- United States

- /

- Banks

- /

- NasdaqGS:BUSE

The Bull Case For First Busey (BUSE) Could Change Following Expanded Buybacks And New CFO - Learn Why

Reviewed by Sasha Jovanovic

- First Busey Corporation recently expanded its share repurchase program, authorizing buybacks of up to 5,454,275 common shares with no set expiration, while also reporting insider purchases of its Series B preferred depositary shares and appointing Christopher H.M. Chan as Chief Financial Officer for both the company and Busey Bank.

- The enlarged, open-ended buyback authorization highlights management’s confidence in the company’s intrinsic value and provides additional flexibility in how capital is returned to shareholders over time.

- Next, we’ll examine how the enlarged, open-ended share repurchase authorization shapes First Busey’s investment narrative and capital return profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is First Busey's Investment Narrative?

To own First Busey today, you really need to believe the bank can convert its solid net interest income and reliable dividend into consistently higher, less volatile earnings, despite recent margin pressure and a low return on equity. The enlarged, open‑ended buyback authorization and insider preferred stock purchase add a supportive backdrop for the share price, but they do not fundamentally change the near‑term earnings story or the importance of credit quality, funding costs and Q4 2025 results as the main catalysts. The CFO transition also matters here, as investors will be watching how capital is allocated between dividends, buybacks and balance sheet strength after a loss-making Q1 and more mixed profit trend. Overall, the repurchase news is helpful, but not a game‑changer for the key risks.

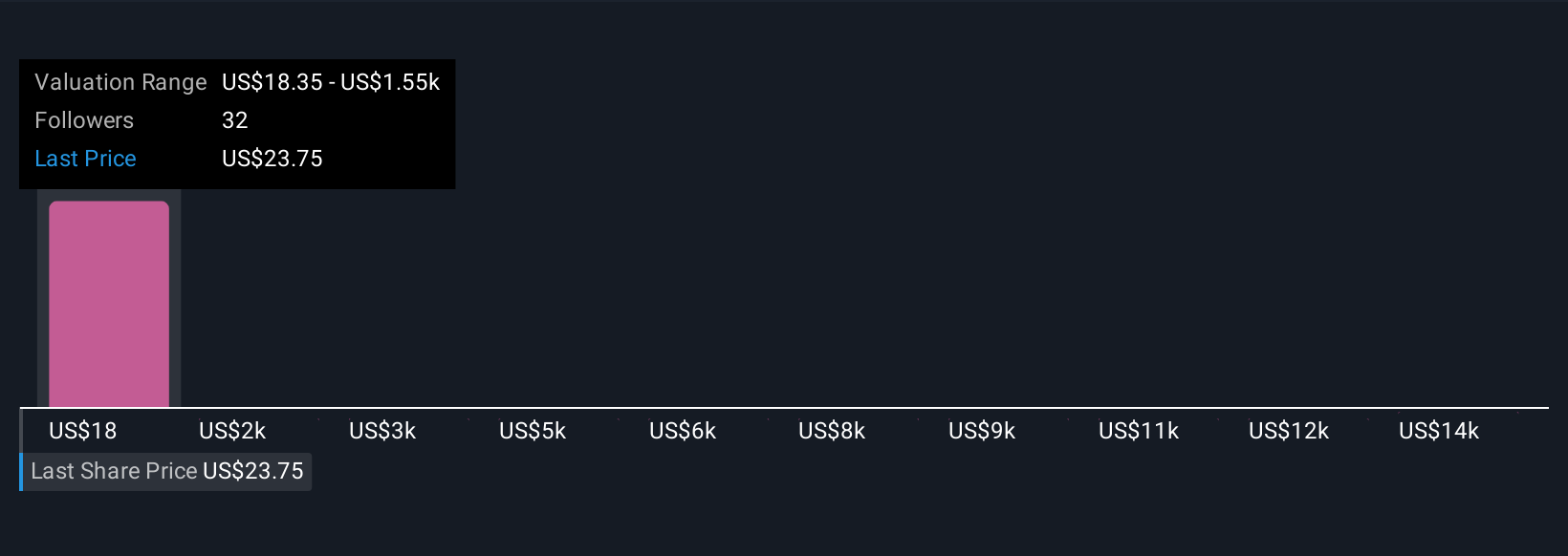

However, one risk around earnings quality and sustainability may not be fully appreciated yet. First Busey's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on First Busey - why the stock might be worth 24% less than the current price!

Build Your Own First Busey Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Busey research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Busey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Busey's overall financial health at a glance.

No Opportunity In First Busey?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026