- United States

- /

- Banks

- /

- NasdaqGS:UBSI

How Investors May Respond To United Bankshares (UBSI) Boosting Buybacks And Raising Its Dividend Again

Reviewed by Sasha Jovanovic

- United Bankshares recently authorized a new stock repurchase program covering up to 5 million shares, about 3.6% of its common stock, and announced its 52nd consecutive annual dividend increase, with the higher fourth-quarter payout scheduled for early January 2026.

- The company’s continued focus on returning capital through buybacks and steadily rising dividends, while analysts highlight organic growth over mergers, underscores a disciplined capital allocation approach that can shape investor expectations.

- We’ll now examine how United Bankshares’ renewed share repurchase plan influences its investment narrative and long-term capital return profile.

Find companies with promising cash flow potential yet trading below their fair value.

What Is United Bankshares' Investment Narrative?

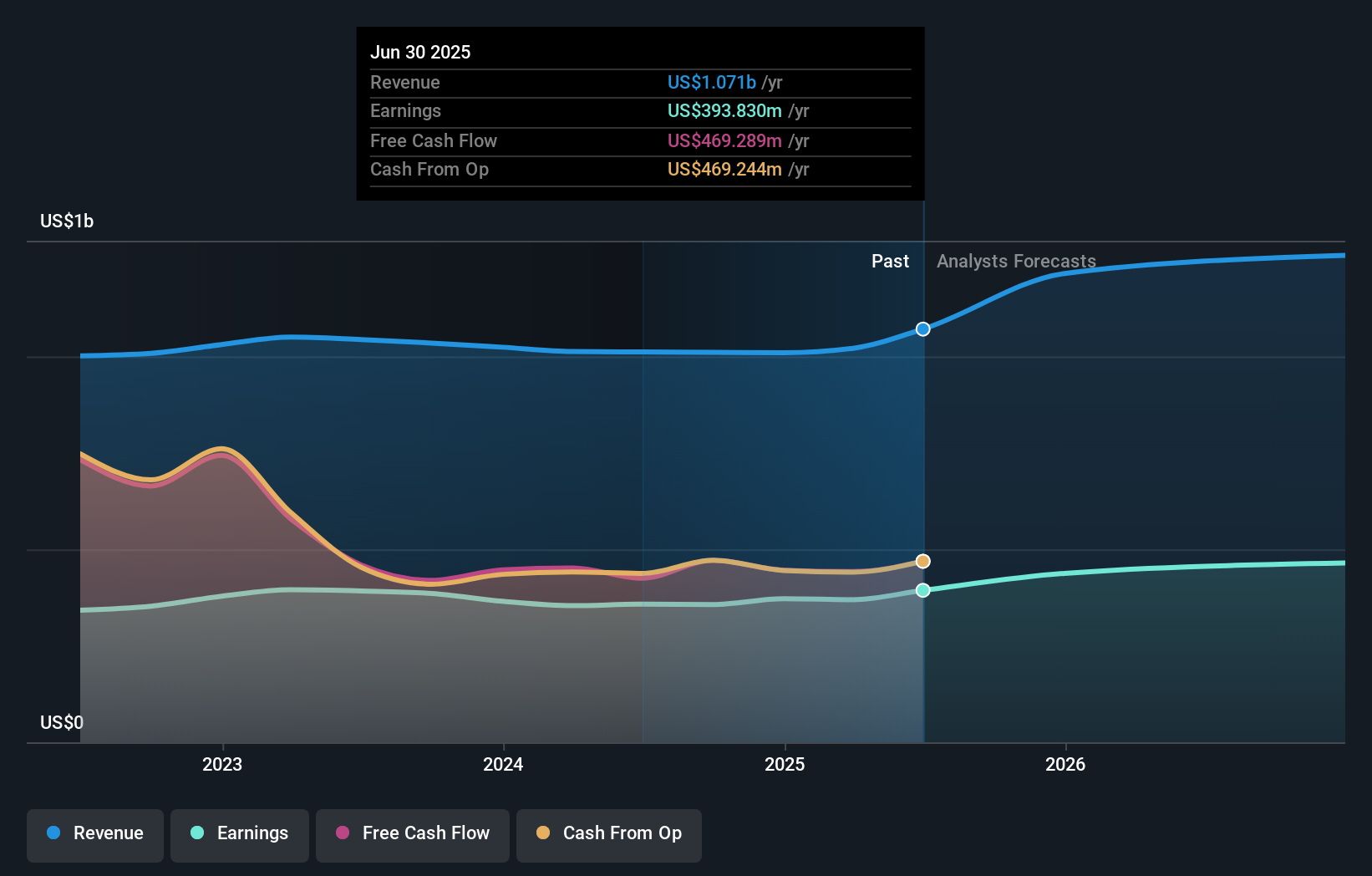

To own United Bankshares, you have to believe in a slower, steadier regional bank story where disciplined capital returns and solid profitability matter more than flashy growth. Earnings and revenue have been growing, but at a more modest pace than the broader market, and returns on equity remain on the low side, so the investment case leans heavily on income and valuation support rather than rapid expansion. The new buyback authorization and the 52nd consecutive dividend increase reinforce that income-focused narrative, while also signaling management confidence in capital strength. In the near term, the main catalysts stay the same: execution on loan growth, credit quality, and how effectively excess capital is put to work, with the repurchase plan incrementally improving per-share metrics if carried through. Key risks, such as lagging share performance and comparatively slow growth, are not removed by this announcement, but the renewed commitment to shareholder returns does help frame how management intends to address them.

However, one risk around growth lagging the wider market is important for investors to understand. United Bankshares' shares have been on the rise but are still potentially undervalued by 36%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on United Bankshares - why the stock might be worth as much as 56% more than the current price!

Build Your Own United Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Bankshares' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026