- United States

- /

- Auto

- /

- NYSE:HOG

Harley-Davidson (HOG) Valuation Discount Clashes With Negative Earnings Outlook in Latest Filings

Reviewed by Simply Wall St

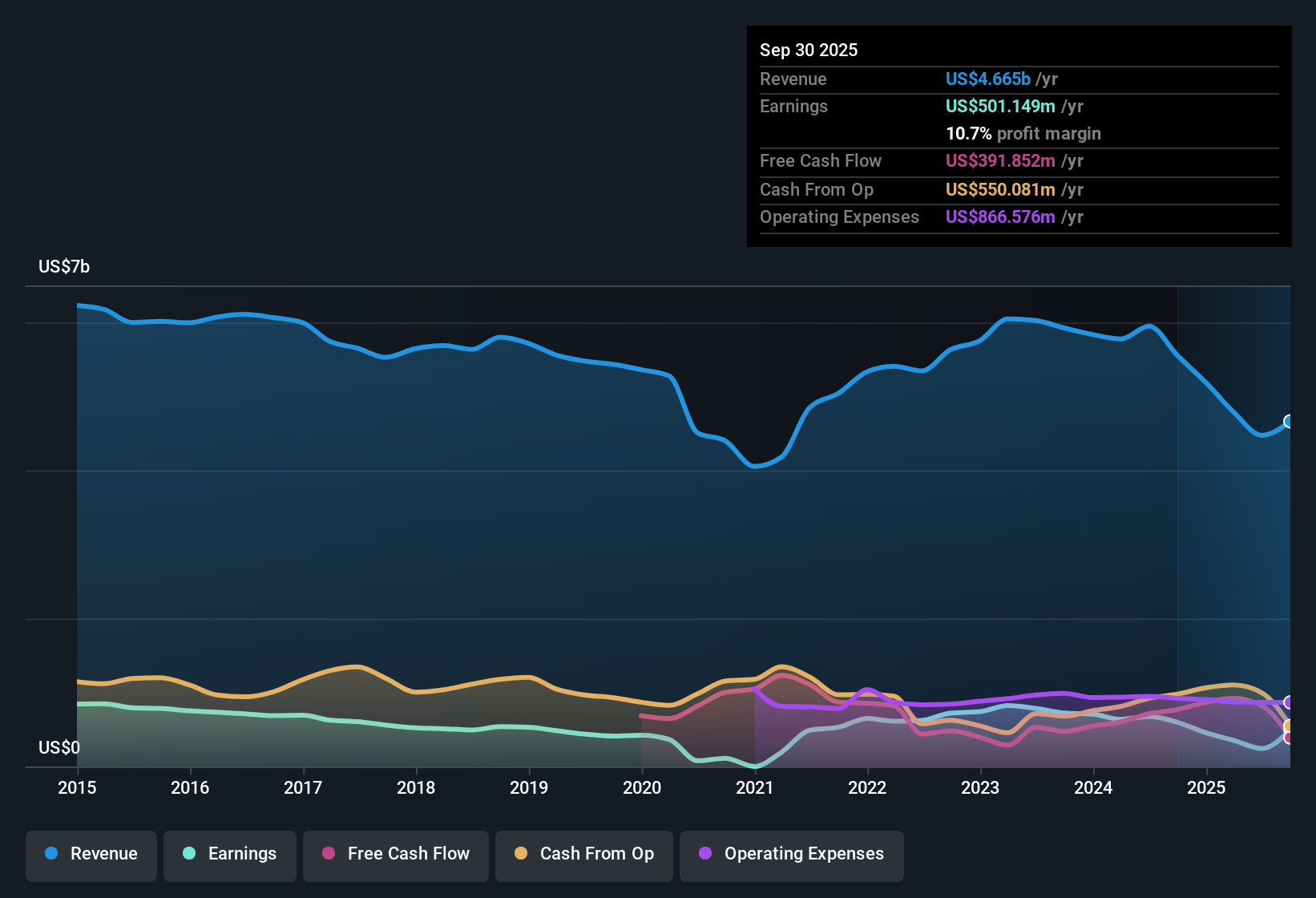

Harley-Davidson (HOG) is facing a challenging road ahead, with the latest filings pointing to a 3.6% annual drop in revenue and a steeper 11.8% annual decline in earnings expected over the next three years. The company’s net profit margin sits at 10.7%, just below last year’s 10.8%, capping off a period where five-year annual earnings growth averaged 7.8% but has now turned negative over the last twelve months. For investors, these results set the stage for tough decisions as attractive value ratios and a history of quality profits meet a decidedly grim earnings outlook.

See our full analysis for Harley-Davidson.Next, we’ll weigh these headline results against the most talked-about narratives on Simply Wall St to see what tracks with the data, and what may be called into question.

See what the community is saying about Harley-Davidson

Profit Margin Remains Resilient

- Harley-Davidson's net profit margin is 10.7%, just a hair below last year's margin of 10.8%. This suggests that cost controls are helping maintain profitability even as both revenue and overall earnings head lower.

- According to the analysts' consensus view, operational efficiencies and recent partnerships are positioned to bolster both short-term profits and long-term flexibility.

- Consensus narrative notes that cost rationalization programs and a strategic $1.25 billion cash unlock via HDFS are freeing up funds for accelerated share buybacks and future growth investments.

- These operational changes are expected to let Harley-Davidson support brand revitalization and expand into new buyer segments, targeting growth even as near-term headwinds persist.

- Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

PE Ratio Flags Deep Discount

- The company's price-to-earnings ratio of 6.2x is substantially below the peer average of 17.3x and industry average of 18.2x. This suggests that Harley-Davidson shares trade at a heavy discount against sector benchmarks.

- Analysts' consensus view highlights the valuation tension. While Harley-Davidson looks attractively priced based on traditional ratios, there is a wide split in opinion about whether the low multiple fairly reflects persistent growth risks.

- Several analysts see the value as justified only if revenue returns to growth and share buybacks boost per-share earnings (with an expected 4.53% annual decline in share count over the next three years).

- Others point to ongoing macro risks and slow progress with new models as reasons the market remains skeptical despite the attractive price tag.

Dividend and Financial Flexibility in Question

- Dividend sustainability is at risk, as weak revenue trends, reliance on heavyweight models, and increased tariff costs leave future cash flow projections on shakier ground compared to prior years.

- Analysts' consensus narrative underlines that, even though efficiency gains and a strong past earnings record support near-term payout ability, high dividend expectations face major tests from declining global motorcycle sales and volatile macroeconomic conditions.

- With global retail sales down 15% year-on-year in Q2 and only 55 electric motorcycles sold versus 158 a year prior, challenges to revenue and margin growth could put further pressure on Harley-Davidson's ability to fund dividends and buybacks.

- This tension grows as ongoing tariff costs, seen at $50 million to $85 million for 2025 alone, threaten to eat into profits and complicate financial planning for growth investments or shareholder returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Harley-Davidson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that stands out to you? It only takes a few moments to build out your own angle and share your perspective. Do it your way

A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Harley-Davidson faces shrinking earnings, uncertain revenue, and questions over its dividend strength and financial flexibility as industry headwinds mount.

If dependable income matters to you, check out these 1982 dividend stocks with yields > 3% to discover companies delivering stronger and more reliable dividend payouts even in challenging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harley-Davidson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives