- United States

- /

- Auto

- /

- NYSE:NIO

Does NIO’s Lower Q4 Delivery Outlook Challenge the Growth Narrative for NIO (NIO)?

Reviewed by Sasha Jovanovic

- NIO Inc. recently announced third-quarter 2025 results, delivering 87,071 vehicles, up 40.8% from the prior year, and reported improved vehicle gross margins and a narrowing net loss.

- Despite these gains, NIO lowered its fourth-quarter guidance, citing reduced demand following government subsidy reductions, while highlighting continued international expansion and product innovation.

- We’ll explore how NIO’s decision to cut its Q4 delivery outlook amid subsidy cuts impacts the company’s investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NIO Investment Narrative Recap

To be a shareholder in NIO today, an investor must believe in the company’s ability to drive high-volume sales growth, expand internationally, and steadily improve margins, even as challenges in achieving profitability and the volatility of policy support remain. The recent reduction in fourth-quarter delivery guidance highlights policy risk as the most important short-term headwind for NIO; however, as the company still forecasts strong year-over-year delivery growth, the near-term catalyst of sustained volume expansion remains intact but its magnitude is less certain.

The announcement of NIO’s Q4 2025 delivery outlook, now set between 120,000 and 125,000 vehicles, down from previous expectations, directly reflects the impact of subsidy cuts on consumer demand and brings policy risk to the forefront. This announcement is especially relevant for investors tracking whether NIO can maintain the delivery momentum necessary for margin improvement and, ultimately, progress toward breakeven.

But here’s something investors should be fully aware of: while growth potential is significant, the phaseout of subsidies puts the spotlight on…

Read the full narrative on NIO (it's free!)

NIO's forecast projects CN¥148.4 billion in revenue and CN¥7.5 billion in earnings by 2028. This assumes an annual revenue growth rate of 28.8% and a CN¥31.8 billion increase in earnings from the current level of CN¥-24.3 billion.

Uncover how NIO's forecasts yield a $6.83 fair value, a 24% upside to its current price.

Exploring Other Perspectives

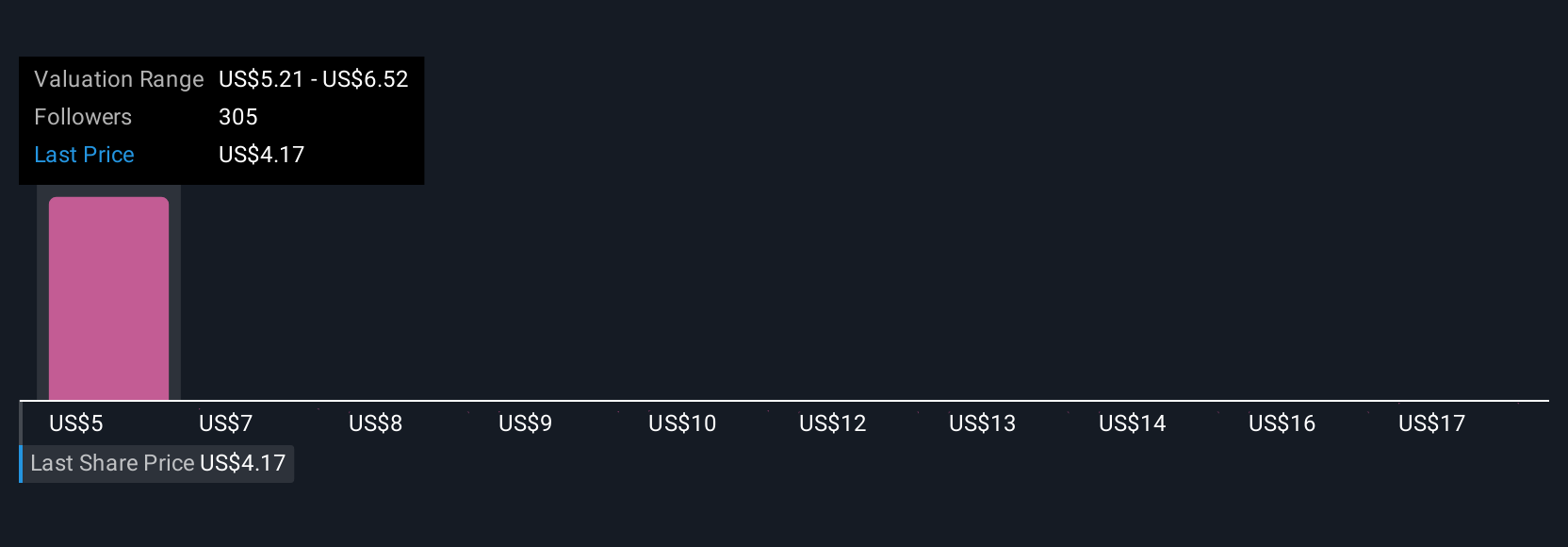

Twenty-one fair value estimates in the Simply Wall St Community put NIO's worth between US$4.18 and US$18.27 per share, revealing broad differences in outlook. With subsidy reductions clouding near-term demand, it is clear that views on NIO’s upside and risks are just as varied, read on for several alternative opinions you should consider.

Explore 21 other fair value estimates on NIO - why the stock might be worth over 3x more than the current price!

Build Your Own NIO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIO's overall financial health at a glance.

No Opportunity In NIO?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.