- United States

- /

- Auto

- /

- NYSE:THO

Could a Fresh Analyst Upgrade Shift the Longer-Term Outlook for THOR Industries (THO)?

Reviewed by Sasha Jovanovic

- Raymond James upgraded Thor Industries (THO) from Underperform to Market Perform on October 27, 2025, reflecting increased confidence from analyst Joseph Altobello.

- This rating shift, supported by Altobello’s recent track record, points to an evolving view among analysts covering the recreational vehicle manufacturer.

- We’ll now explore how this influential analyst upgrade could shape Thor Industries’ investment narrative in the near term.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is THOR Industries' Investment Narrative?

To believe in THOR Industries as a shareholder today, you need to be confident in the company’s ability to manage steady but moderate earnings and sales growth in a recreational vehicle market that has lagged broader industry expansion. The recent upgrade from Raymond James’ Joseph Altobello, shifting to a Market Perform rating, injects a dose of analyst confidence, but stops short of a bullish outlook and does not alter the consensus price target. This change could boost sentiment in the short term but is unlikely to materially shift the main catalysts or risks already in play, such as the rollout of electric motorhomes, ongoing share buybacks, and gradual improvements in profitability and margins. However, risks like THOR’s higher-than-average valuation, slower revenue and earnings growth forecasts, and underwhelming relative stock performance remain front and centre, especially as peer and market comparisons continue to highlight these areas. The analyst upgrade may support stability but doesn’t erase these near-term challenges for investors.

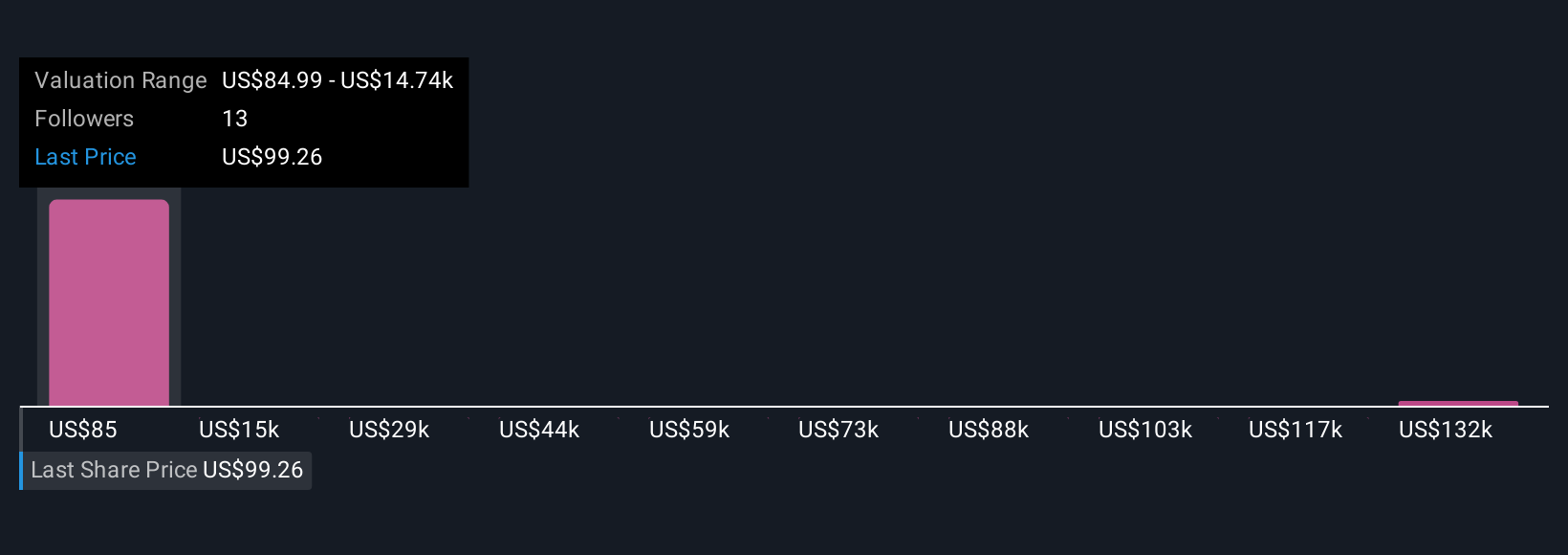

But with value looking stretched and earnings growth trailing the market, that’s a risk you can’t ignore. THOR Industries' share price has been on the slide but might be up to 22% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on THOR Industries - why the stock might be worth 18% less than the current price!

Build Your Own THOR Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your THOR Industries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free THOR Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate THOR Industries' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives