- United States

- /

- Banks

- /

- NasdaqGS:INDB

The Bull Case For Independent Bank (INDB) Could Change Following Analyst Upgrade Despite Earnings Miss

Reviewed by Sasha Jovanovic

- Earlier this week, Gerard F. Nadeau, a director at Independent Bank Corp, sold 3,000 shares for a total of US$210,000, and the company reported third-quarter 2025 earnings per share of US$0.69, falling short of analyst expectations and resulting in a noteworthy negative earnings surprise.

- Despite missing on earnings, the stock was upgraded by Keefe, Bruyette & Woods, who cited a strong growth outlook as a key driver behind their increased confidence in the business.

- We'll examine how the analyst upgrade following the earnings miss may reshape Independent Bank's investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Independent Bank Investment Narrative Recap

For shareholders in Independent Bank, the key belief centers on management’s ability to reduce its exposure to commercial real estate (CRE) risk while pursuing profitable growth in community banking and small business lending. The recent earnings miss does not appear to materially change the main short-term catalyst, progress with CRE concentration and integration of the Enterprise acquisition, although it keeps the spotlight on the ongoing risk of higher credit losses tied to the CRE portfolio.

Among recent developments, the completion of a share buyback program stands out as particularly relevant. The repurchase of 364,528 shares for US$23.36 million in the last quarter reflects management’s ongoing confidence in the company’s outlook, potentially providing support for the share price as Independent Bank addresses its near-term catalysts and works to mitigate key risks.

In contrast, investors should keep a careful eye on the unresolved risk around maturing office loans and potential credit loss pressures…

Read the full narrative on Independent Bank (it's free!)

Independent Bank's outlook anticipates $1.6 billion in revenue and $604.7 million in earnings by 2028. This scenario assumes 32.9% annual revenue growth and a $416.2 million increase in earnings from the current $188.5 million.

Uncover how Independent Bank's forecasts yield a $82.75 fair value, a 15% upside to its current price.

Exploring Other Perspectives

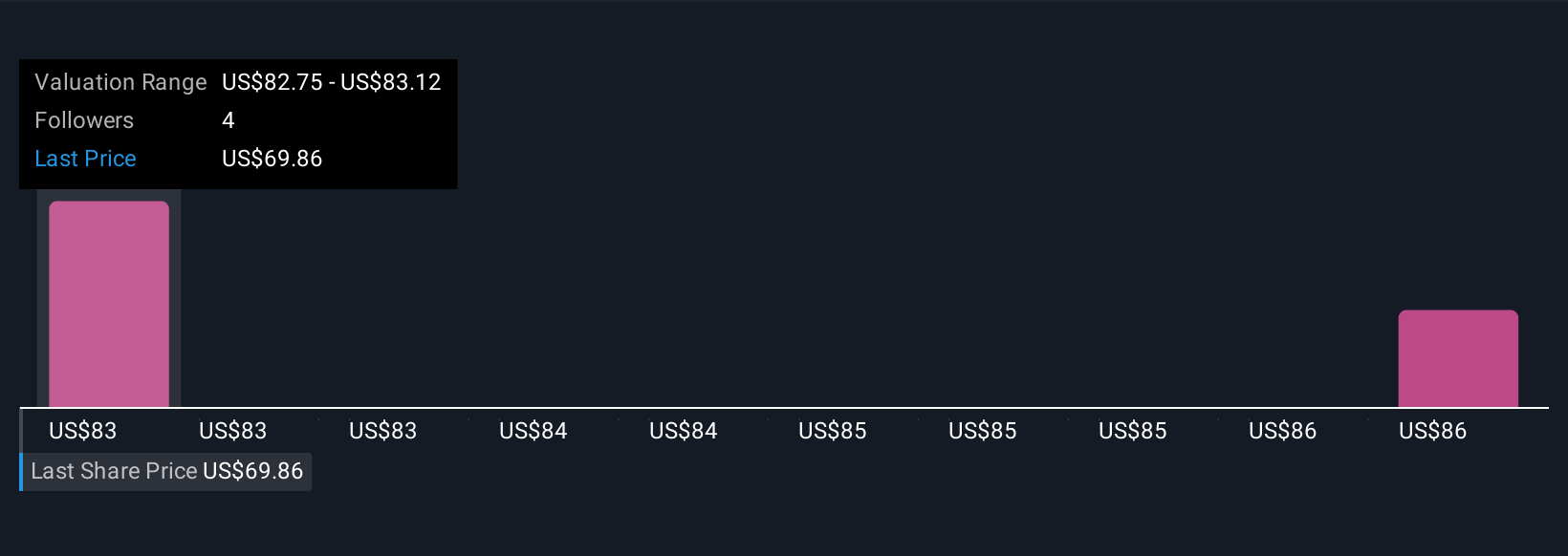

Two private investors in the Simply Wall St Community estimate fair value for Independent Bank between US$82.75 and US$86.41 per share. While the focus remains on progress reducing CRE concentration, these widely varying views highlight how investor expectations can diverge considerably on growth drivers and future credit concerns.

Explore 2 other fair value estimates on Independent Bank - why the stock might be worth just $82.75!

Build Your Own Independent Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Independent Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Independent Bank's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.