- United States

- /

- Banks

- /

- NasdaqGM:QCRH

Earnings Beat, Dividend and Ownership Shifts Could Be A Game Changer For QCR Holdings (QCRH)

Reviewed by Sasha Jovanovic

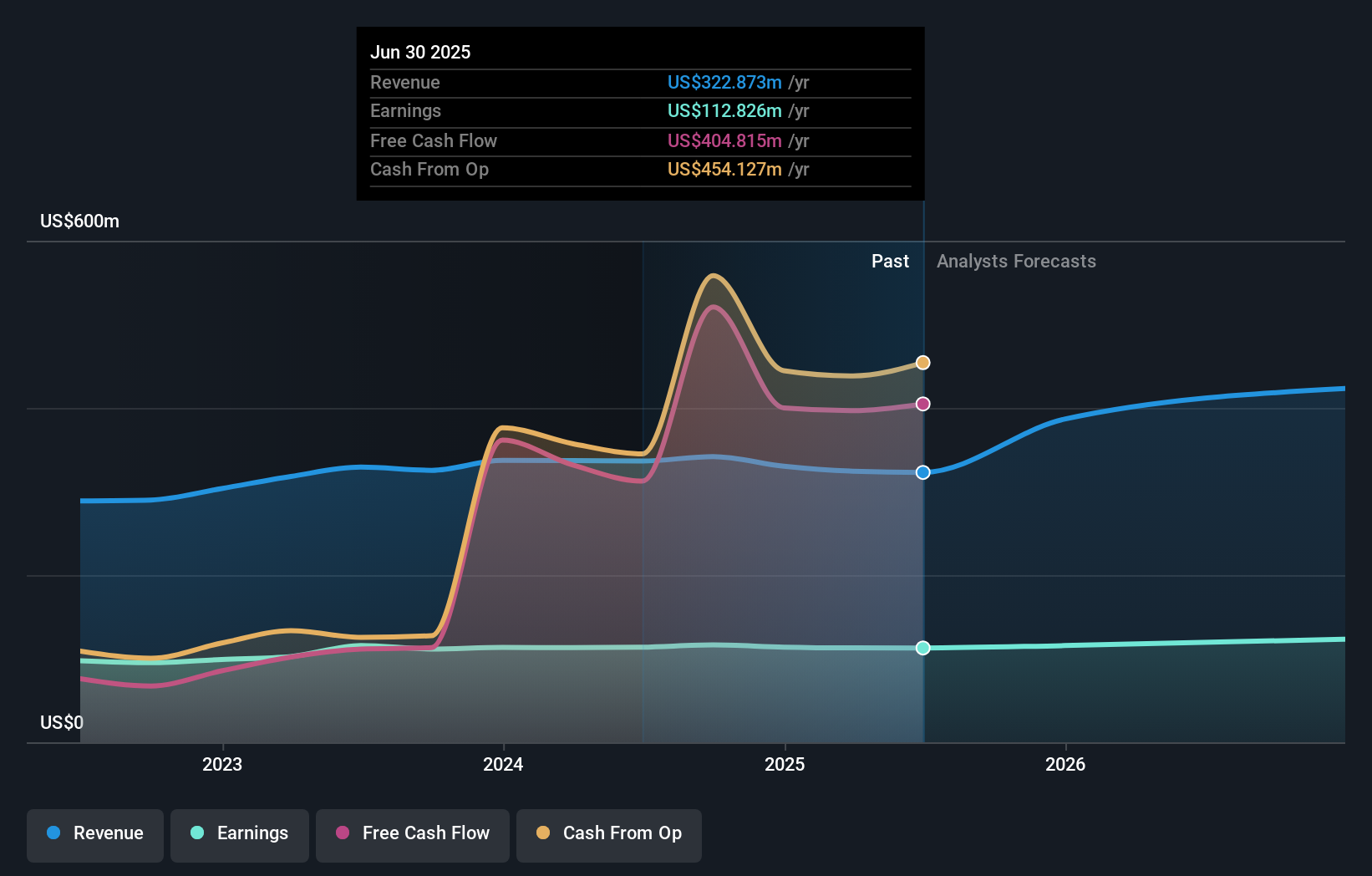

- QCR Holdings recently reported a very strong third quarter, with revenue and earnings per share coming in well above analyst expectations, while institutional investors including Franklin Resources and Vanguard adjusted their positions and the company declared a quarterly dividend payable on 7 January.

- This mix of earnings outperformance, shifting institutional ownership, and a modest dividend underscores how investors are reassessing QCR Holdings’ earnings quality and capital return profile.

- With QCR Holdings’ quarterly results surpassing analyst forecasts, we’ll now examine how this earnings beat reshapes the company’s longer-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

QCR Holdings Investment Narrative Recap

To own QCR Holdings, you need to believe its community banking model, fee income streams, and digital push can support steady earnings, even as it leans on CRE and LIHTC exposure. The latest earnings beat and 20% share price move highlight strong near term momentum but do not materially change the key short term catalyst, which remains execution on digital and efficiency initiatives, or the biggest risk, which is concentration in CRE and specialized lending if credit conditions weaken.

The reaffirmed US$0.06 per share quarterly dividend, implying a modest 0.3% yield, is the most relevant announcement here because it frames how management is balancing growth investment with capital returns after a very strong quarter. For investors, the combination of robust Q3 earnings, a rising share price, and a stable dividend policy feeds directly into the question of how durable QCR’s earnings mix really is as it approaches the US$10 billion asset threshold and prepares for Durbin related revenue pressure.

But against this stronger quarter, investors should be aware of how concentrated exposure to commercial real estate could...

Read the full narrative on QCR Holdings (it's free!)

QCR Holdings’ narrative projects $549.9 million revenue and $134.4 million earnings by 2028. This requires 19.4% yearly revenue growth and an earnings increase of about $21.6 million from $112.8 million today.

Uncover how QCR Holdings' forecasts yield a $89.30 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently offer just 1 fair value estimate at US$89.30 per share, showing how even a single private view can differ from market pricing. When you set that against QCR’s reliance on CRE and specialized lending, it underlines why many participants seek out several perspectives before deciding how comfortable they are with the bank’s risk return profile.

Explore another fair value estimate on QCR Holdings - why the stock might be worth just $89.30!

Build Your Own QCR Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QCR Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free QCR Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QCR Holdings' overall financial health at a glance.

No Opportunity In QCR Holdings?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026