- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Texas Capital Bancshares (TCBI): Assessing Valuation After Rate Cut Hopes Spark Optimism for Regional Banks

Reviewed by Simply Wall St

Comments from the New York Federal Reserve President sent a jolt through the banking sector and fueled speculation about an earlier-than-expected interest rate cut. Texas Capital Bancshares (TCBI) benefited as investors grew more optimistic about the outlook for regional banks.

See our latest analysis for Texas Capital Bancshares.

Texas Capital Bancshares has been building momentum, with its 7-day share price return jumping 6.5% following renewed rate cut hopes and recent optimism for regional banks. While its latest share price sits at $90.23, the company’s one-year total shareholder return is up a modest 1.1%. Longer-term holders have enjoyed a 61% total return over the past five years.

If you’re looking for more opportunities beyond the banking sector, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

Given the recent jump in share price and improved outlook on regional banks, is Texas Capital Bancshares still trading at a discount? Or has the market already priced in the potential for future growth?

Most Popular Narrative: 1.9% Undervalued

With Texas Capital Bancshares’s narrative fair value of $92 sitting slightly above the last close price of $90.23, the market has almost reached analyst expectations. There is just enough of a gap to catch investors’ attention. The narrative fair value reflects a delicate balance between the optimism for new initiatives and recognized risks.

Significant investments in digital platforms, including treasury and wealth management services, are delivering operational efficiencies and enhanced client connectivity, which are expected to lower non-interest expenses and support improved net margins over time.

What is driving this nearly spot-on price target? The narrative hinges on a bold expansion into new fee-driven businesses and the potential for higher margins as digital initiatives take effect. However, a handful of key forecast assumptions could influence this view, such as dramatic shifts in revenue growth and future earnings power. Uncover the underlying projections that set this fair value apart.

Result: Fair Value of $92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Texas Capital Bancshares’ heavy Texas focus and rising technology expenses could quickly challenge this optimistic outlook if local or competitive pressures intensify.

Find out about the key risks to this Texas Capital Bancshares narrative.

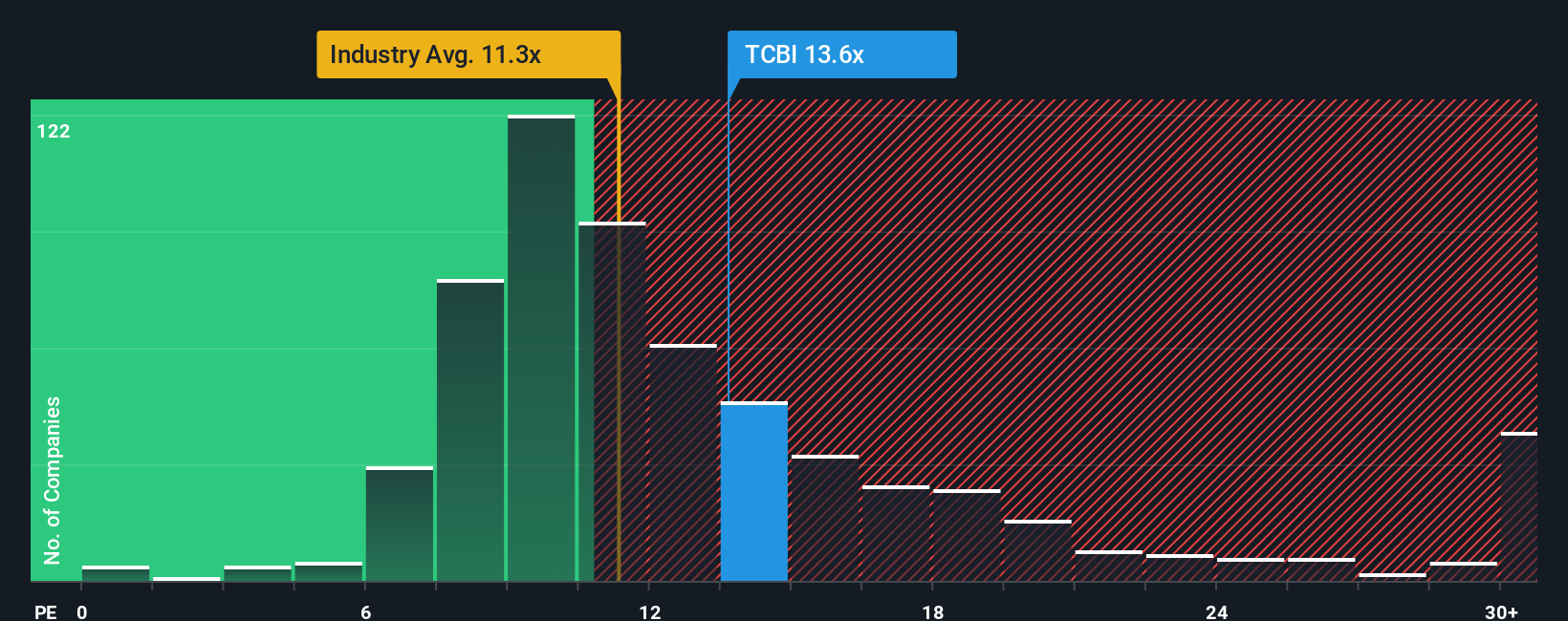

Another View: Looking at Valuation Multiples

On the other hand, Texas Capital Bancshares trades at a price-to-earnings ratio of 14.5x, which is higher than the industry average of 11.4x and above its own fair ratio of 11.8x. This suggests the stock may be more expensive than its peers and what the market could consider a reasonable value. Does this mean there is less upside left, or could the market be rewarding the company’s new growth strategy?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Capital Bancshares Narrative

If you have a different perspective or want to analyze the numbers yourself, you can develop your own outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Texas Capital Bancshares.

Looking for More Smart Investment Ideas?

Don’t let the best opportunities pass you by. Use Simply Wall Street’s powerful Screener to spot high-potential stocks that most investors miss and keep your portfolio ahead of the curve.

- Lock in potential income streams when you browse these 15 dividend stocks with yields > 3% with attractive yields and strong payout records.

- Get ahead of tomorrow’s breakthroughs by tracking industry leaders through these 25 AI penny stocks driving innovation with artificial intelligence.

- Seize value opportunities and secure a bargain by targeting these 926 undervalued stocks based on cash flows fueled by compelling cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success