- United States

- /

- Food

- /

- NasdaqGS:CALM

Cal-Maine Foods And 2 Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As U.S. stock indexes experience modest gains following key inflation data, investors are closely watching the Federal Reserve's upcoming policy decisions and major corporate moves like Netflix's acquisition of Warner Bros. Discovery. In this dynamic market environment, dividend stocks such as Cal-Maine Foods can offer a reliable income stream and potential stability, making them an attractive option for those looking to enhance their portfolios amidst economic fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.79% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.40% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.86% | ★★★★★★ |

| Omnicom Group (OMC) | 4.56% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.59% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.58% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.83% | ★★★★★★ |

| Ennis (EBF) | 5.68% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.09% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.46% | ★★★★★★ |

Click here to see the full list of 122 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Cal-Maine Foods (CALM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cal-Maine Foods, Inc., along with its subsidiaries, operates in the production, grading, packaging, marketing, and distribution of shell eggs and related products with a market cap of approximately $4.01 billion.

Operations: Cal-Maine Foods, Inc.'s revenue primarily derives from the production, grading, packaging, marketing, and distribution of shell eggs, amounting to $4.40 billion.

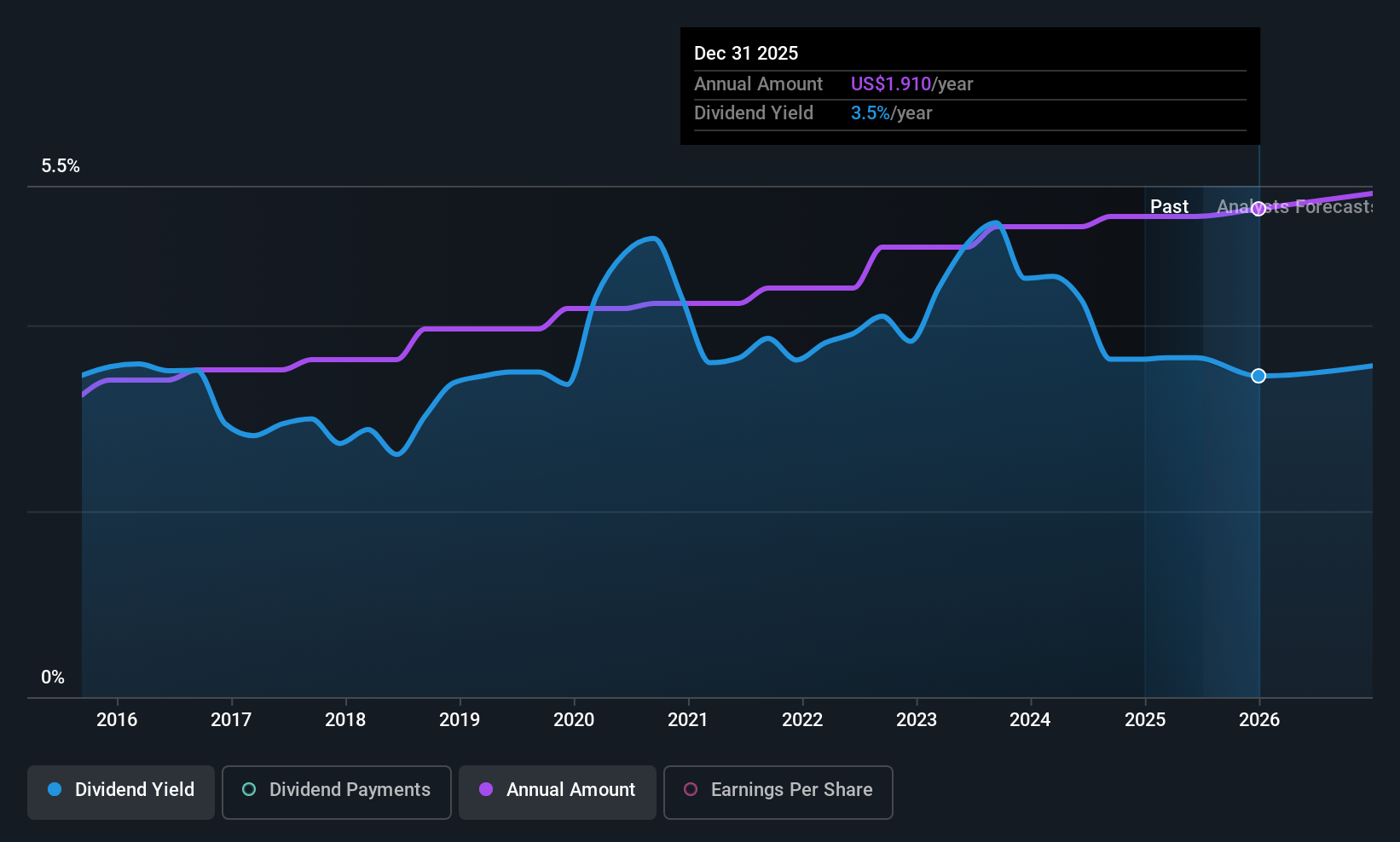

Dividend Yield: 9.8%

Cal-Maine Foods offers a compelling dividend profile with a payout ratio of 33.3%, indicating dividends are well-covered by earnings and cash flows. The dividend yield is among the top 25% in the US market, though past payments have been volatile. Recent earnings growth and strategic M&A pursuits suggest robust cash flow generation, supporting future dividends despite an unstable track record. Leadership changes may enhance financial strategy execution, potentially stabilizing future payouts.

- Dive into the specifics of Cal-Maine Foods here with our thorough dividend report.

- According our valuation report, there's an indication that Cal-Maine Foods' share price might be on the cheaper side.

Community Trust Bancorp (CTBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Trust Bancorp, Inc. is the bank holding company for Community Trust Bank, Inc., with a market cap of approximately $1.03 billion.

Operations: Community Trust Bancorp, Inc. generates its revenue primarily through Community Banking Services, contributing $266.61 million, and the Holding Company segment, adding $96.77 million.

Dividend Yield: 3.7%

Community Trust Bancorp maintains a stable dividend profile with a 37.4% payout ratio, ensuring dividends are well-covered by earnings. Over the past decade, dividends have grown consistently without volatility. The current yield of 3.71% is reliable but below the top quartile of US dividend payers. Recent earnings growth supports this stability, with net income increasing to US$23.91 million in Q3 2025 from US$22.14 million a year ago, reinforcing dividend sustainability despite modest charge-offs reported recently.

- Click to explore a detailed breakdown of our findings in Community Trust Bancorp's dividend report.

- The analysis detailed in our Community Trust Bancorp valuation report hints at an deflated share price compared to its estimated value.

National Bank Holdings (NBHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank Holdings Corporation is a bank holding company for NBH Bank, offering a range of banking products and financial services to commercial, business, and consumer clients in the United States with a market cap of $1.45 billion.

Operations: National Bank Holdings Corporation generates its revenue primarily through its banking segment, which accounts for $405.87 million.

Dividend Yield: 3.2%

National Bank Holdings recently increased its quarterly dividend by 3.3% to US$0.31 per share, maintaining a stable dividend history over the past decade with a payout ratio of 37.8%, indicating strong earnings coverage. Despite a yield of 3.21% being below top-tier US payers, the dividends remain reliable and well-supported by earnings growth, as evidenced by Q3 net income rising to US$35.29 million from US$33.11 million last year amidst reduced charge-offs.

- Take a closer look at National Bank Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility National Bank Holdings' shares may be trading at a discount.

Next Steps

- Click this link to deep-dive into the 122 companies within our Top US Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CALM

Cal-Maine Foods

Engages in the production, grading, packaging, marketing, and distribution of shell eggs, egg products, and prepared foods.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026