- United States

- /

- Banks

- /

- NasdaqGS:BOKF

Assessing BOK Financial (BOKF) Valuation: Is Further Upside Possible After a Recent Uptrend?

Reviewed by Kshitija Bhandaru

BOK Financial (BOKF) shares have edged up around 2% in the past week, continuing a steady upward trend. Investors looking at the month and past 3 months will notice gains of 0% and 9% respectively.

See our latest analysis for BOK Financial.

Momentum has picked up for BOK Financial, with its latest share price holding steady at $113.34 and its one-year total shareholder return reaching 12.8%. This recent upturn suggests improving sentiment among investors, even as other regional banks report more mixed results.

If BOK Financial’s resilient performance caught your attention, it could be the perfect moment to discover fast growing stocks with high insider ownership.

The question now is whether BOK Financial’s share price is trading below its real worth, or if the strong results and growth prospects are already reflected in today’s valuation. This could mean there is little room for further upside.

Most Popular Narrative: 2.4% Undervalued

Compared to the last close price of $113.34, the most widely followed narrative pegs BOK Financial’s fair value at $116.10. This modest premium sets the stage for a close look at the bank’s growth drivers and future prospects.

Sustained population and economic growth in the Sun Belt and Midwest regions are driving strong demand for lending, commercial real estate, and wealth management. This is reflected in accelerating loan growth in core C&I, CRE, and new mortgage finance initiatives, supporting ongoing revenue expansion. Broader adoption of digital banking, combined with BOK Financial's continued investments in technology and customer experience, is expected to yield long-term operational efficiencies, reduce operating costs, and enhance net margins.

Curious how growth in key U.S. regions and a push for digital excellence fuel this valuation? The narrative is built on ambitious expansion goals and forecasts banking metrics you wouldn’t expect for a regional lender. The numbers supporting this price target might just surprise you.

Result: Fair Value of $116.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on regional economic strength and concentration in commercial real estate lending could challenge BOK Financial’s growth story if conditions shift unexpectedly.

Find out about the key risks to this BOK Financial narrative.

Another View: What Multiples Say

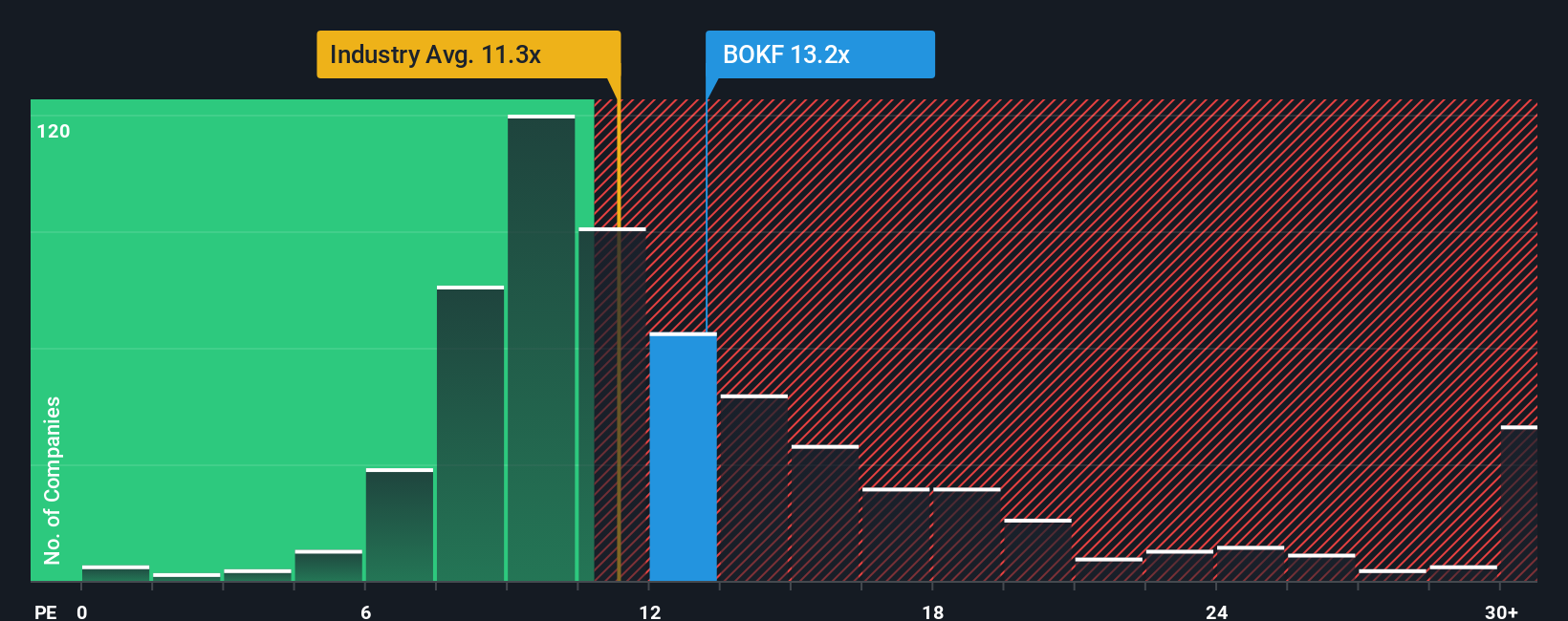

While the narrative and analyst forecasts see BOK Financial as undervalued, the market’s most common yardstick tells a different story. At 13.6 times earnings, BOK Financial trades above both the US banks industry average (11.8x) and its peer average (13x). This signals a pricier position. In fact, this is also higher than its fair ratio of 12.1x. Investors are therefore paying a premium compared to what the numbers suggest the market could eventually settle on. Is the growth story strong enough to justify paying more, or could this premium limit upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you think there’s more to the story or want to dig into the numbers yourself, building your own view of BOK Financial takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Looking for more investment ideas?

Unlock your next opportunity right now. The market moves fast, and you won’t want to miss stocks making waves in high-potential corners of the investing landscape.

- Capitalize on the payout power of companies consistently delivering yields above 3% with these 19 dividend stocks with yields > 3%.

- Stay ahead of breakthroughs by targeting innovators riding the artificial intelligence boom through these 24 AI penny stocks.

- Catch undervalued businesses primed for growth before everyone else using these 885 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives