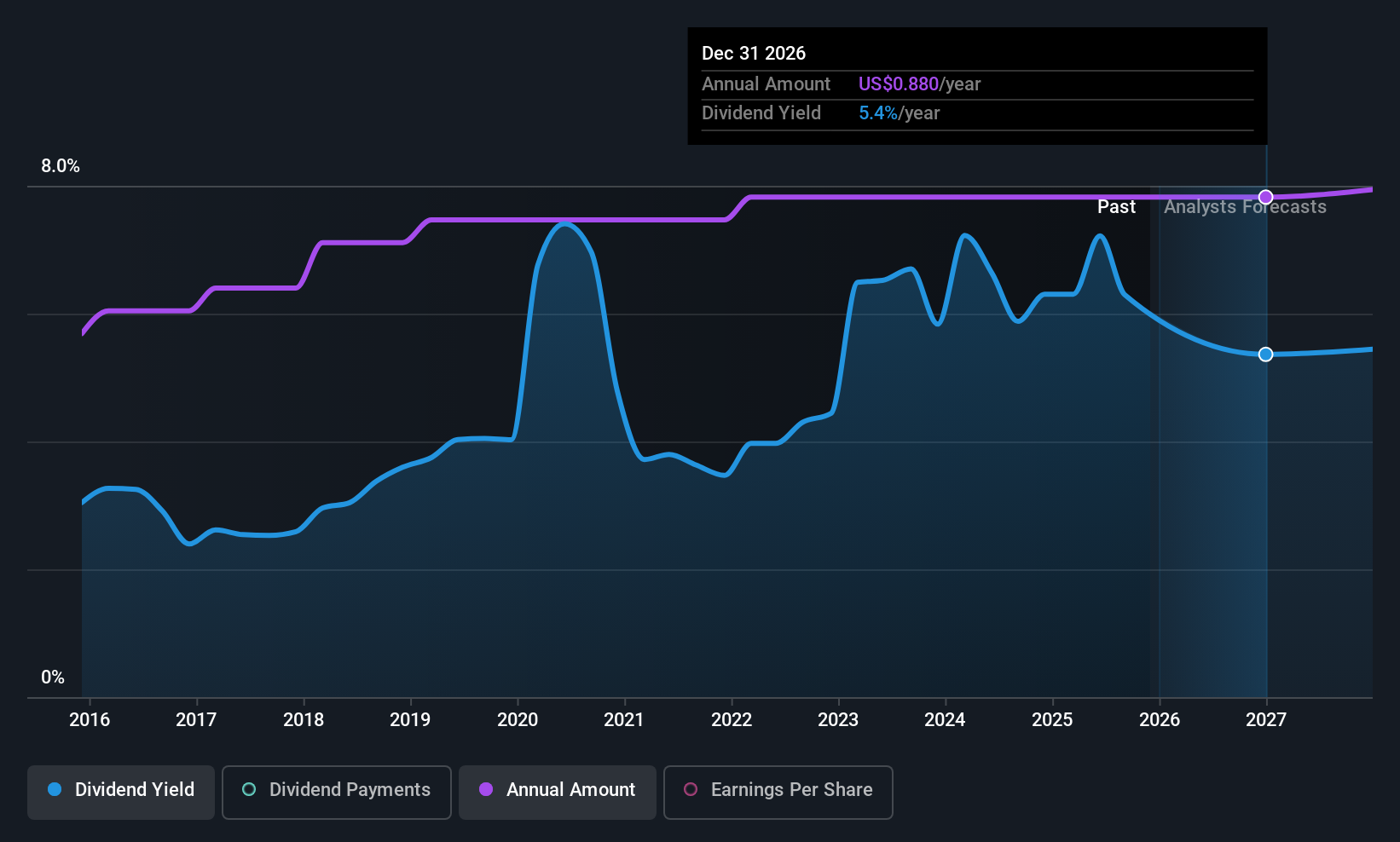

Flushing Financial Corporation (NASDAQ:FFIC) has announced that it will pay a dividend of $0.22 per share on the 19th of December. This makes the dividend yield 5.4%, which will augment investor returns quite nicely.

Flushing Financial's Earnings Will Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable.

Flushing Financial has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions unfortunately do not guarantee future ones, and Flushing Financial's last earnings report actually showed that the company went over its net earnings in its total dividend distribution. This is very worrying for shareholders, as this shows that Flushing Financial will not be able to sustain its dividend at its current rate.

According to analysts, EPS should be several times higher in the next 3 years. Additionally, they estimate future payout ratio will be 52% over the same time horizon, which makes us pretty comfortable with the sustainability of the dividend.

Check out our latest analysis for Flushing Financial

Flushing Financial Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the dividend has gone from $0.64 total annually to $0.88. This works out to be a compound annual growth rate (CAGR) of approximately 3.2% a year over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Flushing Financial's earnings per share has shrunk at 40% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

We should note that Flushing Financial has issued stock equal to 16% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Although they have been consistent in the past, we think the payments are a little high to be sustained. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Flushing Financial that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FFIC

Flushing Financial

Operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026