- United States

- /

- Banks

- /

- NasdaqGS:INDB

What Independent Bank (INDB)'s Director Share Sale After Earnings Miss Means For Shareholders

Reviewed by Sasha Jovanovic

- In early December 2025, Independent Bank Corp. director Gerard F. Nadeau sold 2,000 shares, shortly after the bank reported third-quarter earnings per share of US$0.69 versus an expected US$1.54.

- Despite the earnings shortfall, Keefe, Bruyette & Woods upgraded the stock to Outperform, highlighting strong organic growth and an improving net interest margin as key positives.

- With the recent earnings miss now on the table, we’ll examine how this development reshapes Independent Bank’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Independent Bank Investment Narrative Recap

To own Independent Bank, you need to believe its organic growth, improving net interest margin and acquisition integration can more than offset credit and integration risks. The sharp Q3 earnings miss and Gerard Nadeau’s 2,000 share sale are worth watching, but they do not appear to alter the key short term catalyst, which remains management’s ability to improve profitability without letting credit costs or acquisition related expenses erode margins.

The most relevant recent development here is the October launch and subsequent execution of the up to US$150.0 million buyback, with 364,528 shares repurchased by September 30, 2025. That capital return sits alongside the earnings disappointment and insider sale, giving investors a mixed but useful context when weighing how confident management appears in the bank’s earnings power and balance sheet flexibility as it works through credit and integration risks.

Yet against this backdrop, investors should also be aware of the bank’s elevated commercial real estate exposure and what that might mean for...

Read the full narrative on Independent Bank (it's free!)

Independent Bank's narrative projects $1.6 billion revenue and $604.7 million earnings by 2028. This requires 32.9% yearly revenue growth and a $416.2 million earnings increase from $188.5 million today.

Uncover how Independent Bank's forecasts yield a $82.75 fair value, a 12% upside to its current price.

Exploring Other Perspectives

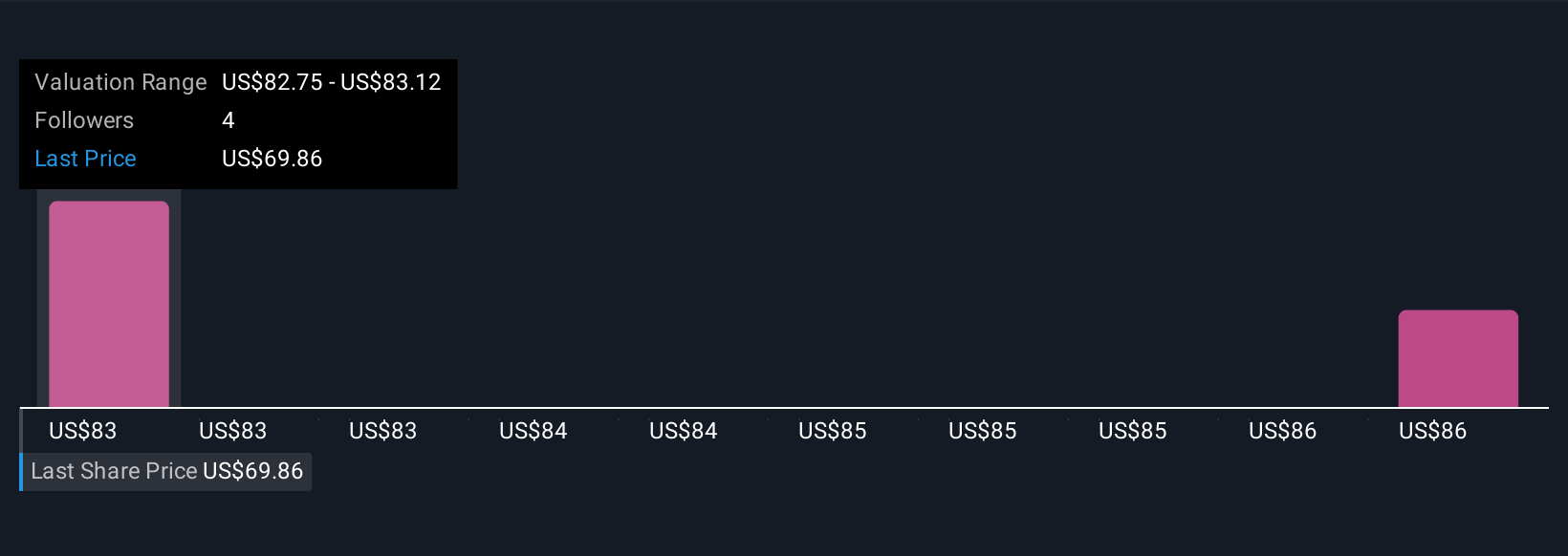

Two Simply Wall St Community valuations cluster between US$82.75 and about US$86.41 per share, underscoring how differently private investors can view Independent Bank’s worth. You can weigh those views against the recent Q3 earnings miss and ongoing commercial real estate and acquisition integration risks, which may influence how the bank’s performance unfolds and are important to consider before forming your own stance.

Explore 2 other fair value estimates on Independent Bank - why the stock might be worth just $82.75!

Build Your Own Independent Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Independent Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Independent Bank's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026