- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NYSE:NIO) Valuation in Focus After Recent Share Gains and Analyst Price Target Update

Reviewed by Simply Wall St

See our latest analysis for NIO.

Zooming out, NIO’s share price has rebounded sharply over the past three months, hinting at renewed optimism after a long period of declines. While momentum has returned in the short term, the company’s longer-term total shareholder returns still trail well below early investors’ expectations.

If electric vehicles are on your radar, this could be the right time to discover auto innovators beyond NIO. See the full list of opportunities with See the full list for free.

But with shares sitting just below analyst targets and strong recent gains, investors are left asking whether NIO is still undervalued at these levels or if the market is already factoring in all its future growth potential.

Most Popular Narrative: 2.9% Undervalued

NIO closed at $6.71, just below the consensus fair value of $6.91, suggesting that analyst projections see modest undervaluation at current levels. This narrow gap draws focus to the underlying drivers that fuel these expectations.

Strong delivery growth driven by the launch of new high-demand models (ONVO L90, all-new ES8, FIREFLY) and a multi-brand strategy positions NIO to capture a broader user base and higher market share in premium and mainstream EV segments, supporting robust top-line revenue growth and volume leverage. Expansion and densification of NIO's proprietary Power Swap network and charging infrastructure across China's largest cities and highways removes range anxiety and further differentiates NIO from competitors, accelerating EV adoption and increasing recurring services revenue and margin stability.

Want to know what’s behind this price? The narrative is fueled by ambitious growth targets for revenue, vehicle launches, and margin expansion. Find out what bold assumptions drive this verdict. These are not typical analyst projections. Which forces really shape NIO’s future? Read on to see the specific numbers powering the fair value.

Result: Fair Value of $6.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and fierce competition could challenge NIO’s pathway to lasting profitability, particularly if margin improvements do not occur as projected.

Find out about the key risks to this NIO narrative.

Another View: What Do Sales Ratios Reveal?

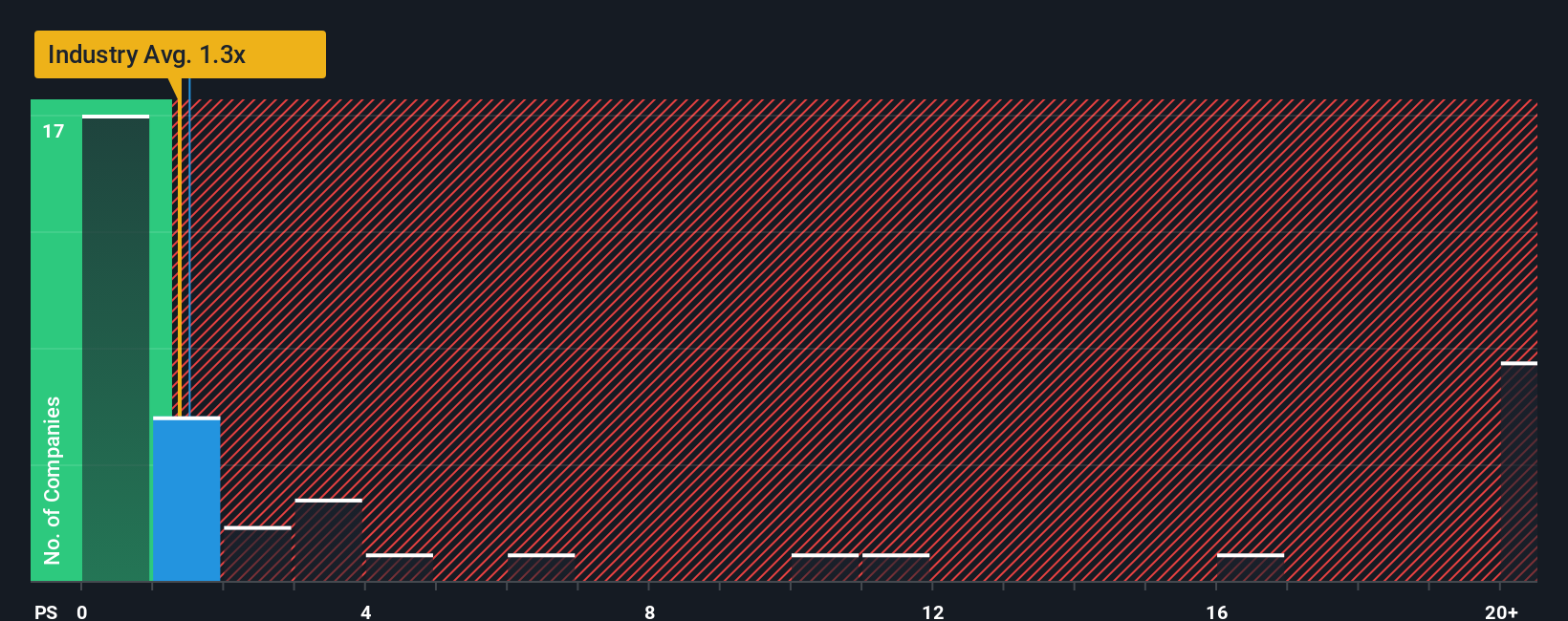

While the fair value estimate suggests NIO is undervalued, its current price-to-sales ratio of 1.7x is higher than the US Auto industry average of 1.1x. However, it is lower than the peer group’s 3.2x. This gap implies NIO may offer value relative to peers but appears expensive by industry standards. Could the market adjust to the fair ratio of 1.4x, altering today’s opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NIO Narrative

If you want to dig deeper, you can interpret the data for yourself and develop a personalized thesis in just a few minutes with Do it your way.

A great starting point for your NIO research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Instantly broaden your watchlist and catch the trends everyone else wishes they saw sooner with these hand-picked market angles:

- Target reliable passive income by comparing high-yield picks inside these 16 dividend stocks with yields > 3% to secure steady returns as rates evolve.

- Tap into big breakthroughs in healthcare innovation by seeing which cutting-edge companies are transforming medicine with these 32 healthcare AI stocks.

- Catch undervalued gems before the crowd by analyzing price gaps in these 871 undervalued stocks based on cash flows based on real cash flow data and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives