- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN): Evaluating Valuation After Mixed Q3 Earnings and Rising Credit Costs

Reviewed by Simply Wall St

First Financial Bankshares (FFIN) just released third-quarter results, showing higher net interest income than last year. However, the company reported a drop in net income along with a substantial rise in net charge-offs. These shifting credit and profitability trends are drawing investor attention this quarter.

See our latest analysis for First Financial Bankshares.

Shares of First Financial Bankshares have faced pressure lately, with a 1-year total shareholder return of -13.2% and a 30-day share price return of -8.2%, reflecting investor caution around the recent jump in net charge-offs and mixed quarterly results. Over the longer term, the company’s five-year total shareholder return still stands at a modest 14.2%, but short-term momentum has clearly faded as risk perceptions shift.

If recent volatility has you scanning for new ideas, it could be the perfect time to set your sights on fast growing stocks with high insider ownership.

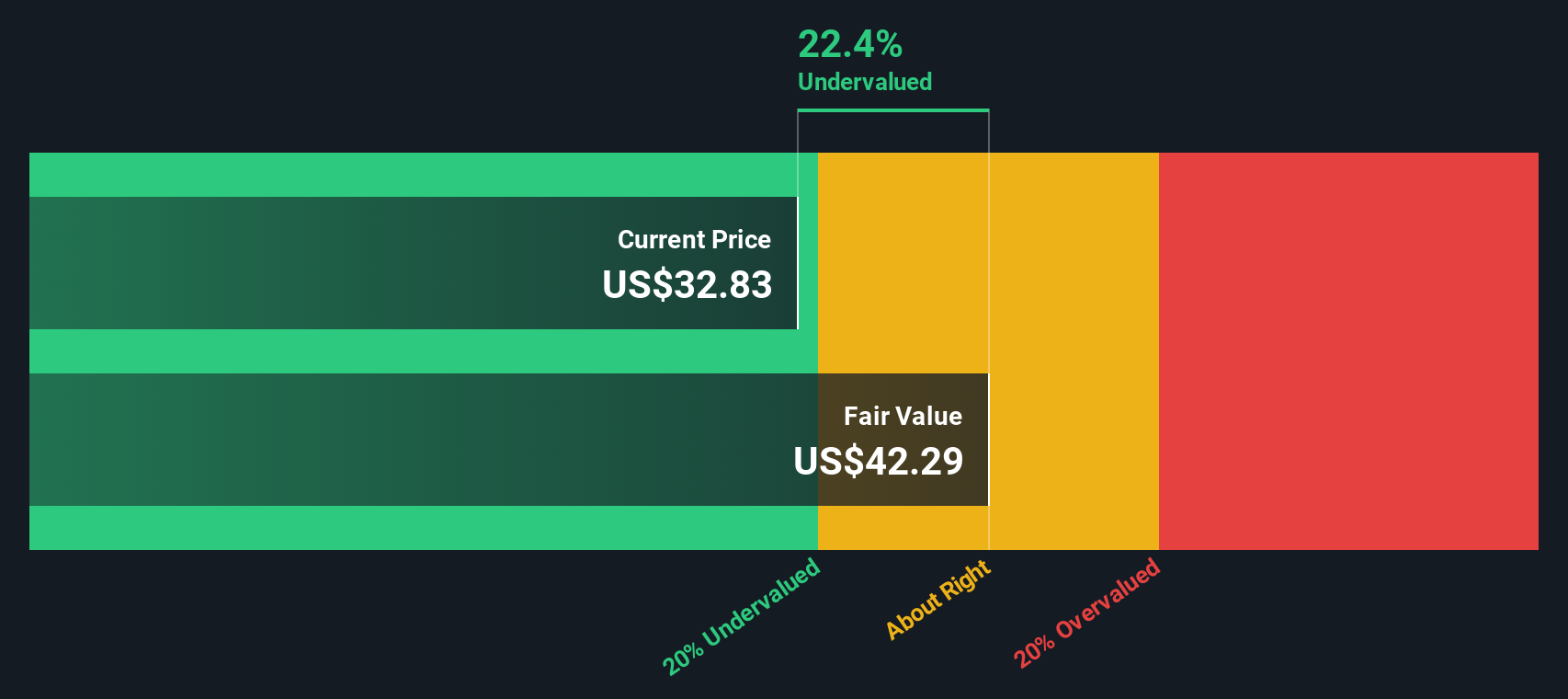

With shares now trading at a discount to analyst price targets and ongoing questions about credit quality, investors are left wondering: Is First Financial Bankshares undervalued, or is the market already factoring in its future performance?

Price-to-Earnings of 18.3x: Is it justified?

First Financial Bankshares currently trades at a price-to-earnings (P/E) ratio of 18.3x, noticeably above both industry and peer benchmarks, despite recent share price declines. This elevated P/E indicates the market is assigning a premium to FFIN’s current and expected earnings, compared to most US banks.

The P/E ratio is a widely used measure that compares the company’s share price to its per-share net earnings, helping investors gauge whether a stock is overvalued or undervalued versus its peers. For banks, it can reflect investor sentiment towards growth prospects and earnings stability.

Notably, FFIN’s P/E of 18.3x is higher than the US Banks industry average of 11.2x and peer group average of 11.9x, and also well above the estimated fair price-to-earnings ratio for the business at 12.9x. This suggests the market could be overpricing the company’s future earnings, and there is a possibility the valuation multiple may trend down if investor expectations soften or if fundamental results fail to impress.

Explore the SWS fair ratio for First Financial Bankshares

Result: Price-to-Earnings of 18.3x (OVERVALUED)

However, ongoing concerns around rising net charge-offs and sluggish stock performance could challenge bullish views if credit trends or sentiment worsen further.

Find out about the key risks to this First Financial Bankshares narrative.

Another View: DCF Model Suggests Undervaluation

While the market appears to be pricing First Financial Bankshares at a premium based on earnings multiples, our DCF model tells a different story. The SWS DCF model estimates a fair value of $42.52 per share, which is about 26% above the current price. Could the market be missing something fundamental about FFIN’s long-term value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you want to dig into the numbers yourself or believe there’s a different story, you can easily put together your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for more investment ideas?

Seize the opportunity to broaden your portfolio with companies at the forefront of innovation, growth, and income. Don’t miss your chance to get ahead of market trends using the tools trusted by smart investors.

- Uncover tomorrow’s growth stories and promising market disruptors with these 27 AI penny stocks, which are breaking boundaries in artificial intelligence applications across multiple industries.

- Tap into consistent income streams and attractive yields with these 19 dividend stocks with yields > 3%, featuring companies recognized for reliable dividend payments above 3%.

- Accelerate your search for value by targeting these 870 undervalued stocks based on cash flows, which are trading below their intrinsic cash flow valuations for outsized potential returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives