- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

WeRide (WRD) Is Up 15.4% After Launching Fully Driverless Uber Robotaxis In Abu Dhabi

Reviewed by Sasha Jovanovic

- In November 2025, WeRide and Uber launched Level 4 fully driverless Robotaxi commercial services in Abu Dhabi, the first such deployment in the Middle East and the first city outside the U.S. with fully driverless operations on the Uber platform.

- This rollout, backed by pioneering city-level permits and a path toward breakeven unit economics, highlights WeRide’s growing commercial footprint and regulatory traction in autonomous mobility.

- With WeRide’s autonomous Abu Dhabi rollout gaining scale, we’ll examine how this progress shapes the company’s investment narrative around commercialization.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is WeRide's Investment Narrative?

To own WeRide, you really need to believe that Level 4 robotaxis can move from pilots to scaled, profitable networks, and that the company can defend its early lead in key markets like the Middle East. The fully driverless Uber rollout in Abu Dhabi directly targets one of the main short term catalysts: proving breakeven unit economics on commercial routes rather than just racking up test miles. It also reinforces the regulatory story, adding to permits across multiple countries and helping justify a rich price to sales multiple despite continued losses of over CNY 1 billion in the first nine months of 2025. At the same time, the equity raises and share price volatility underline the biggest risks around dilution, cash burn and execution if utilization or deployment targets slip.

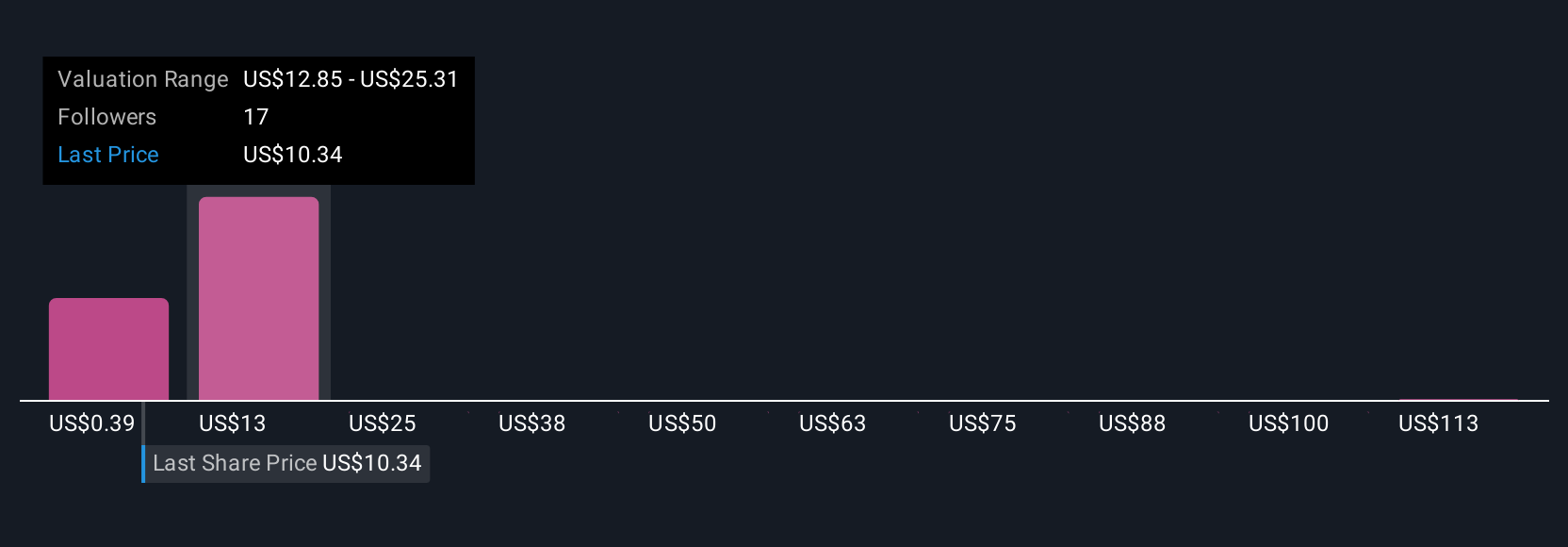

But there is a less obvious execution risk investors should have on their radar. Insights from our recent valuation report point to the potential overvaluation of WeRide shares in the market.Exploring Other Perspectives

Explore 15 other fair value estimates on WeRide - why the stock might be worth less than half the current price!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

An investment holding company, provides autonomous driving products and solutions for mobility, logistics, and sanitation industries in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026