- United States

- /

- Banks

- /

- NasdaqGS:HBAN

3 Reliable Dividend Stocks Yielding Up To 3.8%

Reviewed by Simply Wall St

As the U.S. stock market enters December, major indices like the Dow Jones, Nasdaq, and S&P 500 have experienced slight declines amid a risk-off sentiment impacting big tech and cryptocurrency-tied shares. In such uncertain times, dividend stocks can offer a measure of stability by providing regular income streams to investors.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.01% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.53% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.68% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.77% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.78% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.72% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.00% | ★★★★★★ |

| Ennis (EBF) | 5.73% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.19% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.56% | ★★★★★★ |

Click here to see the full list of 124 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

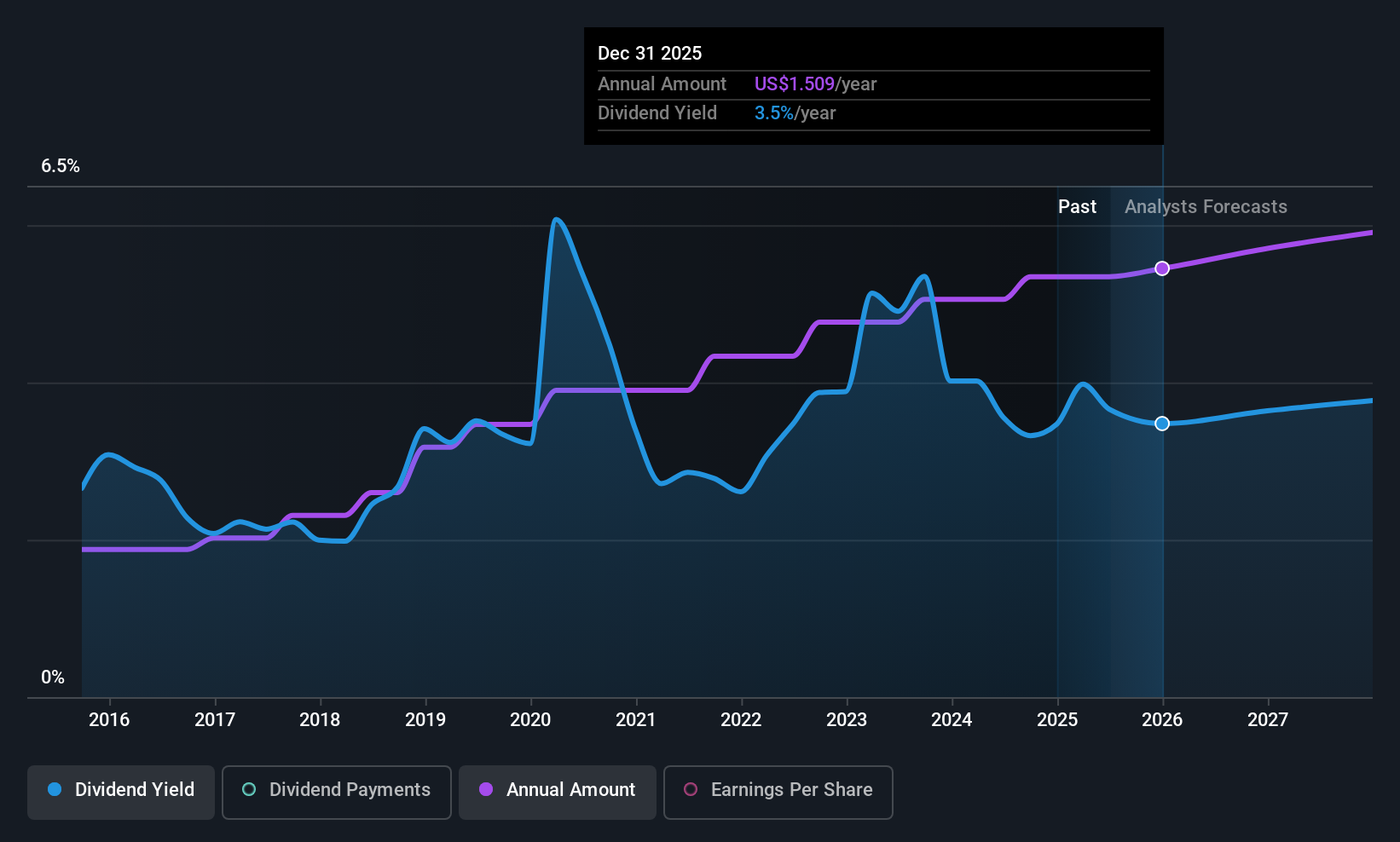

Fifth Third Bancorp (FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services in the United States with a market cap of approximately $28.73 billion.

Operations: Fifth Third Bancorp's revenue is primarily derived from Consumer and Small Business Banking ($4.84 billion), Commercial Banking ($3.37 billion), and Wealth and Asset Management ($633 million).

Dividend Yield: 3.7%

Fifth Third Bancorp's recent financial performance highlights a steady increase in net interest income and net income, supporting its reliable dividend payments. Despite a significant impairment charge related to alleged fraud, the company's dividends remain stable and well-covered by earnings with a payout ratio of 44.8%. The dividend yield of 3.68% is below the top tier in the US market but has shown growth over the past decade, indicating sustainability and reliability for investors seeking consistent returns.

- Take a closer look at Fifth Third Bancorp's potential here in our dividend report.

- Our valuation report here indicates Fifth Third Bancorp may be undervalued.

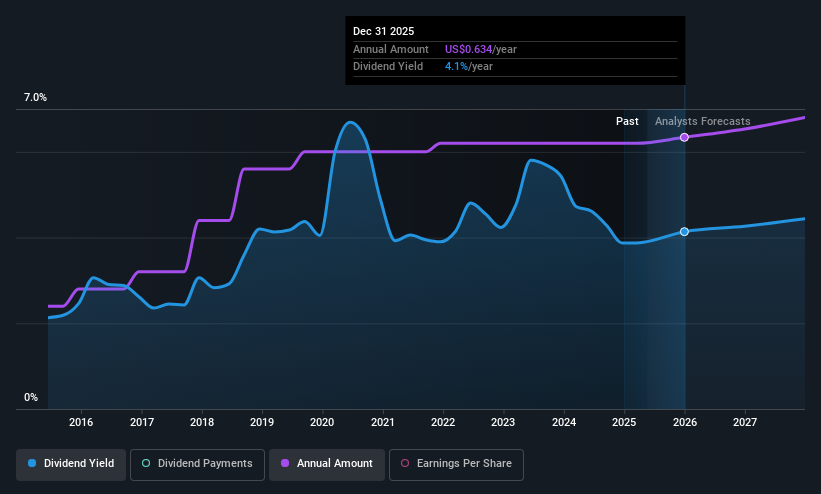

Huntington Bancshares (HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States, with a market cap of approximately $25.63 billion.

Operations: Huntington Bancshares generates its revenue primarily from two segments: Commercial Banking, which accounts for $2.81 billion, and Consumer & Regional Banking, contributing $5.10 billion.

Dividend Yield: 3.8%

Huntington Bancshares maintains stable dividend payments with a payout ratio of 42.8%, ensuring coverage by earnings. The bank's dividends have grown consistently over the past decade, though its yield of 3.8% is below the top US dividend payers. Recent expansions in North Carolina and South Carolina, alongside strategic leadership changes, aim to enhance growth prospects. Despite no recent share buybacks, Huntington's financials show robust net income growth and increased earnings guidance for 2025, bolstering investor confidence in its dividends' sustainability.

- Navigate through the intricacies of Huntington Bancshares with our comprehensive dividend report here.

- The analysis detailed in our Huntington Bancshares valuation report hints at an deflated share price compared to its estimated value.

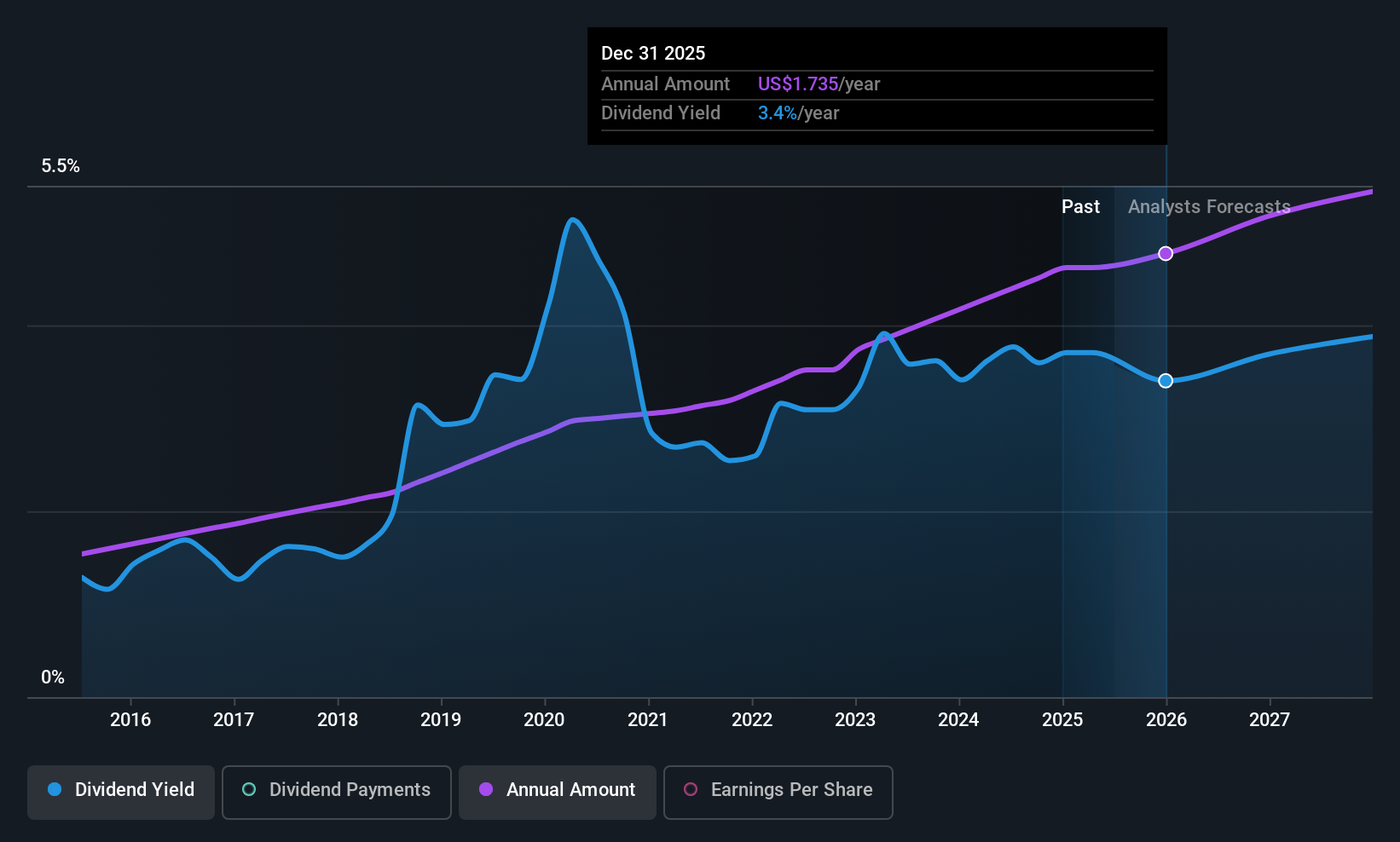

Bank OZK (OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK is a full-service Arkansas state-chartered bank offering retail and commercial banking services across the United States, with a market cap of approximately $5.18 billion.

Operations: Bank OZK generates revenue primarily from its Community Banking segment, which amounts to $1.54 billion.

Dividend Yield: 3.8%

Bank OZK's dividend reliability is underscored by its consistent quarterly increases over the past 61 quarters, including a recent hike to US$0.45 per share. Despite a lower yield of 3.82% compared to top US dividend payers, its dividends are well-covered by earnings with a payout ratio of 27.3%. Recent earnings show growth in net interest income and net income, supporting future dividend sustainability amidst favorable value trading conditions relative to peers and industry benchmarks.

- Delve into the full analysis dividend report here for a deeper understanding of Bank OZK.

- Our valuation report unveils the possibility Bank OZK's shares may be trading at a discount.

Key Takeaways

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 121 more companies for you to explore.Click here to unveil our expertly curated list of 124 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026