- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (XPEV) Is Up 25.2% After Record EV Deliveries and Humanoid Robot Unveiling – What’s Changed

Reviewed by Sasha Jovanovic

- XPeng Inc. reported record deliveries of 42,013 Smart EVs in October 2025, a 76% year-over-year increase, while unveiling its next-generation 'Iron' humanoid robot at its recent AI Day event.

- This combination of robust vehicle deliveries and new robotics innovation signals XPeng's ongoing efforts to expand its technology leadership and strengthen its brand momentum.

- To assess the impact of these developments, we'll examine how XPeng's record EV deliveries and robotics unveiling influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

XPeng Investment Narrative Recap

To be an XPeng shareholder, you need to believe in the company’s ability to convert rapid Smart EV delivery growth and AI-driven innovation into sustainable profitability. The record-breaking October deliveries and robotics showcase reinforce the short-term catalyst around accelerating sales momentum, but don’t fundamentally change the biggest risk, high R&D and marketing spending persistently outweighing gross profit, delaying the path to positive net margins and shareholder returns.

Among recent announcements, the Volkswagen partnership stands out, as it could enhance both next-generation vehicle technology and recurring high-margin IP revenues. In the context of surging deliveries, this alliance adds weight to XPeng’s ambitions to lift its average selling price and brand profile, supporting the company’s efforts to improve margins and shift toward profitability over time.

However, contrasting with this positive news, investors should be aware of XPeng’s continued net losses and the risk that...

Read the full narrative on XPeng (it's free!)

XPeng's narrative projects CN¥137.4 billion revenue and CN¥6.4 billion earnings by 2028. This requires 31.6% yearly revenue growth and a CN¥10.7 billion increase in earnings from the current CN¥-4.3 billion.

Uncover how XPeng's forecasts yield a $26.95 fair value, in line with its current price.

Exploring Other Perspectives

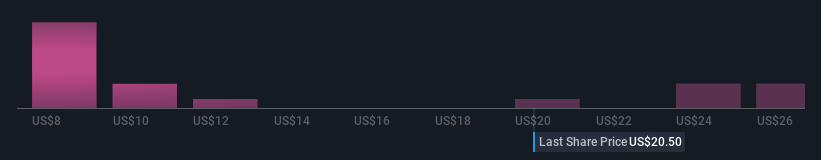

Fifteen private investors in the Simply Wall St Community estimate fair value for XPeng shares between CN¥9.86 and CN¥33.26. With automotive price competition still fierce, your outlook may differ significantly depending on whether you see rising deliveries offsetting margin pressures, consider exploring several different viewpoints before making up your mind.

Explore 15 other fair value estimates on XPeng - why the stock might be worth less than half the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives