- United States

- /

- Auto

- /

- NYSE:HOG

The Bull Case For Harley-Davidson (HOG) Could Change Following Strong Q3 Results and Dividend Affirmation

Reviewed by Sasha Jovanovic

- On November 25, 2025, Harley-Davidson's Board of Directors affirmed a cash dividend of US$0.18 per share for the fourth quarter, payable on December 22 to shareholders of record as of December 9.

- This consistent dividend, paired with third quarter earnings and revenue surpassing analyst expectations, highlights continued stability and shareholder-focused financial performance for Harley-Davidson.

- Next, we'll consider how Harley-Davidson's stronger-than-expected earnings might influence analyst views on long-term profitability and growth initiatives.

Find companies with promising cash flow potential yet trading below their fair value.

Harley-Davidson Investment Narrative Recap

To be a Harley-Davidson shareholder, you need to believe in the company’s ability to adapt to evolving consumer trends, revitalize demand for heavyweight motorcycles, and maintain brand relevance despite macro headwinds. The recent fourth-quarter dividend affirmation and earnings beat add to perceptions of near-term stability but do not fundamentally alter the key risk of continued pressure on core revenue growth from weak global motorcycle sales and shifting customer demographics.

Among Harley-Davidson’s recent announcements, the launch of new 2026 motorcycle models stands out as most relevant, aligning with efforts to energize its product lineup and appeal to new buyers. This initiative remains closely tied to key catalysts involving product innovation and brand engagement, viewed as important steps to counteract demand softness and broaden the customer base.

By contrast, investors should also be aware of Harley-Davidson's exposure to declining global motorcycle retail sales, especially as...

Read the full narrative on Harley-Davidson (it's free!)

Harley-Davidson's outlook projects $3.9 billion in revenue and $390.5 million in earnings by 2028. This reflects a 4.4% annual revenue decline and a $147.7 million increase in earnings from the current $242.8 million.

Uncover how Harley-Davidson's forecasts yield a $28.33 fair value, a 16% upside to its current price.

Exploring Other Perspectives

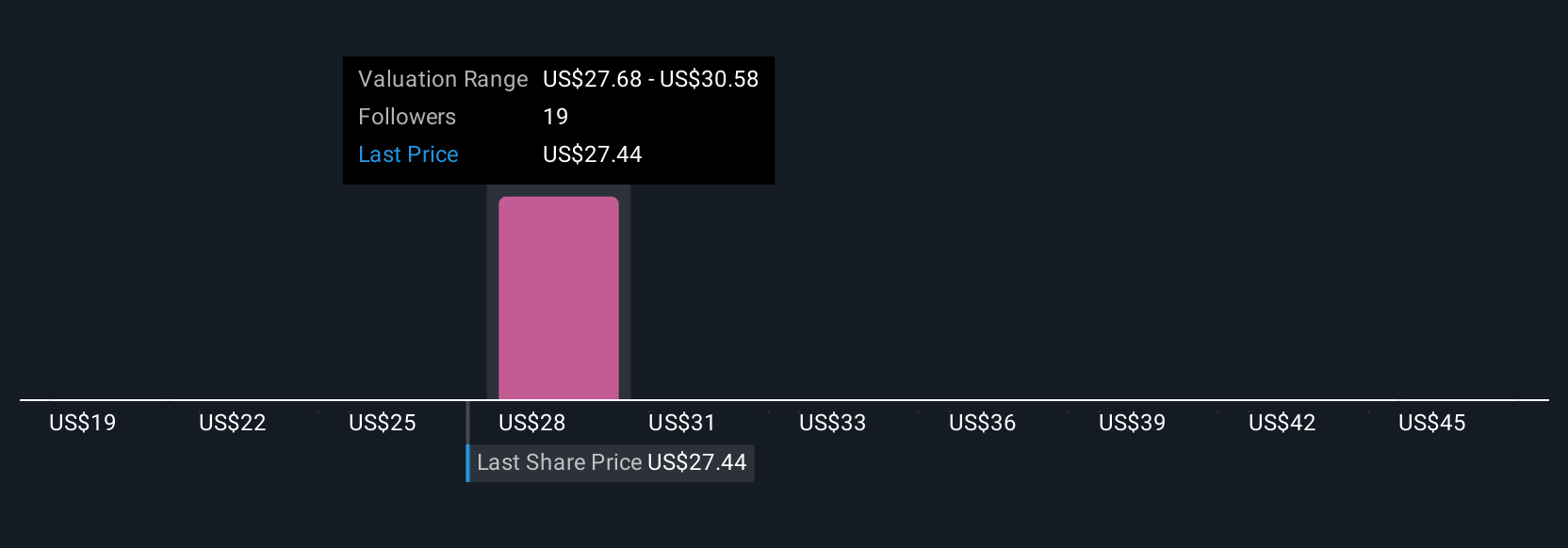

Simply Wall St Community members estimate Harley-Davidson’s fair value between US$19 and US$47.94, with 5 different views reflected in this range. You can see how the risk of persistent weak demand, especially in traditional markets, weighs on the outlook and why it may be useful to compare such diverse opinions.

Explore 5 other fair value estimates on Harley-Davidson - why the stock might be worth as much as 96% more than the current price!

Build Your Own Harley-Davidson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Harley-Davidson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harley-Davidson's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harley-Davidson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026