- United States

- /

- Banks

- /

- NasdaqGS:CCB

Could Shifting EPS Drivers and a Risk Chief Exit Recast Coastal Financial’s Core Story (CCB)?

Reviewed by Sasha Jovanovic

- Recently, TD Cowen highlighted Coastal Financial Corp as being at an inflection point in its earnings per share growth trajectory, expecting revenue growth to accelerate while expense growth slows.

- Around the same time, Coastal Financial announced the amicable resignation of Executive Vice President and Chief Risk Officer Andrew Stines, signaling a planned leadership transition in its risk function.

- Next, we’ll examine how TD Cowen’s view of accelerating revenue alongside moderating expenses could influence Coastal Financial’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Coastal Financial's Investment Narrative?

To own Coastal Financial, you have to believe its higher growth profile can justify a richer bank valuation while recent earnings wobble back toward a steadier upward path. The TD Cowen call that Coastal is at an EPS “inflection point,” with faster revenue and slower expense growth, aligns with earlier forecasts of strong top and bottom line expansion and helps explain why the stock has already delivered a very large five year return despite trading below some fair value estimates. In the short term, the key catalyst is whether upcoming quarters actually show that operating leverage improving after recent margin compression. The amicable exit of the Chief Risk Officer looks immaterial so far, but it does refocus attention on execution risk and governance at a time when expectations are already high and the shares screen expensive versus peers.

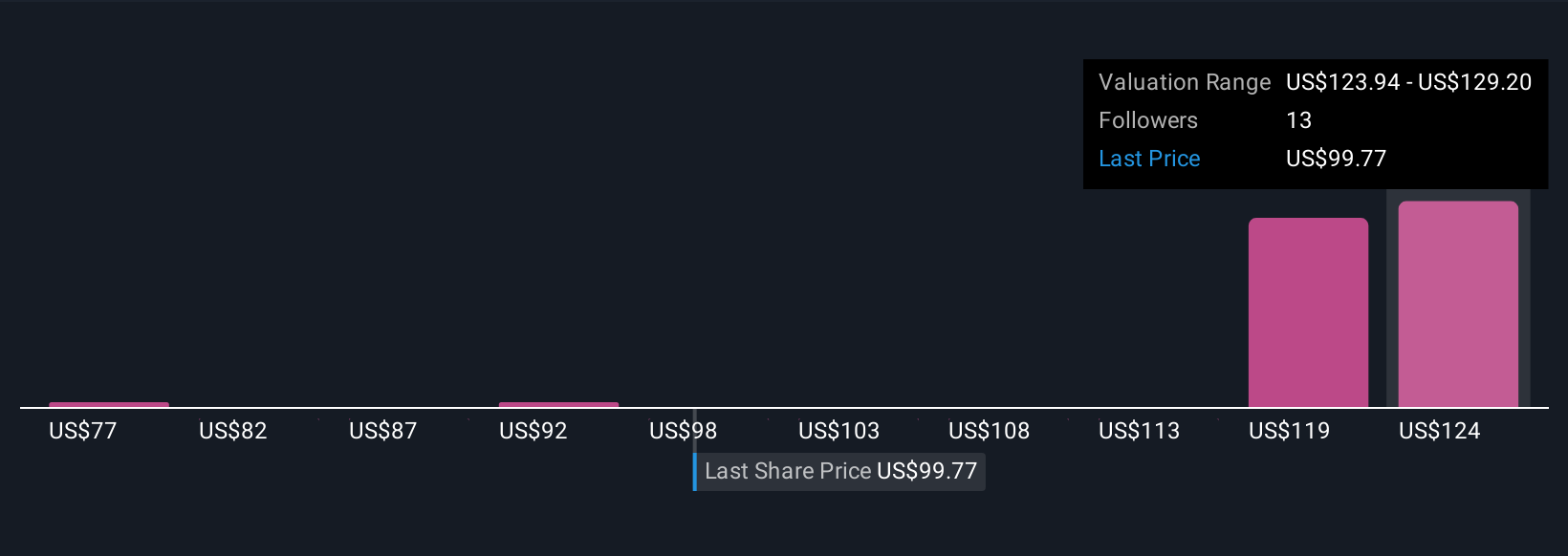

However, investors should be aware of how much must go right to support today’s valuation. Coastal Financial's shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Coastal Financial - why the stock might be worth 32% less than the current price!

Build Your Own Coastal Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coastal Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coastal Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coastal Financial's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026