- United States

- /

- Banks

- /

- NasdaqGS:COLB

Does Columbia Banking System’s Recent 8% Rally Signal a Value Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if Columbia Banking System’s stock could be a hidden bargain or if the market has already caught on? You’re in the right place for a straightforward look at what the numbers really say.

- The stock’s been on a bit of a ride lately: up 1.6% over the last week and gaining 8.0% in the past month. However, it remains nearly flat for the year and is down about 10% compared to this time last year.

- Recent headlines have focused on regional banks as market volatility keeps investors on their toes. Industry-wide merger discussions and renewed focus on regional lenders have brought Columbia Banking System into the spotlight, influencing shifting sentiment and price momentum.

- On our six-point valuation check, Columbia Banking System earns a 4/6, a decent showing that might make value-seekers take notice. We will explore how this score is calculated and why it is not the only angle for figuring out what the stock is really worth, so stick around for a smarter way to understand valuation by the end of this article.

Find out why Columbia Banking System's -9.6% return over the last year is lagging behind its peers.

Approach 1: Columbia Banking System Excess Returns Analysis

The Excess Returns valuation model looks at how much profit Columbia Banking System generates above its cost of equity. This approach focuses on the company’s ability to create value for shareholders by comparing the returns on invested capital to its equity costs.

For Columbia Banking System, the numbers paint a solid picture:

- Book Value: $26.04 per share

- Stable EPS: $3.04 per share

(Source: Weighted future Return on Equity estimates from 8 analysts.) - Cost of Equity: $1.93 per share

- Excess Return: $1.11 per share

- Average Return on Equity: 10.93%

- Stable Book Value: $27.79 per share

(Source: Weighted future Book Value estimates from 10 analysts.)

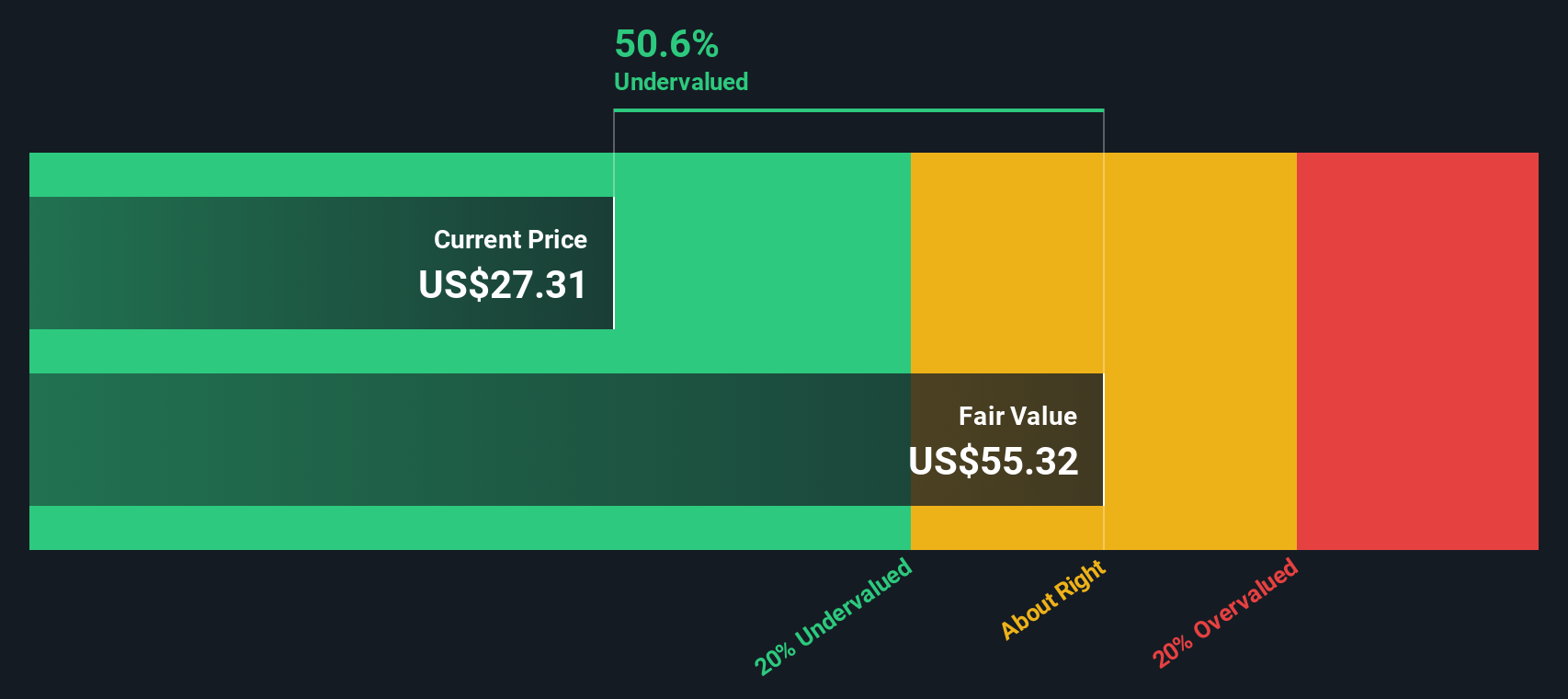

By projecting these returns forward, the model estimates an intrinsic value well above the current share price. The implied discount from intrinsic value is 53.4 percent, suggesting the stock is significantly undervalued using this method.

Columbia Banking System’s ability to generate excess returns over its cost of equity makes it stand out in value-driven analyses. If these trends continue, current prices may offer compelling entry points for long-term investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Columbia Banking System is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover 856 more undervalued stocks based on cash flows.

Approach 2: Columbia Banking System Price vs Earnings

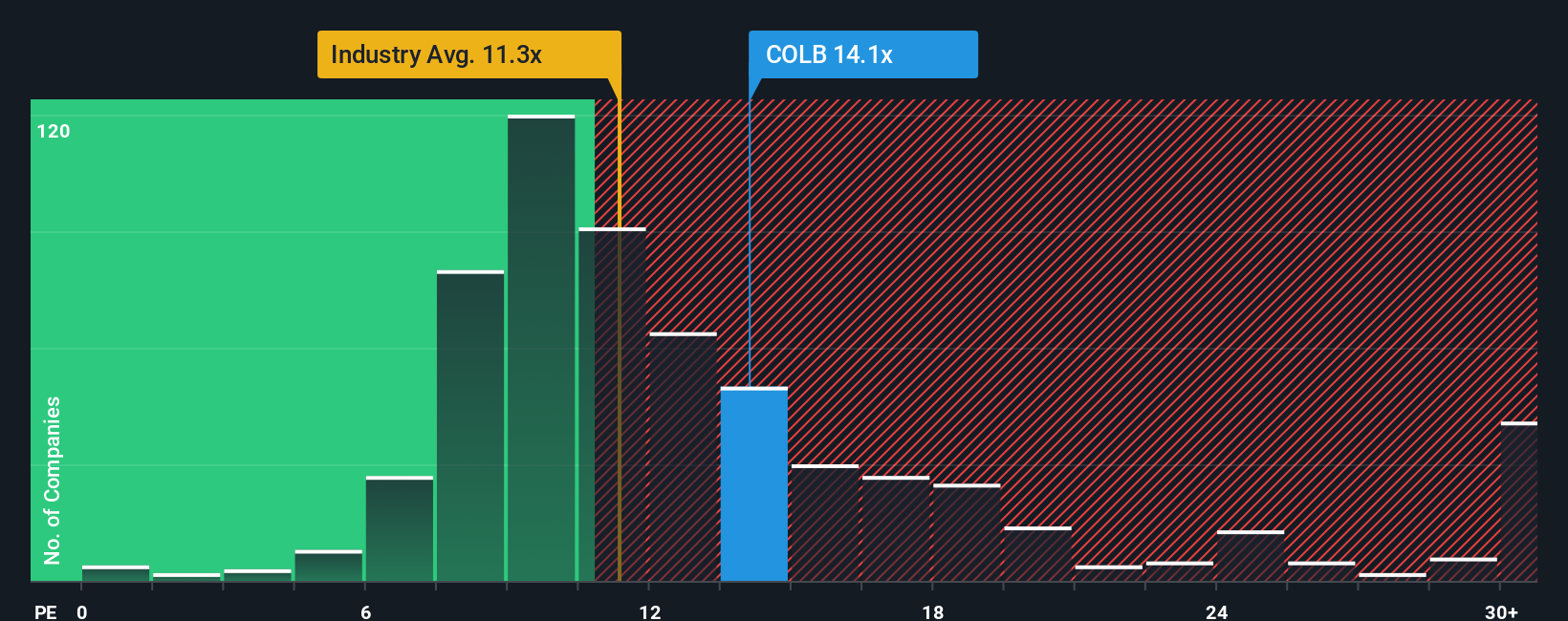

For profitable companies like Columbia Banking System, the Price-to-Earnings (PE) ratio is a practical and popular way to gauge valuation. This multiple answers a simple question: how much are investors willing to pay for each dollar of earnings? When a company has steady or rising profits, the PE ratio helps compare those earnings to the stock price and benchmark it against other companies.

The "right" PE ratio depends on expectations for future growth and the risks involved. Higher growth prospects or lower risk can justify higher PE ratios; slower growth or greater uncertainty often lead to lower ones. For Columbia Banking System, the current PE ratio stands at 16.8x. That is above the banking industry average of 11.2x, but below the average across its peers at 25.0x.

Rather than relying only on broad industry numbers or what peers are trading at, Simply Wall St’s Fair Ratio offers a more tailored benchmark. The Fair Ratio is designed to reflect what the PE ratio should be, considering the company’s growth outlook, profit margin, market cap, risk factors, and industry trends. In Columbia Banking System’s case, the Fair Ratio is calculated at 17.2x, just a fraction above its current PE.

This close alignment tells us the market pricing is reasonable, based on both fundamentals and expectations. The stock’s valuation looks fair using the PE ratio approach and does not show a significant disparity to warrant a strong under- or overvaluation case.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1371 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Columbia Banking System Narrative

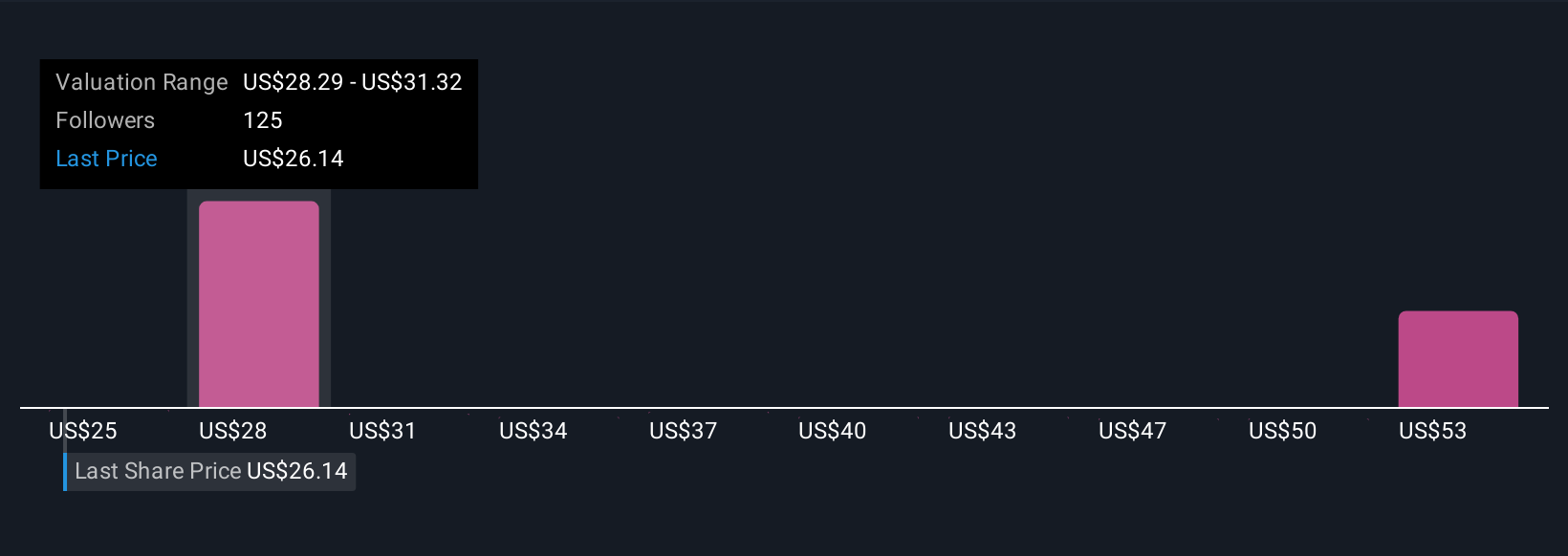

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story behind a company; it is how you interpret the business, markets, and management and how those beliefs translate into what you think the company is worth. With Narratives, you can link your personal perspective (for example, expectations of expansion into high-growth Western regions, digital innovation, or risks from integration and competition) to a financial forecast and a fair value, making your investment logic more visible and trackable.

Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors share, update, and debate their viewpoints. This tool helps you compare your own fair value estimate to the actual share price, assess upside or downside, and decide when buying or selling makes sense. Whenever new events or news affect Columbia Banking System, such as management changes, earnings updates, or analyst revisions, Narratives can be updated instantly so your story and the numbers stay current with reality.

For example, one investor might see Columbia Banking System’s expansion and cost-saving strategies as catalysts for growth, using optimistic revenue and earnings forecasts to set a price target as high as $35.00; another may worry about integration risks and margin pressures, supporting a more cautious target closer to $25.00.

Do you think there's more to the story for Columbia Banking System? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives