- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Northwest Bancshares (NWBI) Valuation After Mixed Q3 Results and Insider Share Purchase

Reviewed by Simply Wall St

Northwest Bancshares (NWBI) just delivered a mixed third quarter, with revenue topping forecasts while earnings per share lagged. A director quietly bought 1,500 shares, a combination that deserves a closer look.

See our latest analysis for Northwest Bancshares.

Those mixed results and the director’s recent share purchase come after a choppy run, with the latest 1 month share price return of 1.50% contrasting with a weaker year to date share price performance and a more reassuring 5 year total shareholder return of 34.44%. This suggests longer term holders have still been rewarded even as near term momentum has cooled.

If this kind of steady regional bank story has you thinking about where else capital might work harder, it could be worth exploring fast growing stocks with high insider ownership for more ideas.

With the shares trading below analyst targets yet boasting solid long term returns and insider buying, is Northwest Bancshares still flying under the radar, or is the market already factoring in its future growth?

Most Popular Narrative Narrative: 9% Undervalued

With Northwest Bancshares last closing at $12.17 against a narrative fair value of $13.38, the story implies modest upside grounded in improving fundamentals.

The successful completion and integration of the Penns Woods acquisition, with cost savings tracking ahead of original expectations and full run rate efficiencies expected by mid 2026, should materially improve expense ratios and net margins going forward. Digital transformation initiatives (including enhanced consumer lending platforms and strengthened deposit gathering via technology) are expected to improve customer retention, attract younger demographics, and reduce operating costs, contributing to both revenue growth and improved efficiency ratios.

Want to see the full blueprint behind this upside case? The narrative leans on accelerating revenue, widening margins, and a future earnings base that looks very different from today.

Result: Fair Value of $13.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower loan growth in core regions and rising credit risk in multifamily construction could undermine the optimistic case if conditions deteriorate further.

Find out about the key risks to this Northwest Bancshares narrative.

Another Angle on Valuation

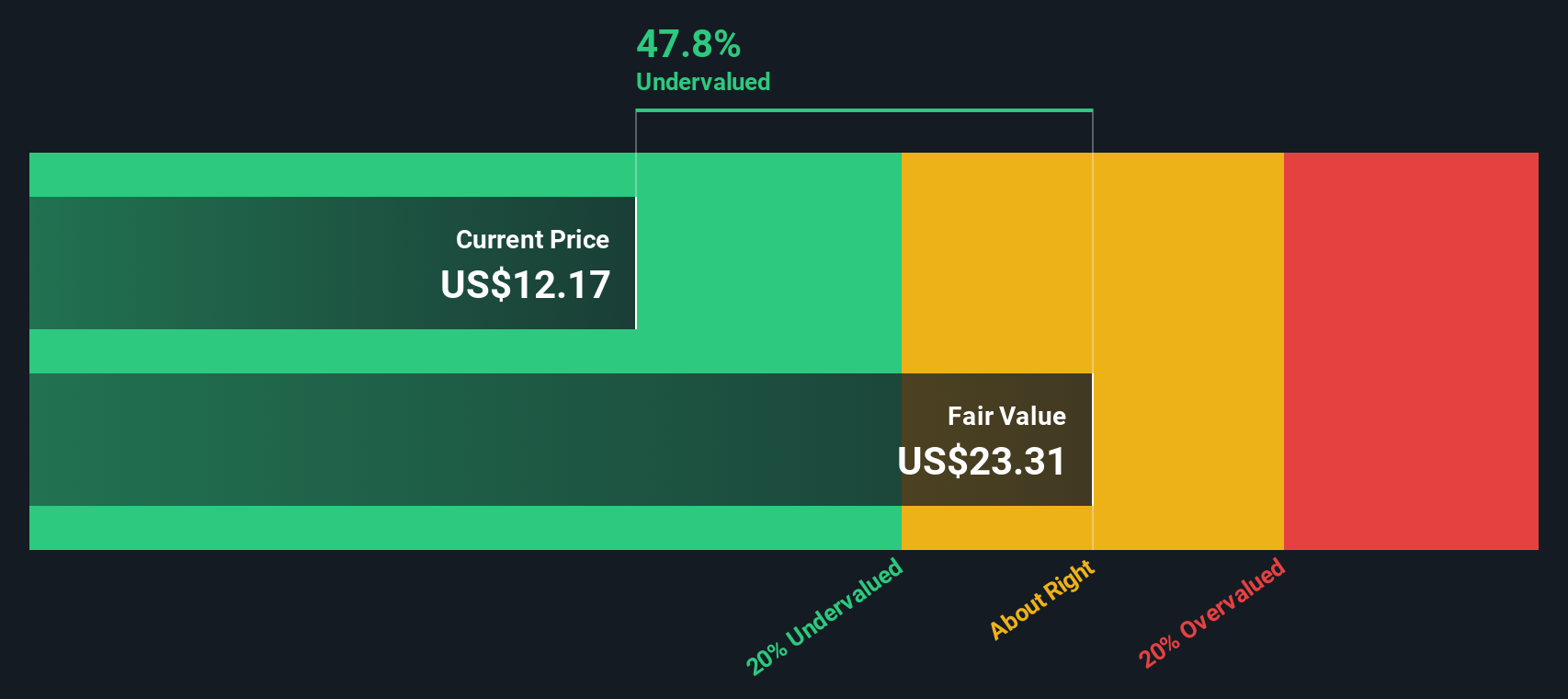

While the narrative suggests only modest upside, our DCF model paints a bolder picture, putting fair value at about $22.10 versus today’s $12.17. That implies Northwest Bancshares could be deeply undervalued if its cash flows materialize as expected, or the model is simply too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northwest Bancshares Narrative

If you see the numbers differently or prefer to dig into the data yourself, you can shape a full narrative in just minutes: Do it your way.

A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before markets shift again, put your cash to work by using the Simply Wall Street Screener to uncover focused opportunities you will not want to miss.

- Lock in potential income streams by targeting companies in these 15 dividend stocks with yields > 3% that offer attractive yields with room for growth.

- Ride structural tech trends by scanning these 26 AI penny stocks positioned to benefit from real world artificial intelligence adoption.

- Hunt for mispriced opportunities using these 906 undervalued stocks based on cash flows that may be trading well below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026