- United States

- /

- Auto Components

- /

- NYSE:QS

QuantumScape (QS) Valuation Check After Cobra Separator Breakthrough and New OEM Partnership Progress

Reviewed by Simply Wall St

QuantumScape (QS) just checked several big boxes at once, from locking in its Cobra ceramic separator as the production standard to showcasing its QSC5 tech in Ducati field tests and deepening OEM partnerships.

See our latest analysis for QuantumScape.

These milestones have arrived alongside punchy price action, with the latest share price at $12.97 and a powerful year to date share price return of 134.12 percent. The 1 year total shareholder return of 159.92 percent and 3 year total shareholder return of 86.35 percent suggest momentum and expectations around QuantumScape's growth story are building rather than fading.

If QuantumScape's progress has you thinking more broadly about the EV supply chain, it could be a good time to explore other auto innovators through auto manufacturers for fresh ideas.

With QuantumScape rallying hard despite zero revenue and its share price now sitting above the average analyst target, investors face a critical question: Is there still undiscovered upside here, or is the market already banking on flawless execution and future growth?

Most Popular Narrative: 48.1% Undervalued

With QuantumScape last closing at $12.97 against a narrative fair value of $25, the story here leans heavily toward future upside and rapid scaling.

At the heart of QuantumScape''s innovation is its proprietary ceramic separator, a unique component that enables an anode-free lithium metal battery architecture1.... This design allows them to solve the elusive "and problem" , simultaneously achieving multiple critical performance metrics that have long eluded the battery industry3....

Curious what kind of revenue ramp, margin structure, and long term profit multiple could justify nearly doubling today''s price? The narrative spells out bold, quantified assumptions that turn this breakthrough ceramic separator into a full valuation blueprint.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in scaling Cobra driven production or weaker than hoped OEM adoption could quickly deflate expectations embedded in that $25 fair value.

Find out about the key risks to this QuantumScape narrative.

Another Valuation Lens

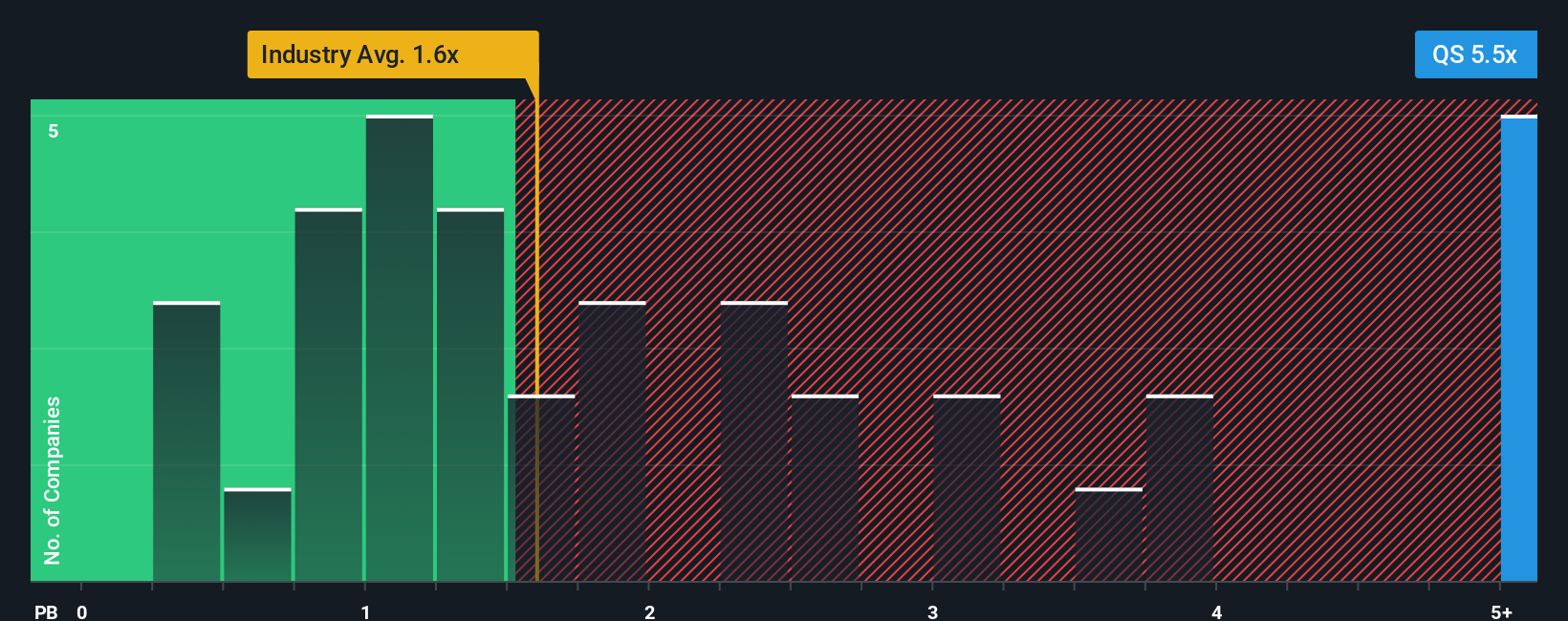

While the narrative points to a fair value of $25, our numbers driven view looks very different. On a price to book basis, QuantumScape trades at 6.4 times, far richer than both the US Auto Components industry at 1.6 times and its peer average of 3.5 times, which implies significantly higher downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you see the numbers differently or want to stress test your own assumptions directly in the model, you can build a tailored view in minutes: Do it your way

A great starting point for your QuantumScape research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you close this tab, consider scanning fresh ideas on Simply Wall Street’s powerful screener so you can explore a wider range of opportunities.

- Look for potential multibaggers by targeting strong businesses trading at attractive valuations through these 909 undervalued stocks based on cash flows.

- Explore the wave of intelligent automation by focusing on companies using technology to transform industries with these 26 AI penny stocks.

- Research developments in computing by examining innovators working in the field with these 27 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026