- United States

- /

- Banks

- /

- NasdaqGS:FSUN

Insider Confidence In High Growth Stocks December 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight uptick with major indices like the Dow Jones, S&P 500, and Nasdaq showing modest gains amidst anticipation of a Federal Reserve rate cut, investors are keenly observing economic indicators such as job openings and interest rates. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in their future potential and align well with investor interests during times of market fluctuation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's uncover some gems from our specialized screener.

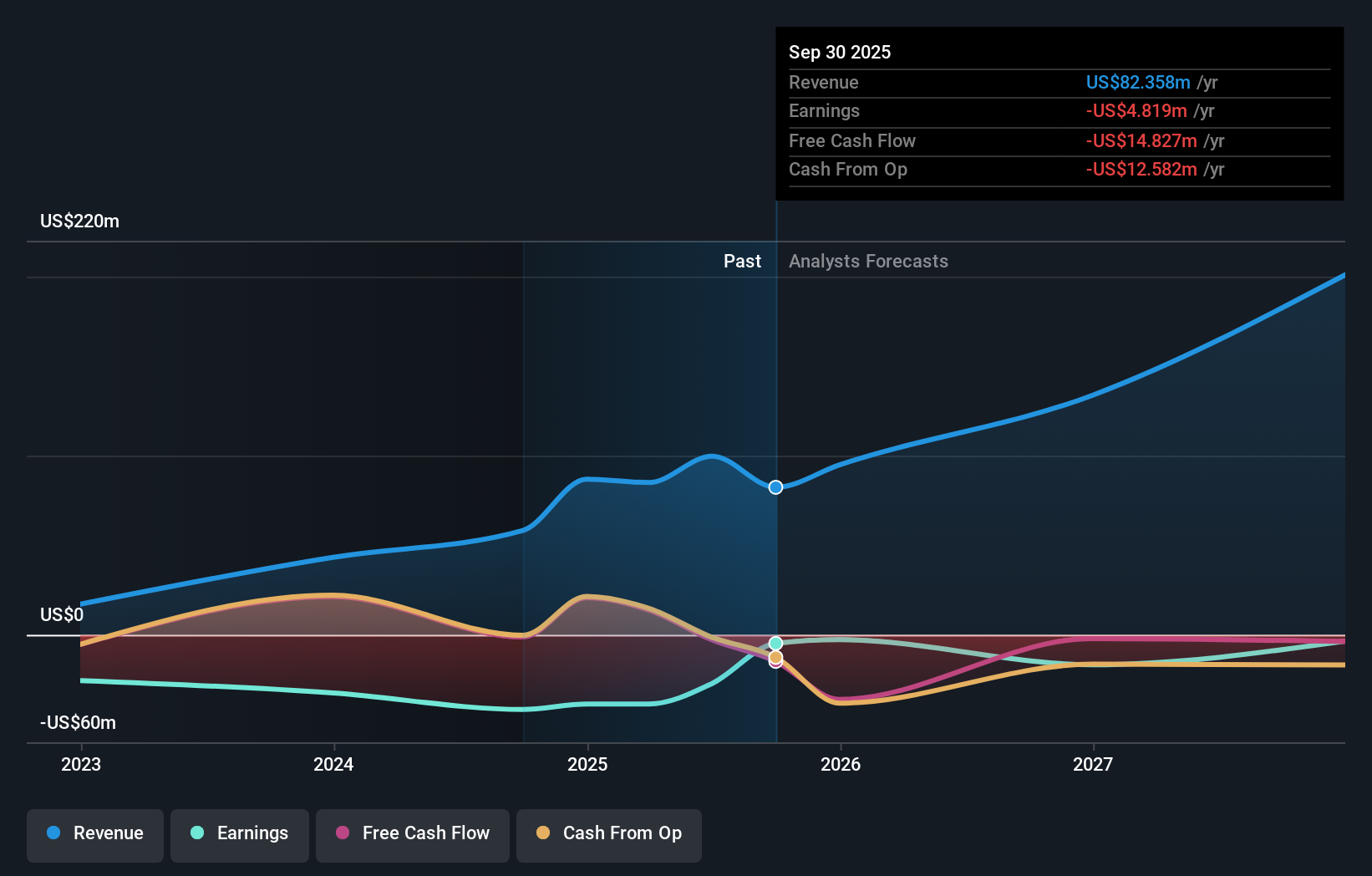

AIRO Group Holdings (AIRO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AIRO Group Holdings, Inc. is a multi-faceted advanced Aerospace and Defense company with a market cap of $296.76 million.

Operations: The company's revenue segments consist of Drones generating $70.96 million, Avionics contributing $6.66 million, and Training accounting for $4.74 million.

Insider Ownership: 12.8%

Revenue Growth Forecast: 33.3% p.a.

AIRO Group Holdings is experiencing rapid revenue growth, forecasted at 33.3% annually, outpacing the broader US market. Despite a recent net loss reduction to US$4.06 million for the nine months ending September 2025, AIRO anticipates surpassing its 2024 revenue of US$86.9 million in 2025. The company has formed a strategic joint venture to expand its high-speed interceptor drone production and secured multiple index inclusions, although significant insider selling occurred recently.

- Dive into the specifics of AIRO Group Holdings here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, AIRO Group Holdings' share price might be too pessimistic.

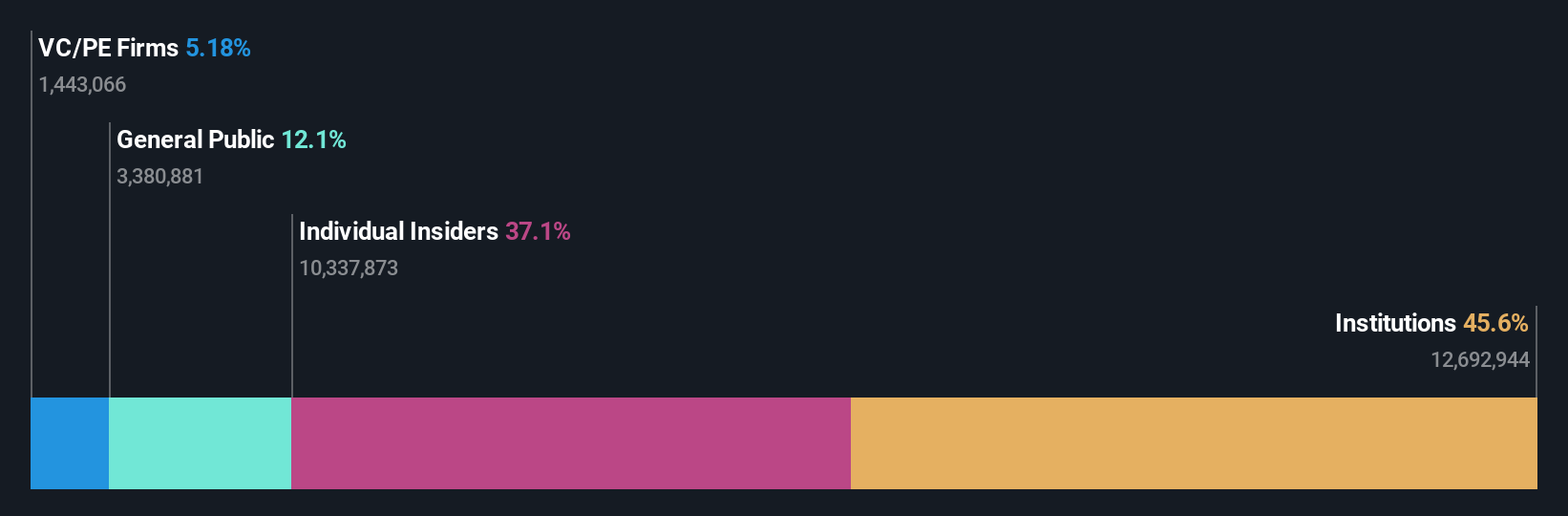

FirstSun Capital Bancorp (FSUN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FirstSun Capital Bancorp is the bank holding company for Sunflower Bank, National Association, offering commercial and consumer banking services to small and medium-sized businesses across several U.S. states, with a market cap of $997.54 million.

Operations: FirstSun Capital Bancorp generates revenue from its Banking segment with $319.08 million and Mortgage Operations contributing $70.59 million.

Insider Ownership: 37.1%

Revenue Growth Forecast: 33.3% p.a.

FirstSun Capital Bancorp is poised for significant growth, with revenue projected to increase by 33.3% annually, surpassing US market averages. The company recently reported a rise in net income for the third quarter of 2025 and announced a merger with First Foundation Inc., enhancing its strategic positioning. Insider ownership remains strong despite no substantial insider trading activity over the past three months. Castle Creek's acquisition of a minority stake further solidifies institutional interest in FirstSun.

- Navigate through the intricacies of FirstSun Capital Bancorp with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of FirstSun Capital Bancorp shares in the market.

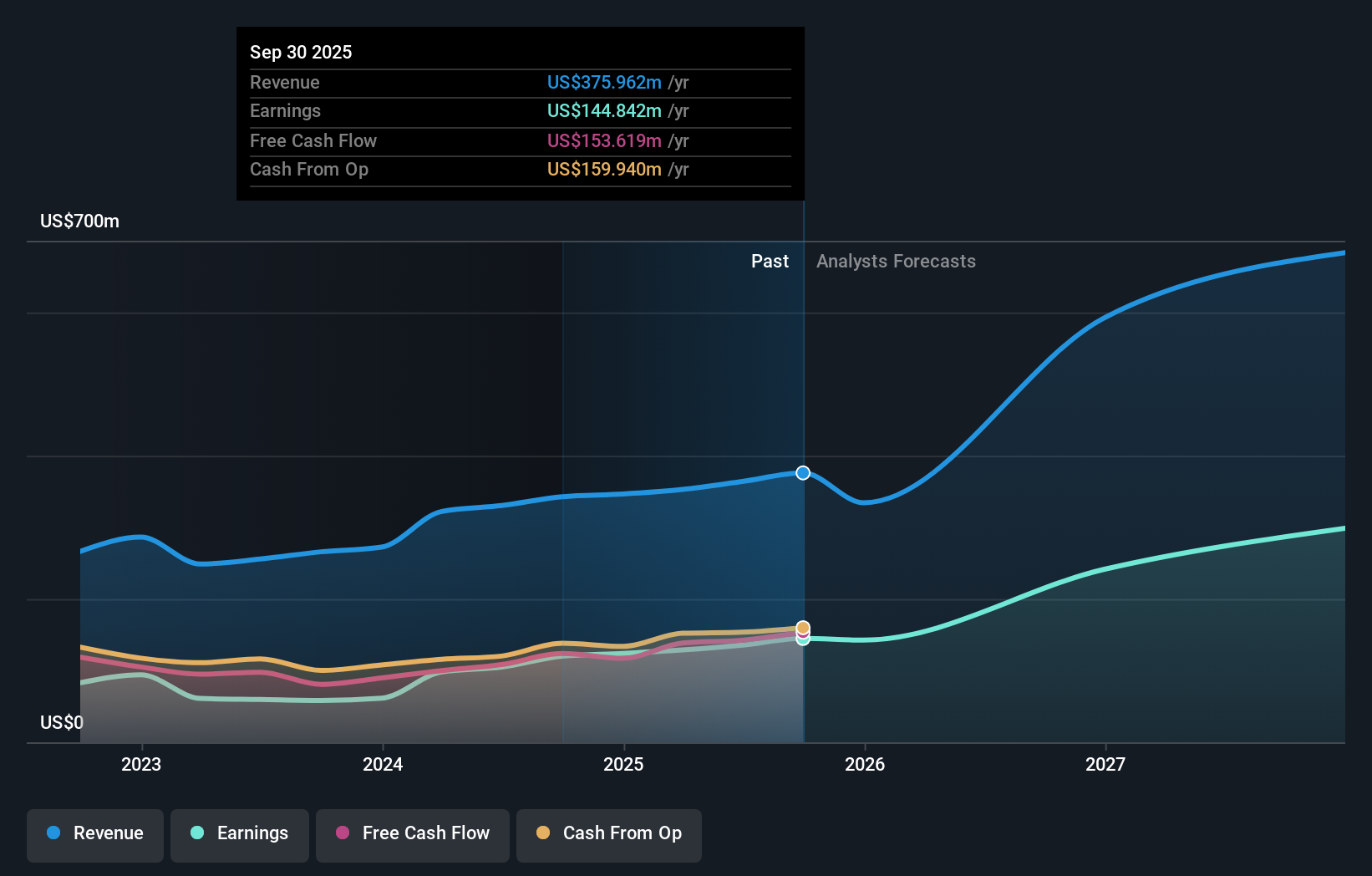

Nicolet Bankshares (NIC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nicolet Bankshares, Inc. is the bank holding company for Nicolet National Bank, offering banking products and services to businesses and individuals across Wisconsin, Michigan, and Minnesota, with a market cap of $1.92 billion.

Operations: The company's revenue is primarily derived from Consumer and Commercial Banking Services, totaling $375.96 million.

Insider Ownership: 11.8%

Revenue Growth Forecast: 31.9% p.a.

Nicolet Bankshares demonstrates strong growth potential, with earnings expected to increase by 35.7% annually, outpacing the US market. Recent financials show a rise in net income for Q3 2025 and a strategic merger with MidWestOne Bank. Insider ownership is reinforced by substantial insider buying over the past three months. The stock trades at 46.5% below its estimated fair value, while analysts anticipate a price increase of 20.3%.

- Click here and access our complete growth analysis report to understand the dynamics of Nicolet Bankshares.

- Our expertly prepared valuation report Nicolet Bankshares implies its share price may be lower than expected.

Key Takeaways

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 203 companies by clicking here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026