- United States

- /

- Banks

- /

- NasdaqGS:CVBF

Assessing CVB Financial’s (CVBF) Valuation After a Zacks Rank #2 Buy Upgrade and Renewed Investor Interest

Reviewed by Simply Wall St

Analyst upgrade sparks renewed interest

CVB Financial (CVBF) just picked up a Zacks Rank #2 Buy upgrade, a move that underscores improving earnings expectations and helps explain why investors are taking a fresh look at the regional bank stock.

See our latest analysis for CVB Financial.

The upgrade lands as CVB Financial’s share price has shown a modest rebound recently, with a 1 month share price return of 4.22 percent, but a weaker year to date share price return of 6.43 percent and a 1 year total shareholder return of 12.67 percent, suggesting momentum is only cautiously rebuilding after a tougher stretch for regional banks.

If this shift in sentiment has you rethinking where regional banks fit in your portfolio, it might be a good moment to explore fast growing stocks with high insider ownership for other compelling names.

With shares still trading below analyst targets and a double digit intrinsic discount, yet facing weak multi year returns, investors now have a dilemma: is CVB Financial a value play or is future growth already priced in?

Most Popular Narrative Narrative: 14.5% Undervalued

With the narrative fair value sitting meaningfully above CVB Financial’s last close, the gap hinges on steady growth and resilient profitability over the next few years.

The company's disciplined expense control and operational efficiency through technology investment, branch optimization, and lease negotiations support industry-leading efficiency ratios and provide positive operating leverage even in periods of slow loan growth, benefiting net margins and long-term profitability.

Curious how modest top line growth, shifting margins, and a richer future earnings multiple add up to that valuation? The full narrative breaks down the math behind this conviction, including the revenue path, margin trajectory, and earnings profile that must all click into place.

Result: Fair Value of $22.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, California concentration and elevated commercial real estate exposure mean that a regional downturn or deeper CRE stress could quickly challenge this undervaluation story.

Find out about the key risks to this CVB Financial narrative.

Another View: Multiples Paint a Cautious Picture

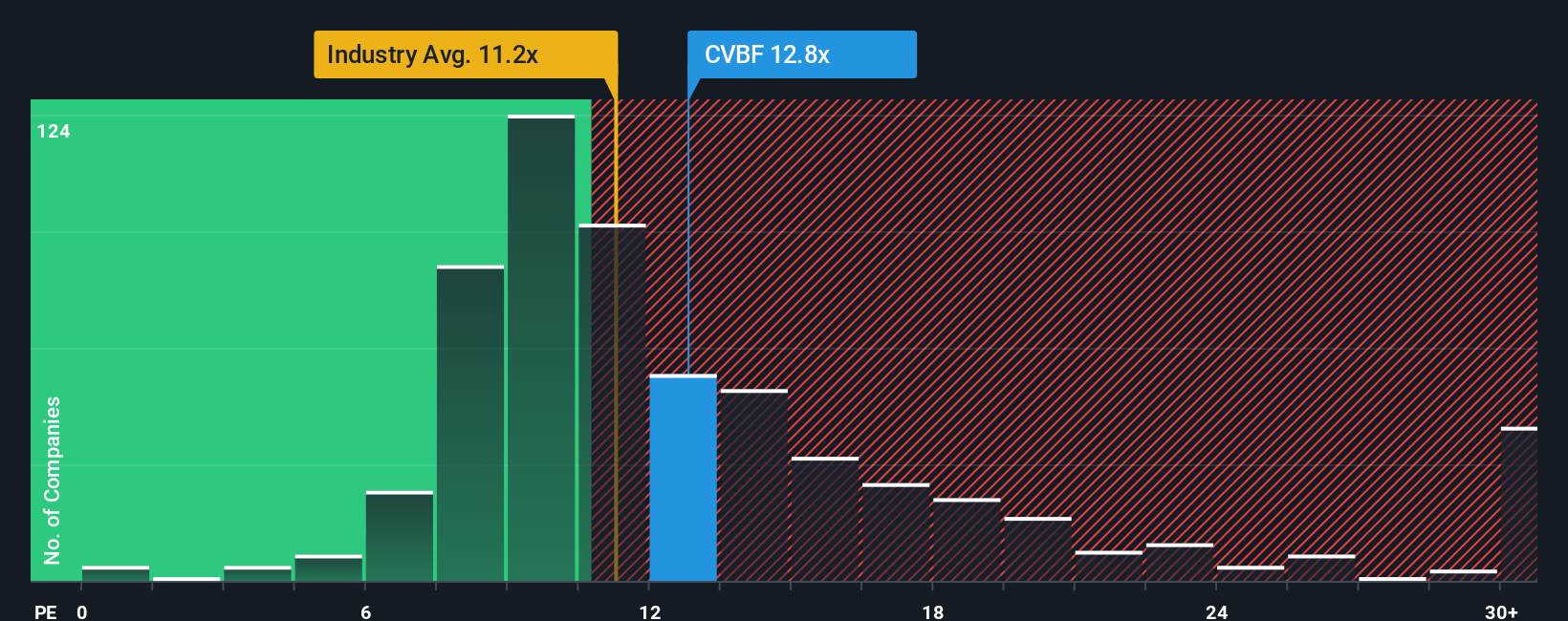

While the narrative and fair value work point to upside, CVB Financial trades on a 13.1x price to earnings ratio versus 11.6x for the US banks sector and a fair ratio of 11.1x. This suggests there is less room for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CVB Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding CVB Financial.

Looking for more investment ideas?

Before you move on, arm yourself with fresh opportunities using the Simply Wall St Screener so you never miss high potential setups hiding in plain sight.

- Lock in potential future income by targeting companies in these 15 dividend stocks with yields > 3% that aim to reward shareholders with attractive, sustainable payouts.

- Position yourself ahead of major shifts in medicine by evaluating innovators powering smarter care through these 30 healthcare AI stocks.

- Strengthen your portfolio’s foundation by focusing on companies passing strict valuation filters in these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVBF

CVB Financial

Operates as a bank holding company for Citizens Business Bank, a state-chartered bank that provides banking and financial services to small to mid-sized businesses and individuals.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026