- United States

- /

- Banks

- /

- NasdaqCM:FRAF

Franklin Financial Services (FRAF) Earnings Rebound With 11.3% Profit Growth Challenges Bearish Narratives

Reviewed by Simply Wall St

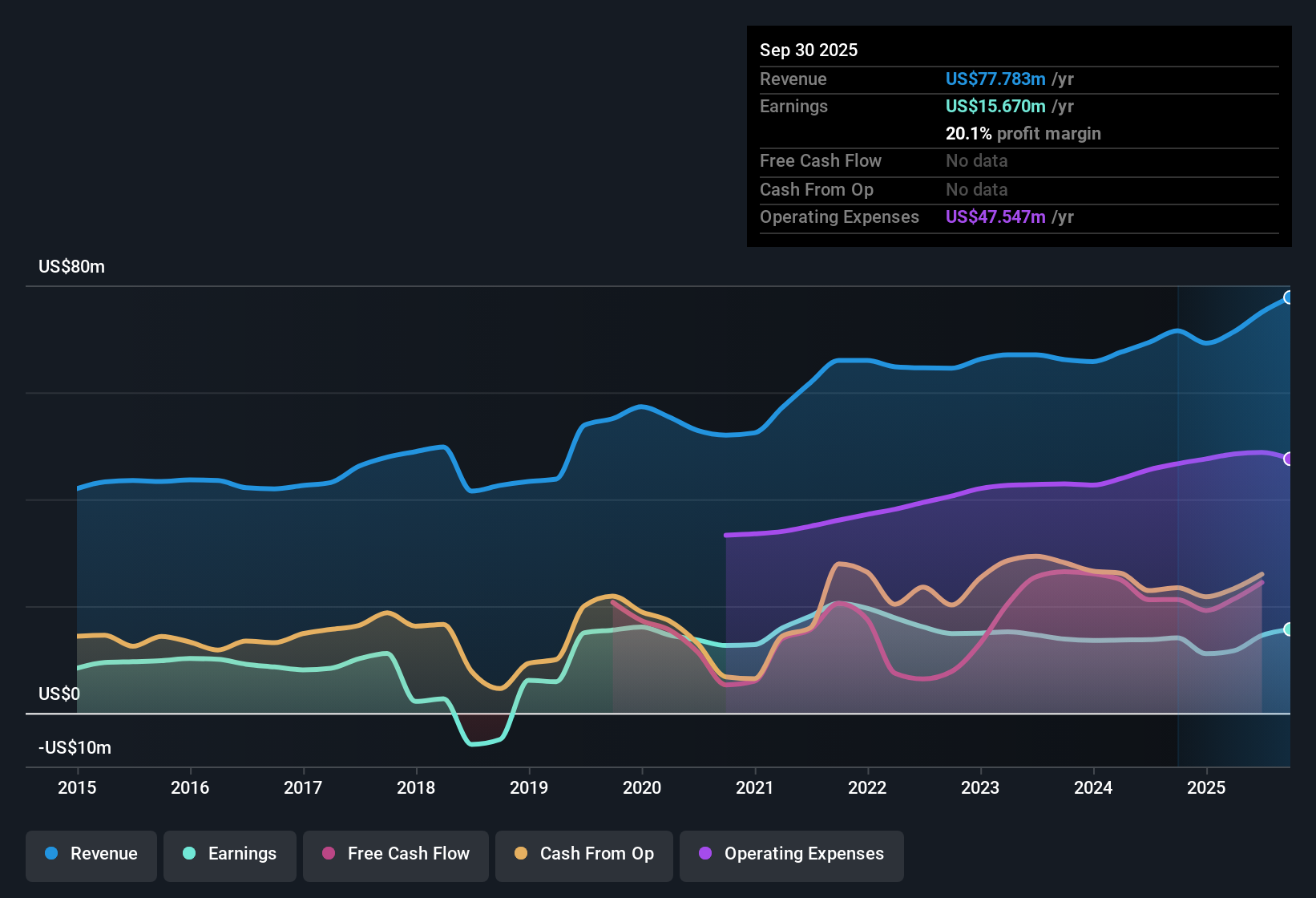

Franklin Financial Services (FRAF) reported a net profit margin of 20.1%, up slightly from last year's 19.7%, with earnings climbing 11.3% year over year. This result stands in contrast to the company’s longer-term trend of earnings declining by an average of 4.6% annually over the past five years. Investors looking at these numbers will note both the recent improvement in profitability and FRAF’s reputation for high quality earnings.

See our full analysis for Franklin Financial Services.Now let’s see how these results line up against the key market narratives. Some convictions could be strengthened, while others may be called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Decline Reverses With 11.3% Earnings Growth

- Even though Franklin Financial Services posted a strong 11.3% earnings growth this year, this contrasts with an average 4.6% annual decline in earnings seen over the last five years. This shift will catch the eye of income-focused investors tracking turnaround potential.

- The prevailing market view points to FRAF being seen as a stable, reliable choice, but

- that shift to growth is a notable break from the longer-term earnings decline. This trend supports the argument for renewed confidence but also calls for caution about whether it can be sustained.

- stability in recent news flow means market sentiment will likely stay measured as investors look for further confirmation in future results before rewarding FRAF with a higher valuation multiple.

Net Profit Margin Rises Even as Growth Risks Remain

- Net profit margin improved to 20.1% from 19.7% last year, suggesting better expense management or operational efficiency. There is no explicit evidence of a revenue or earnings growth trend continuing over a longer horizon.

- Prevailing analysis highlights how, while efficiency gains support the case for FRAF as a “safe harbor” among community banks,

- concerns around muted long-term growth remain, since neither filings nor market commentary confirm sustained uptrends beyond this year’s bounce.

- many value-focused investors may stay on the sidelines until growth visibility strengthens, despite the comfort of higher margins.

Valuation Undercuts Peers, But Premium to Industry

- Shares trade at $45.73, below the DCF fair value of $48.82, and FRAF’s 13.1x Price-To-Earnings ratio is attractive versus peer banks at 16.1x. However, it is pricier than the broader US Banks sector average of 11.2x.

- Commentary on market sentiment emphasizes that being valued below intrinsic fair value reinforces FRAF’s reputation as appealing for defensive investors,

- however, the valuation premium over the sector average indicates the market already recognizes its stability and quality. This could limit upside unless further catalysts emerge.

- investors are watching closely to see if the recent positive momentum justifies a higher multiple, especially with industry peers trading lower.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Franklin Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While FRAF’s recent earnings growth marks a turnaround, the lack of a clear, sustained long-term growth trend still leaves major questions for investors.

If you prefer companies showing consistent track records and fewer growth surprises, check out stable growth stocks screener (2126 results) for steady performers that do not rely on a single strong year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FRAF

Franklin Financial Services

Operates as the bank holding company for Farmers and Merchants Trust Company of Chambersburg that provides commercial, retail banking, and trust services to businesses, individuals, governmental entities in Pennsylvania.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives