- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

How WeRide’s (WRD) Rapid Capital Moves After Uber Robotaxi Launch May Shape Its Investment Appeal

Reviewed by Sasha Jovanovic

- Uber Technologies and WeRide recently announced the launch of autonomous Robotaxi passenger rides in Riyadh, Saudi Arabia, marking the first public availability of AVs on Uber’s platform in the country and following similar launches in Abu Dhabi.

- Shortly after this commercial milestone, WeRide filed and then withdrew large follow-on equity offerings and a universal shelf registration, highlighting active capital markets engagement alongside its operational expansion.

- We'll examine how WeRide's rapid capital markets actions after its high-profile Uber partnership in Saudi Arabia shape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is WeRide's Investment Narrative?

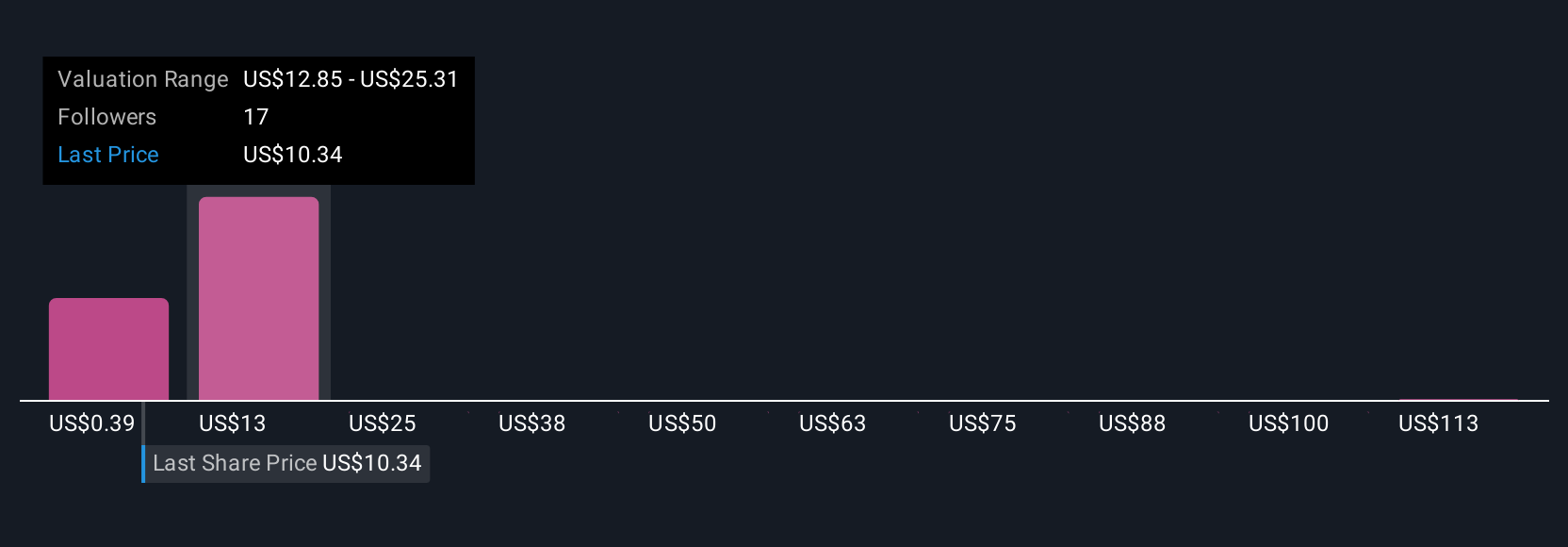

For anyone considering WeRide as an investment, the big picture hinges on belief in autonomous mobility taking off beyond pilot zones and into commercial reality, with WeRide positioned as a key player through rapid geographic and operational expansion. A major short-term catalyst has been market acceptance, highlighted by high-profile partnerships such as the Uber Robotaxi launch in Riyadh, which could accelerate regulatory approvals and commercial deployments. However, the company remains unprofitable, and its quick filing, then withdrawal, of large equity and shelf offerings suggests ongoing uncertainty about funding needs and market appetite. This raised questions about both near-term liquidity and management’s confidence, which could weigh on sentiment if not addressed. The risk environment has clearly shifted, with capital markets execution now firmly in the spotlight. While the operational milestone in Saudi Arabia is significant, the immediate impact on fundamentals or valuation appears modest; recent price moves have been muted and analysts remain cautious on profitability.

However, questions about funding and management’s next moves are important for investors to consider.

Exploring Other Perspectives

Explore 16 other fair value estimates on WeRide - why the stock might be a potential multi-bagger!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

An investment holding company, provides autonomous driving products and solutions for mobility, logistics, and sanitation industries in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives