- United States

- /

- Banks

- /

- NasdaqGS:COLB

Dividend Hike and Leadership Change Could Be a Game Changer for Columbia Banking System (COLB)

Reviewed by Sasha Jovanovic

- Columbia Banking System recently increased its dividend and announced key executive leadership changes, appointing Brock Lakely as Executive Vice President, Chief Accounting Officer, and Corporate Controller following the departure of Lisa M. White in November 2025.

- This development highlights the company's ongoing focus on earnings stability, operational leadership, and commitment to consistent capital returns for shareholders.

- We'll explore how the company's dividend increase signals confidence in operational strength and shapes Columbia Banking System’s investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Columbia Banking System Investment Narrative Recap

Shareholders in Columbia Banking System generally need to believe in the long-term growth potential of regional banking, disciplined capital allocation, and the company’s ability to manage integration risk as it expands. The recent executive leadership change, appointing Brock Lakely as Chief Accounting Officer, is not expected to materially impact the short-term outlook, where the successful execution of acquisitions remains the key catalyst and integration risk is the most significant concern.

The most relevant recent announcement is the 3% dividend increase, which reinforces Columbia’s focus on consistent capital returns. This aligns directly with management’s efforts to signal confidence in operational resilience and earnings quality, especially important as the company works through integration of new acquisitions, currently the central near-term catalyst driving investor attention.

However, in contrast to capital return priorities, investors should also be aware that a concentrated geographic footprint brings exposure to...

Read the full narrative on Columbia Banking System (it's free!)

Columbia Banking System's narrative projects $3.5 billion in revenue and $1.3 billion in earnings by 2028. This requires 22.8% yearly revenue growth and a $771.5 million earnings increase from current earnings of $528.5 million.

Uncover how Columbia Banking System's forecasts yield a $29.46 fair value, a 5% upside to its current price.

Exploring Other Perspectives

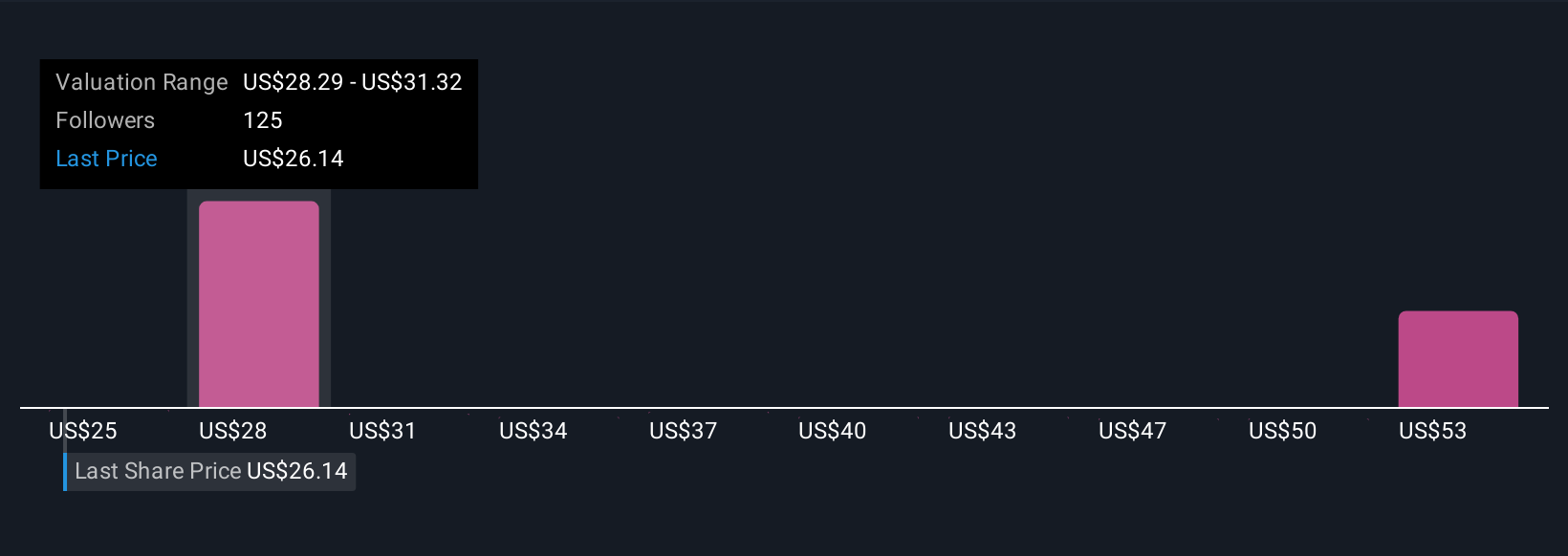

Fair value estimates from 19 Simply Wall St Community members span US$25.25 to US$57.69 per share, reflecting a wide range of individual views. Amid this diversity, be mindful that ongoing acquisition integrations could be a pivotal factor for Columbia Banking System’s future results, see how others interpret the implications here.

Explore 19 other fair value estimates on Columbia Banking System - why the stock might be worth over 2x more than the current price!

Build Your Own Columbia Banking System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Banking System research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Columbia Banking System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Banking System's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026