- United States

- /

- Auto

- /

- NYSE:XPEV

US Stock Market Today: S&P 500 Futures Dip as Shutdown Concerns Weigh on Sentiment

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Tuesday, Nov, 11 2025

US stock futures are slightly lower this morning, with S&P 500 futures down about 0.2%, as investors weigh progress on a potential US government funding bill. The Senate has advanced legislation to end a historic 41-day shutdown, with a final vote still pending in the House. This means basic government services could be restored soon, but any delay could keep markets on edge. Meanwhile, China’s vehicle market powered higher, with October car sales up nearly 9% from last year and new energy vehicles making up over half the market. On one hand, avoiding a prolonged US shutdown might support companies tied to government contracts. On the other hand, the shift toward electric cars puts automakers and tech suppliers in the spotlight as investors try to figure out which manufacturers are ready to ride the next wave of demand.

Get ahead of today's auto shift with 24 AI penny stocks that are primed for outsized gains as markets refocus.

Top Movers

- XPeng (XPEV) surged 16.15% after BofA raised its price target, citing new momentum in AI products.

- Sandisk (SNDK) jumped 11.89% as multiple banks increased price targets and noted AI-driven growth in NAND.

- Palantir Technologies (PLTR) rose 8.81% after announcing a major partnership to launch an AI marketing platform for enterprises.

Is Palantir Technologies still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

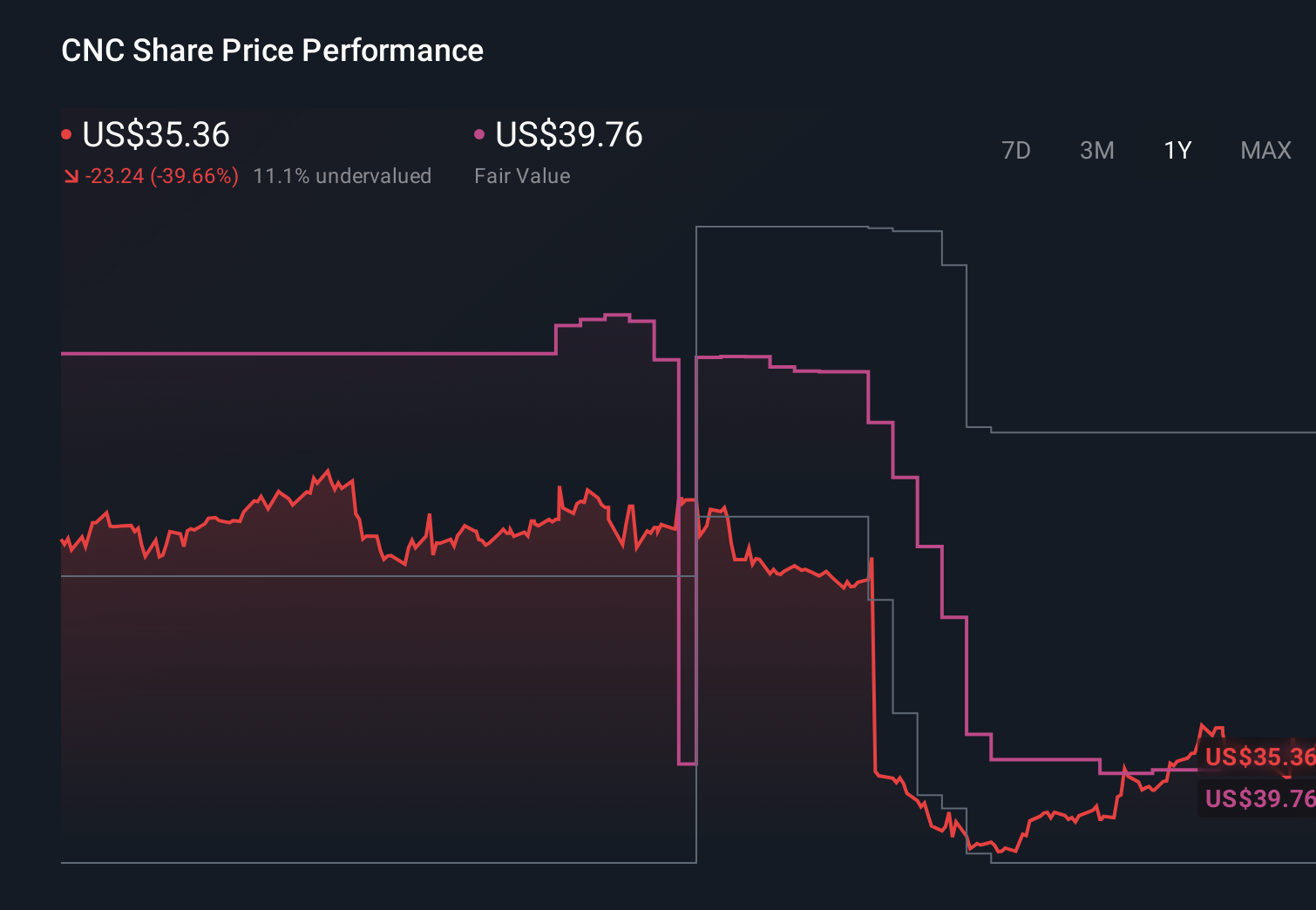

- Centene (CNC) sank 8.81% as Florida's health contract loss is projected to dent profits.

- IonQ (IONQ) slid 6.58% despite announcing a major University of Chicago quantum partnership.

- Humana (HUM) declined 5.40% after analysts cut price targets following concerns about Q3 margins.

Look past the noise - uncover the top narrative that explains what truly matters for IonQ's long-term success.

On The Radar

Technology and consumer giants headline the next round of earnings, promising critical updates on software, entertainment, and chip demand.

- The Walt Disney Company (DIS) will announce Q4 results before the market opens on Wednesday, highlighting streaming growth and theme park performance as indicators of consumer demand.

- Cisco Systems (CSCO) reports Q1 results after the close on Wednesday, offering a key read on enterprise spending and software demand.

- Applied Materials (AMAT) will release Q4 earnings Wednesday afternoon, providing crucial signals on semiconductor equipment orders and chip sector trends.

- JD.com (JD) will report Q3 results before the market opens on Wednesday, spotlighting China’s e-commerce growth in a changing competitive landscape.

- US Government Funding Bill is set for a pivotal House vote, potentially restoring federal operations and shaping the near-term macro outlook.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

Don't Just Read The News, Use It

Hidden gems often go unnoticed until it's too late, so act fast. Our research highlights undervalued stocks based on cash flows that could surprise the market with resilient growth and strong upside potential.

Ready to take control? Use our stock screener to uncover hidden gems that fit your unique investing style and get timely alerts on every new opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives