- United States

- /

- Banks

- /

- NasdaqGS:FBNC

Does Adam Currie’s Board Role and Q3 Earnings Momentum Reveal a Shift in FBNC’s Leadership Edge?

Reviewed by Sasha Jovanovic

- First Bancorp and First Bank recently announced that G. Adam Currie, CEO of First Bank, has been appointed to the Boards of Directors of both organizations, effective immediately.

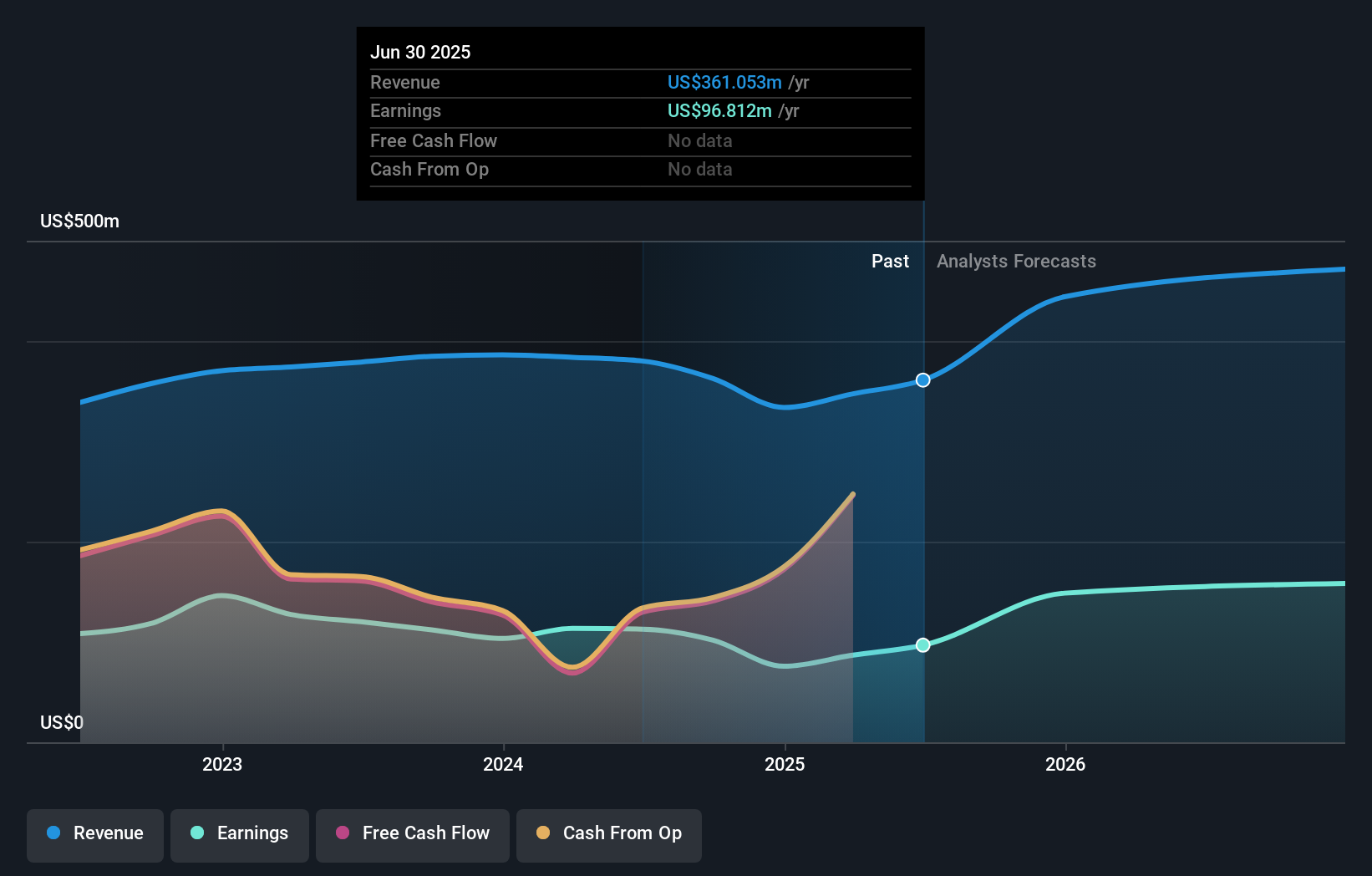

- This leadership move coincides with First Bancorp’s increase in net and comprehensive income for the third quarter of 2025, reflecting ongoing momentum in financial performance and governance focus.

- We’ll explore how executive leadership stability and recent earnings improvement shape First Bancorp’s broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is First Bancorp's Investment Narrative?

To invest in First Bancorp, you have to believe in both the resilience of regional banks and the leadership's ability to translate boardroom changes into meaningful progress. Adam Currie’s board appointment isn’t a transformational shift, but it does signal continuity and an intent to tighten executive oversight, especially as First Bancorp posts improving net and comprehensive income. For now, the major short-term catalysts remain revenue and earnings growth, dividend consistency, and any actions on the sizeable share buyback program, which has seen little execution so far. On the risk side, the bank’s premium valuation versus peers, recent securities losses driving noninterest income volatility, and a historically modest return on equity are front of mind. Currie's governance experience is an asset, but unless there’s a marked shift in direction or capital deployment, his board seat alone is unlikely to materially change major drivers or risks in the near term.

But investors need to keep a close eye on noninterest income swings. First Bancorp's shares have been on the rise but are still potentially undervalued by 40%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on First Bancorp - why the stock might be worth just $54.46!

Build Your Own First Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives