- United States

- /

- Banks

- /

- NasdaqGS:SYBT

A Closer Look at Stock Yards Bancorp’s (SYBT) Valuation as Shares Show Modest Recent Gains

Reviewed by Simply Wall St

Stock Yards Bancorp (SYBT) has recently seen its stock edge higher over the past month, climbing around 2% and reaching $66.61. Investors are watching closely for shifts in the regional banking space as the year progresses.

See our latest analysis for Stock Yards Bancorp.

With shares recently at $66.61, Stock Yards Bancorp’s momentum looks muted after a difficult stretch. While the past month’s 2.45% share price return hints at some stabilization, the year-to-date decline and a one-year total shareholder return of -12.47% point to lingering pressure. Despite the recent uptick, investors seem to be weighing long-term value and near-term headwinds in the regional banking sector.

If you’re curious where the next growth opportunities might emerge, now’s a great time to broaden your horizons and check out fast growing stocks with high insider ownership

With recent financial performance showing both muted price momentum and signs of underlying growth, the key question now is whether Stock Yards Bancorp’s current valuation is an overlooked opportunity for buyers or if markets have already accounted for its future growth prospects.

Price-to-Earnings of 14.5x: Is it justified?

Stock Yards Bancorp currently trades at a price-to-earnings (P/E) ratio of 14.5x, outpacing the US Banks industry average of 11.5x. With the last close at $66.61, this premium signals that investors are paying more for SYBT earnings than for those of its industry peers.

The price-to-earnings ratio compares a company stock price to its per-share earnings, offering a snapshot of how the market values future profit potential. For banks, the P/E ratio can reflect expectations about earnings stability, growth trajectory, and sector trends.

In the case of Stock Yards Bancorp, a higher P/E could indicate the market expects superior earnings quality or resilience compared to competitors. It may also mean the shares are trading at a stretched valuation if growth does not materialize. Compared to the estimated fair P/E ratio of 10.9x, the current valuation looks even less favorable. This suggests the stock could face re-rating pressure toward lower multiples if fundamentals do not improve.

Explore the SWS fair ratio for Stock Yards Bancorp

Result: Price-to-Earnings of 14.5x (OVERVALUED)

However, muted year-to-date returns and recent profit growth deceleration could challenge the stock’s premium valuation in the months ahead.

Find out about the key risks to this Stock Yards Bancorp narrative.

Another View: Discounted Cash Flow Tells a Different Story

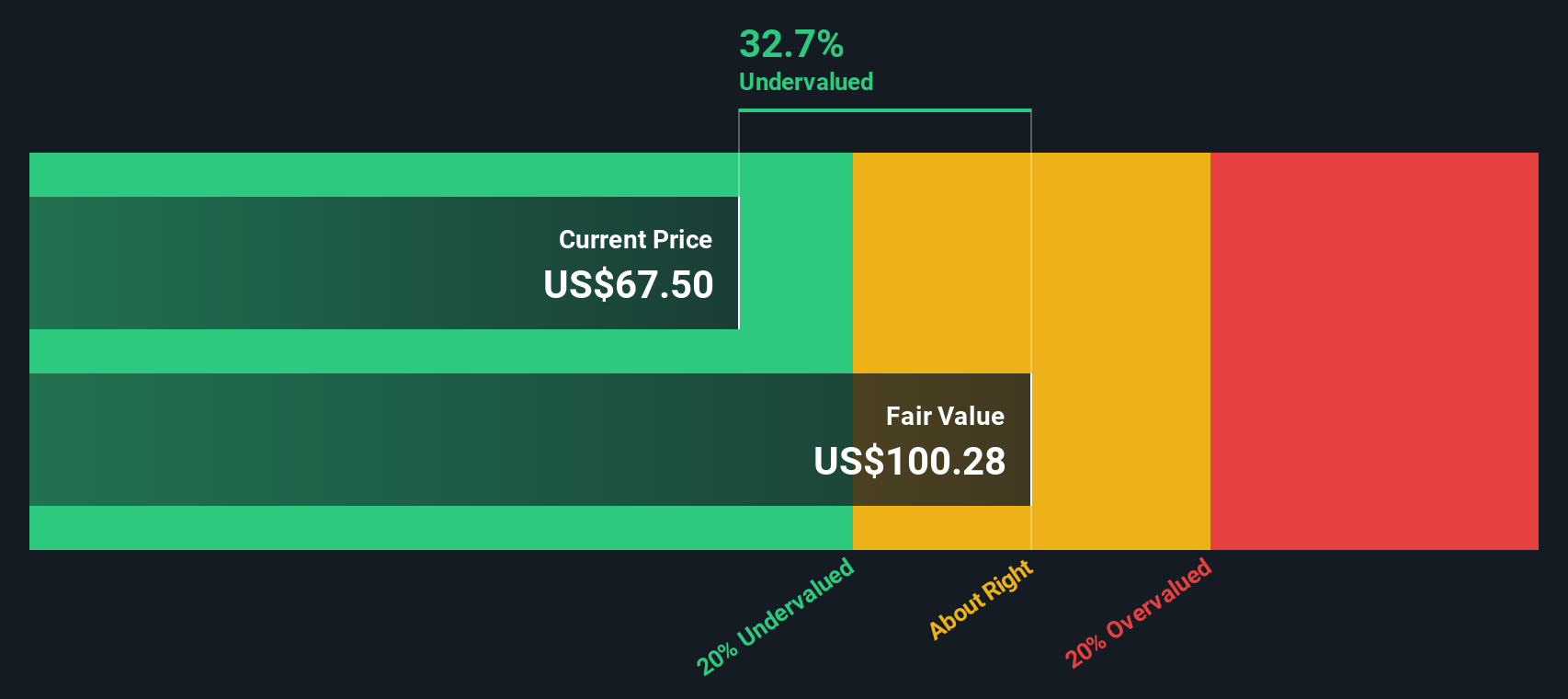

While Stock Yards Bancorp looks expensive based on earnings multiples, our DCF model suggests a sharply different narrative. The current price of $66.61 sits well below our estimated fair value of $103.19. This implies the stock may actually be undervalued and offering more upside than the market currently recognizes. Which method should investors trust with their decision?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stock Yards Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stock Yards Bancorp Narrative

If you'd rather dig into the numbers and chart your own course, it’s easy to create a personalized take on Stock Yards Bancorp in just a few minutes. Do it your way.

A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to take advantage of some of the market’s most promising opportunities. Don’t limit your outlook; see what else could help you get ahead.

- Uncover potential in the fast-growing artificial intelligence sector by checking out these 25 AI penny stocks that are shaping next-generation innovation.

- Benefit from resilient income streams by reviewing these 14 dividend stocks with yields > 3% offering yields over 3% and long-term payout potential.

- Stay ahead of technology’s next big leap by targeting these 27 quantum computing stocks with pioneering advances in quantum computing applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026