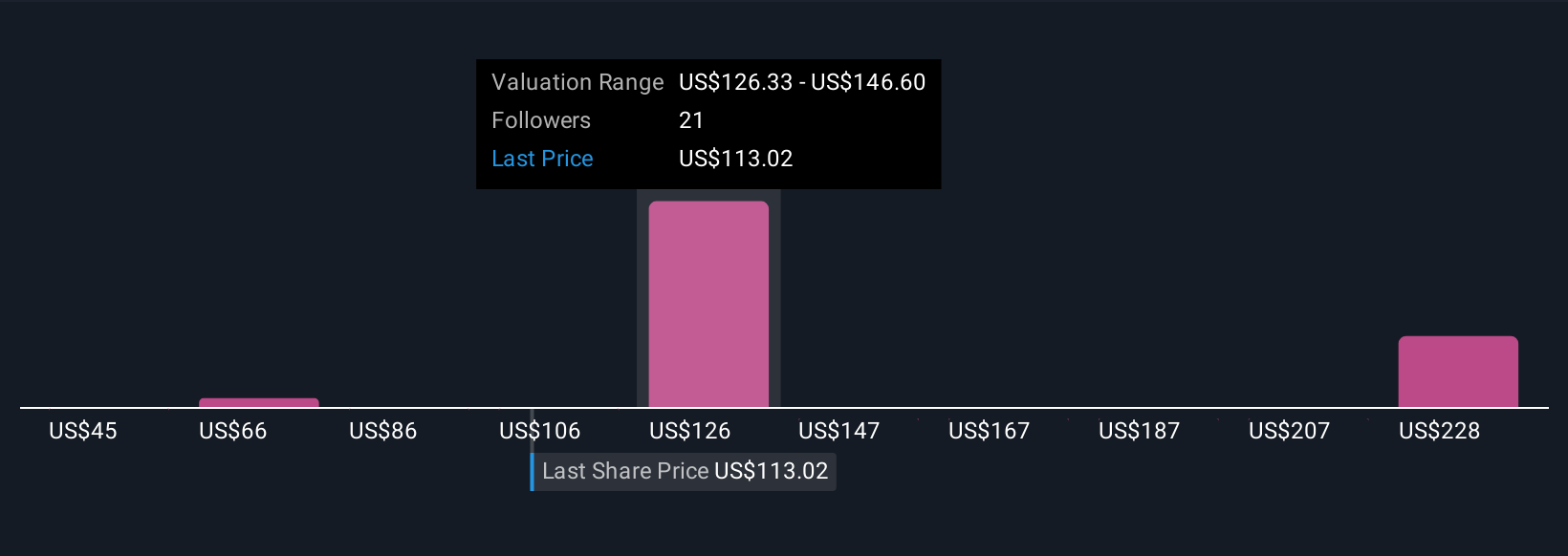

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about what drives a company’s future. This means exploring why you think it will (or will not) outperform, based on your own assumptions for things like fair value, revenue, earnings, and profit margins.

Narratives connect the story you believe about UMB Financial’s business momentum, risks, and competitive landscape to a set of realistic financial forecasts, and ultimately to a fair value that makes sense for you. On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible way to define what matters most, update their assumptions, and compare their fair value estimate with the current price to inform the decision to buy, hold, or sell.

Because Narratives update automatically when new developments occur, such as news, earnings releases, or analyst revisions, they help you stay aligned with the latest outlook. For example, some investors may have a bullish Narrative for UMB Financial, targeting a $150 share price based on anticipated cost savings and tech investments. Others may be more cautious and set their fair value closer to $120, focusing instead on integration risks and competition.

Do you think there's more to the story for UMB Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives