- United States

- /

- Auto

- /

- NYSE:THO

THOR Industries (THO): Assessing Valuation After Recent Stock Price Uptick

Reviewed by Simply Wall St

See our latest analysis for THOR Industries.

This recent share price uptick follows a generally constructive trend for THOR Industries over 2024, with a year-to-date share price return of more than 10%. While its 1-year total shareholder return is modestly negative, the three- and five-year total returns of nearly 40% and 32% respectively suggest momentum has built over the longer term. This is especially notable as the RV market stabilizes and investors weigh improving net income growth.

If you’re interested in discovering what’s driving other auto manufacturers lately, now’s a perfect moment to check out See the full list for free.

With THOR Industries showing improving fundamentals and a recent move closer to analyst price targets, the real question is whether today’s valuation offers an attractive entry point or if future growth is already fully accounted for.

Price-to-Earnings of 21.2x: Is it justified?

THOR Industries trades at a price-to-earnings ratio of 21.2x, notably higher than both the global auto industry average and its own peers. With a last close price of $104.20, the stock appears more expensive when viewed through this valuation lens.

The price-to-earnings (P/E) ratio compares a company’s share price with its earnings per share. This is a key measure of how much investors are willing to pay for each dollar of earnings. For auto manufacturers, this multiple is widely watched because it often reflects expectations for growth and profitability in a cyclical industry.

Currently, THOR Industries’ P/E is 21.2x, above the global auto industry average of 18x and higher than the peer average of 20.9x. This premium suggests the market is expecting stronger performance or resilience relative to most competitors. However, compared to the estimated fair P/E ratio of 15.2x, the stock trades at a significant premium. The market could move back toward this level if expectations shift.

Explore the SWS fair ratio for THOR Industries

Result: Price-to-Earnings of 21.2x (OVERVALUED)

However, risks remain, such as slower revenue growth and the possibility that profit margins may narrow if industry demand softens or if competition intensifies.

Find out about the key risks to this THOR Industries narrative.

Another View: What Does the SWS DCF Model Suggest?

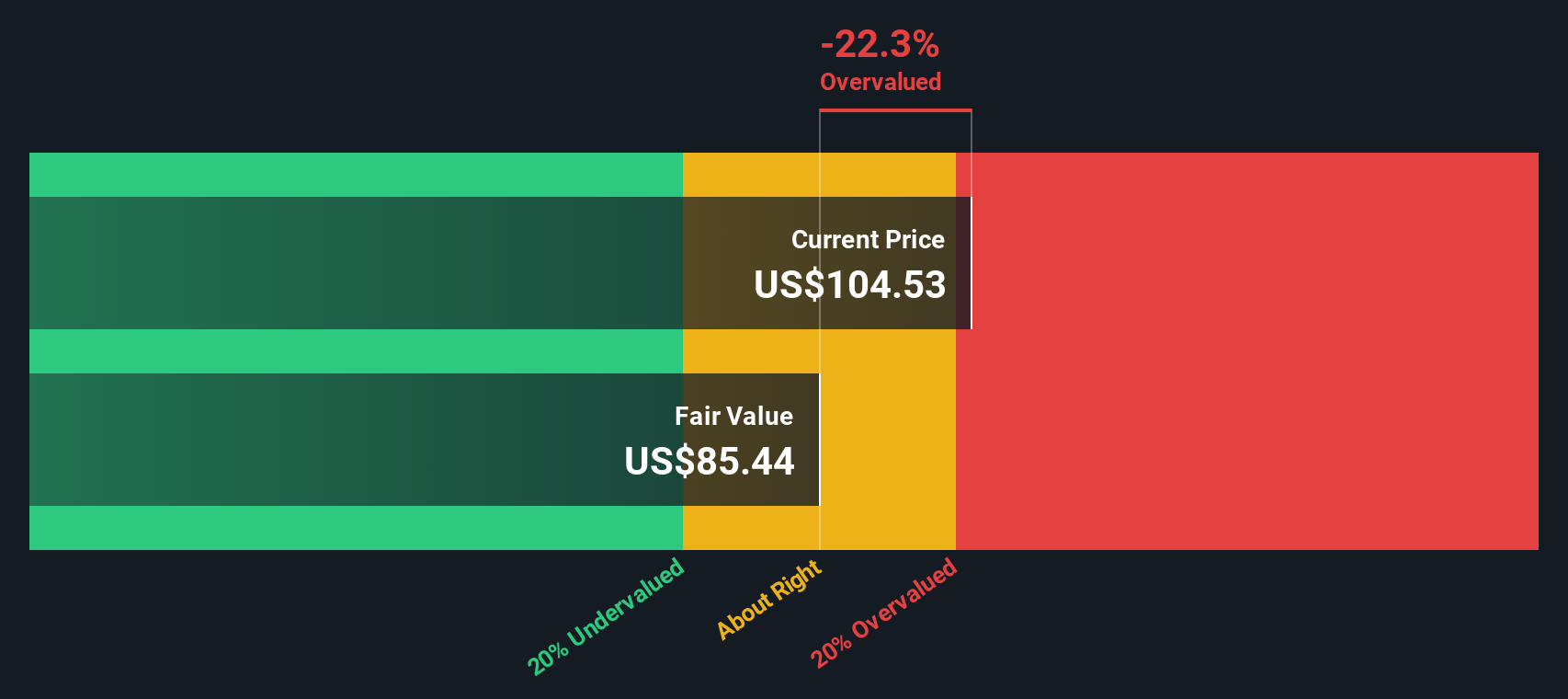

While the current market price and its higher-than-average P/E ratio point to possible overvaluation, our DCF model takes a different approach. It estimates THOR Industries’ fair value at $94.32. This indicates that shares are trading above this level. Could this signal that expectations are running ahead of fundamentals, or is the market seeing something the model cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out THOR Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own THOR Industries Narrative

If you want to challenge these conclusions or dive deeper into the data, you can craft your own view in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding THOR Industries.

Looking for more investment ideas?

Unlock smarter investing by going beyond the obvious. The right screener can reveal tomorrow’s winners in unlikely places. Don’t settle for the ordinary when you can spot true opportunity with just a click.

- Fuel your hunt for untapped potential when you scan these 3606 penny stocks with strong financials that are gaining momentum for their strong financials and surprising resilience.

- Supercharge your portfolio by tapping into the rise of automation and analytics with these 26 AI penny stocks that are pushing the boundaries of intelligence-driven growth.

- Capture compelling value by reviewing these 848 undervalued stocks based on cash flows that Wall Street might be sleeping on, all based on robust cash flow signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives