- United States

- /

- Banks

- /

- NasdaqGS:CNOB

ConnectOne Bancorp (CNOB): Valuation Insights Following Analyst Upgrade and Strong Q3 Earnings

Reviewed by Simply Wall St

Piper Sandler’s recent upgrade of ConnectOne Bancorp (CNOB) to an overweight rating followed closely after third quarter results that showed clear jumps in both net interest income and net income year over year.

See our latest analysis for ConnectOne Bancorp.

ConnectOne Bancorp’s share price has seen renewed momentum lately, closing at $24.34 and notching a 6.2% return over the past 90 days. While the year-to-date share price return stands at 8.0%, longer-term performance tells a more mixed story with a one-year total shareholder return of -7.3%, but a robust 59.4% gain over five years. Recent earnings growth and steady dividend payments have helped revive sentiment; however, challenges remain on the horizon.

If the pickup in performance has you curious about other opportunities, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With analyst upgrades and shares trading at a noticeable discount to price targets, the key question is whether ConnectOne Bancorp is truly undervalued today or if expectations of future growth are already fully reflected by the market.

Most Popular Narrative: 16.4% Undervalued

Despite ConnectOne Bancorp closing at $24.34, the most widely followed narrative suggests a fair value nearly 16% higher. This hints at fresh upside based on bold projections for growth and integration benefits. This framing puts a spotlight on the company’s expanded footprint and operational momentum after its recent merger.

The recent merger with First of Long Island Bank has significantly expanded ConnectOne's geographic footprint and client base, increasing its scale and enhancing market access, especially in high-growth Long Island. This positions the company to capture additional revenue opportunities from lending and deposit growth in economically vibrant metro areas.

Curious what future performance could justify a premium above today’s price? Underneath this narrative, analysts are calling for explosive top-line and margin expansion, culminating in a share price scenario that few would anticipate for a regional bank. The details behind this expected transformation are eye-opening. Find out which aggressive earnings forecasts form the core of this valuation.

Result: Fair Value of $29.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising exposure to commercial real estate and economic concentration in key markets could quickly turn optimism into caution if loan quality trends weaken.

Find out about the key risks to this ConnectOne Bancorp narrative.

Another View: Is the Market Overestimating?

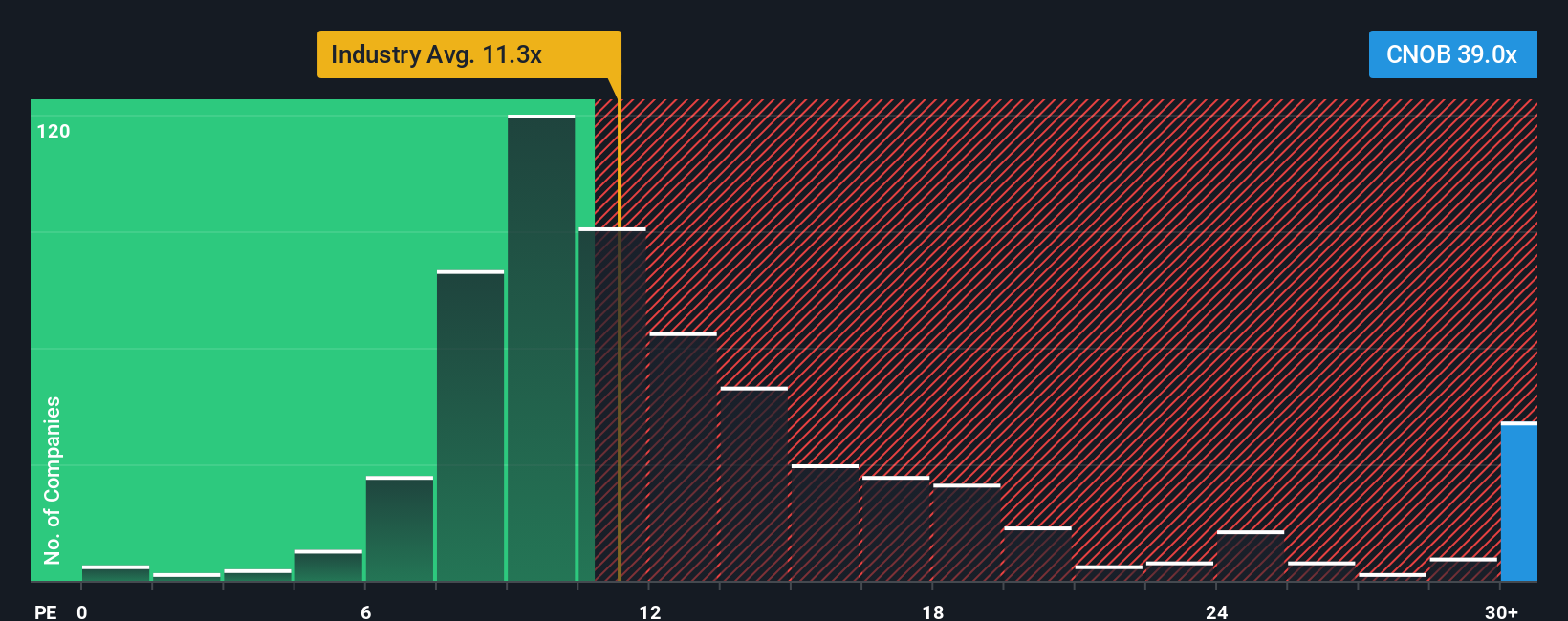

While some see ConnectOne Bancorp as undervalued based on earnings growth narratives, a closer look at its price-to-earnings ratio tells a different story. Shares trade at 22.2 times earnings, which is double the US Banks industry average of 11.1 times and just above the fair ratio of 21.1 times. This premium suggests investors are already pricing in much of the future optimism and could face risk if growth falls short. Is this a signal to pause for thought?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ConnectOne Bancorp Narrative

If you’re not convinced by these perspectives or would rather dig into the numbers yourself, you can build your own story in just a few minutes. Do it your way

A great starting point for your ConnectOne Bancorp research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your investment strategy by tapping into unique opportunities beyond the usual headlines. Don’t let bold new possibilities pass you by on Simply Wall St!

- Uncover high-yield opportunities by checking out these 16 dividend stocks with yields > 3%, which features companies offering yields above 3% and a record of consistent payouts.

- Capture growth potential with these 25 AI penny stocks, where AI-driven businesses are making headlines through innovation and rapid market expansion.

- Position yourself ahead of the market by reviewing these 875 undervalued stocks based on cash flows, which spotlights stocks trading below their intrinsic value based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNOB

ConnectOne Bancorp

Operates as the bank holding company for ConnectOne Bank that provides commercial banking products and services for small and mid-sized businesses, local professionals, and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives