- United States

- /

- Banks

- /

- NasdaqGS:CVBF

Can CVB Financial’s (CVBF) Credit Quality Emphasis Protect Value in a Tougher Economy?

Reviewed by Sasha Jovanovic

- CVB Financial Corp, through Citizens Business Bank, recently released its third quarter 2025 Form 10-Q highlighting stable financial metrics and effective cost management against an economic outlook of lower GDP growth and rising unemployment.

- A unique aspect from the report is the company's continued emphasis on credit quality management and loan portfolio diversification, aiming to mitigate credit risk during a potentially challenging economic period.

- We'll explore how CVB Financial's focus on disciplined credit risk management may shape its investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CVB Financial Investment Narrative Recap

To be a shareholder in CVB Financial, you need to believe in its disciplined approach to credit quality and operational efficiency, particularly as California's economy faces slower growth and rising unemployment. The recent 10-Q report underscores management's ongoing focus on cost control and stable financial performance, though it does not present any material change to the near-term catalyst of core deposit growth or the significant risk stemming from commercial real estate exposure.

Among this quarter's announcements, the reported year-over-year growth in net interest income and earnings stands out, especially as the company emphasizes maintaining credit quality in a challenging macroeconomic setting. While these results reinforce CVB's reputation for conservatism and stable operations, when considered alongside cautious economic forecasts, the growth in earning assets and deposit activity remains the critical short-term factor affecting earnings.

However, it is important for investors to consider the risk that comes with CVB Financial's high concentration in California, as...

Read the full narrative on CVB Financial (it's free!)

CVB Financial's narrative projects $581.6 million revenue and $223.8 million earnings by 2028. This requires 4.6% yearly revenue growth and a $21.5 million earnings increase from $202.3 million.

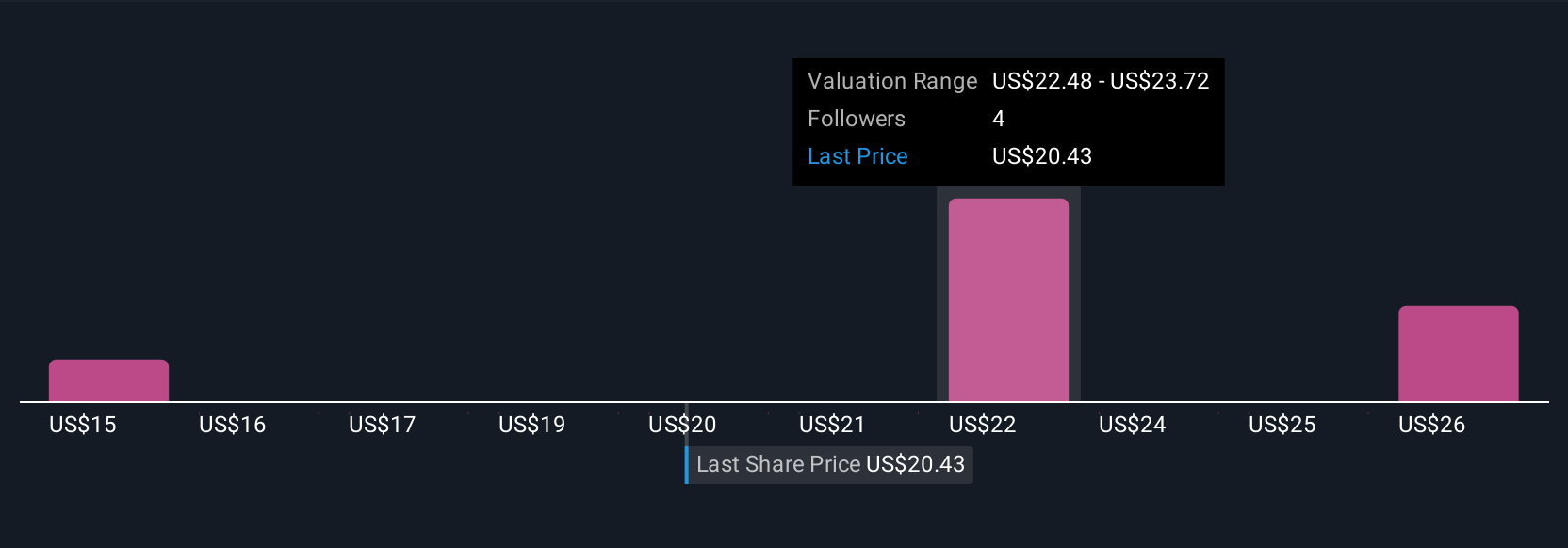

Uncover how CVB Financial's forecasts yield a $22.80 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community placed fair value for CVB Financial shares between US$15 and US$27.65. With some still focused on the ongoing risk from commercial real estate exposure, investor viewpoints reflect an array of possible outcomes for the bank.

Explore 3 other fair value estimates on CVB Financial - why the stock might be worth as much as 48% more than the current price!

Build Your Own CVB Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVB Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CVB Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVB Financial's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVBF

CVB Financial

Operates as a bank holding company for Citizens Business Bank, a state-chartered bank that provides banking and financial services to small to mid-sized businesses and individuals.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives