- United States

- /

- Banks

- /

- NasdaqGS:DCOM

A Look at Dime Community Bancshares’s (DCOM) Valuation Following Expansion Moves in New Jersey and Locust Valley

Reviewed by Simply Wall St

Dime Community Bancshares (DCOM) just made two strategic announcements that underscore its ongoing expansion plans. The company is bringing in Dan Fosina as Senior Vice President, Group Leader, to oversee its push into New Jersey’s middle market commercial banking scene. The company is also preparing to open a new branch in Locust Valley next year.

See our latest analysis for Dime Community Bancshares.

Dime Community Bancshares’ recent moves, including hiring a veteran executive for its New Jersey expansion and laying groundwork for another branch, reflect management’s commitment to growth. Despite these efforts, the 1-year total shareholder return is down 19%, and the year-to-date share price return sits at -6.5%. Still, shares have recently rebounded, with an 8% 1-month share price return, which may indicate that investor sentiment is stabilizing as the company pursues strategic opportunities.

If the prospect of shifting momentum in regional banking caught your attention, now's the perfect time to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets despite recent momentum, the question remains: Is Dime Community Bancshares an undervalued growth story, or is the market already anticipating what comes next?

Most Popular Narrative: 21.2% Undervalued

With Dime Community Bancshares closing at $28.35, the most popular narrative estimates fair value at $36. The difference points to a compelling upside, supported by ambitious growth forecasts and aggressive loan repricing plans.

“The upcoming repricing of nearly $2 billion in loans at substantially higher market rates by the end of 2026, plus another $1.7 billion in 2027, is expected to structurally expand net interest margin and boost earnings significantly in the medium to long term. Continued robust hiring of experienced banking teams, especially in business banking and commercial lending verticals, provides the foundation for above-peer business loan growth and broadening of the customer base, supporting future revenue acceleration.”

Want a behind-the-scenes look at this bold value call? Buried inside the narrative are aggressive profit margin assumptions and a future profit multiple reserved for only the most optimistic projections. Curious to see what’s really driving the fair value estimate? Unlock the crucial details by diving into the numbers that power this narrative.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy concentration in New York and a slow digital investment pace could challenge Dime’s growth story if local market conditions or technology adoption do not keep up.

Find out about the key risks to this Dime Community Bancshares narrative.

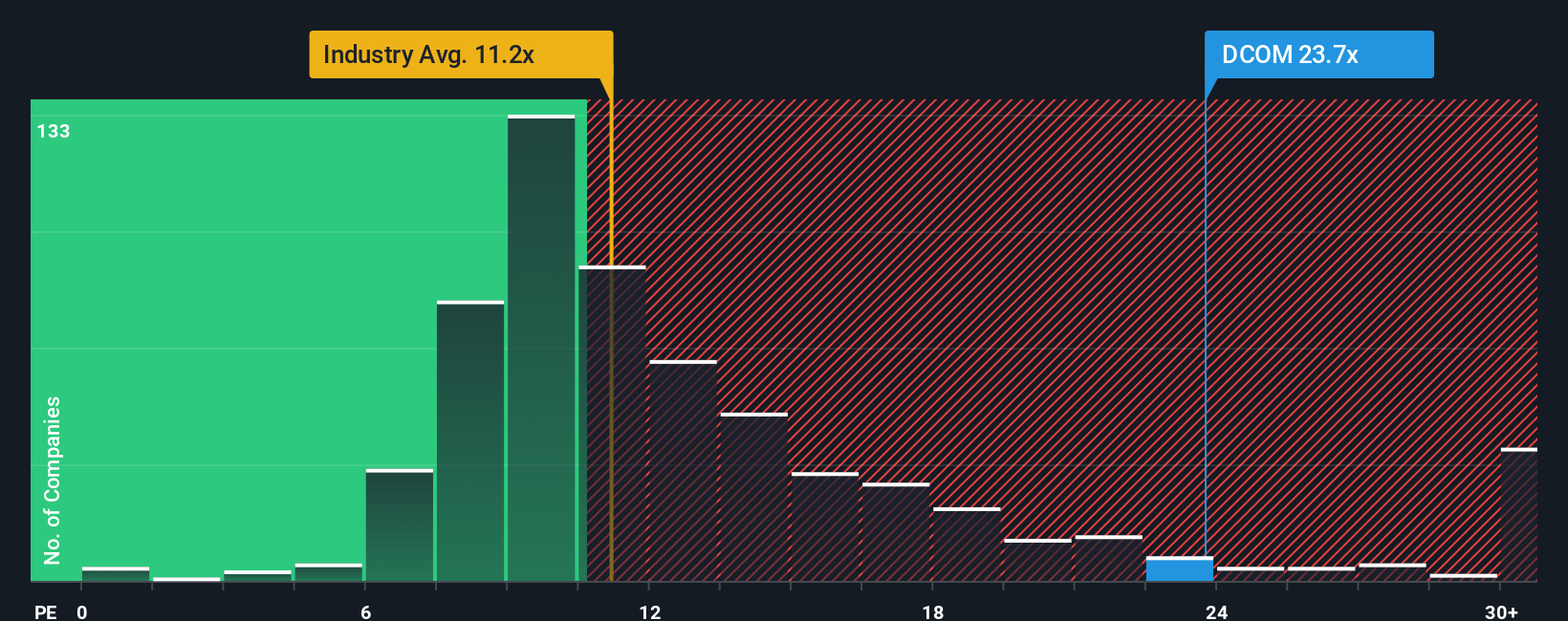

Another View: Valuation by Earnings Multiple

Switching to a simple price-to-earnings yardstick, Dime Community Bancshares trades at 24.8 times earnings. That is far below its peer average of 66 times, yet still above both the industry average of 11.4 and its fair ratio of 21.2. This gap highlights potential upside but also the risk that the market could drift lower toward the fair ratio. Is the market pricing in more challenges than opportunities?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dime Community Bancshares Narrative

If you see the story unfolding differently, or want to dig into the raw numbers yourself, the platform lets you build a narrative in under three minutes, so you can Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dime Community Bancshares.

Looking for more investment ideas?

Get ahead of the crowd by searching for unique opportunities you won’t hear about anywhere else. Reviewing fresh stock picks now can help you stay a step ahead tomorrow.

- Explore powerful trends in artificial intelligence by starting with these 25 AI penny stocks, which are setting the pace for rapid industry transformation.

- Expand your portfolio with tomorrow’s potential breakthroughs as you examine these 28 quantum computing stocks challenging conventional computing limits with revolutionary technology.

- Consider the potential of income investing by turning to these 15 dividend stocks with yields > 3%, delivering attractive yields above 3%, and see what steady income can look like.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DCOM

Dime Community Bancshares

Operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026