- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

Can WeRide’s Dual Listing Strategy Redefine Global Ambitions for Autonomous Vehicles (WRD)?

Reviewed by Sasha Jovanovic

- WeRide Inc. recently completed a historic dual primary listing on the Hong Kong Stock Exchange, raising HK$2.39 billion through an oversubscribed offering of 88.25 million shares as the world's first public robotaxi company with listings in both Hong Kong and the US.

- This move not only increases WeRide's access to global capital markets but also positions the company to accelerate the commercialization and expansion of its autonomous vehicle fleet worldwide.

- We'll explore how WeRide's dual listing and ambitious autonomous fleet expansion could shape the company's broader investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is WeRide's Investment Narrative?

To be a shareholder in WeRide right now, you have to believe in the enormous long-term potential of autonomous mobility and the company’s ability to scale globally, especially as the first robotaxi operator listed on both the Hong Kong and US exchanges. The recent Hong Kong dual listing is a major milestone that shores up capital for WeRide, supports ambitious expansion plans, and gives the company more flexibility amid cross-border regulatory risks. With proceeds of about HK$2.39 billion, WeRide aims to accelerate L4 fleet deployment, AI development, and international partnerships. However, immediate catalysts such as rapid regulatory approvals in new markets or mass adoption remain uncertain, especially after a volatile share debut and sharp price declines. The extra liquidity and global exposure could help offset some balance sheet risks, but dilution remains a concern. Investors should also weigh ongoing losses, high valuation multiples, limited board experience, and recent market underperformance. After the dual listing, the biggest change is that funding risk may ease, but operational and execution risks grow more important as scaling ramps up. On the other hand, uncertainty about path to profitability remains a key consideration investors should be aware of.

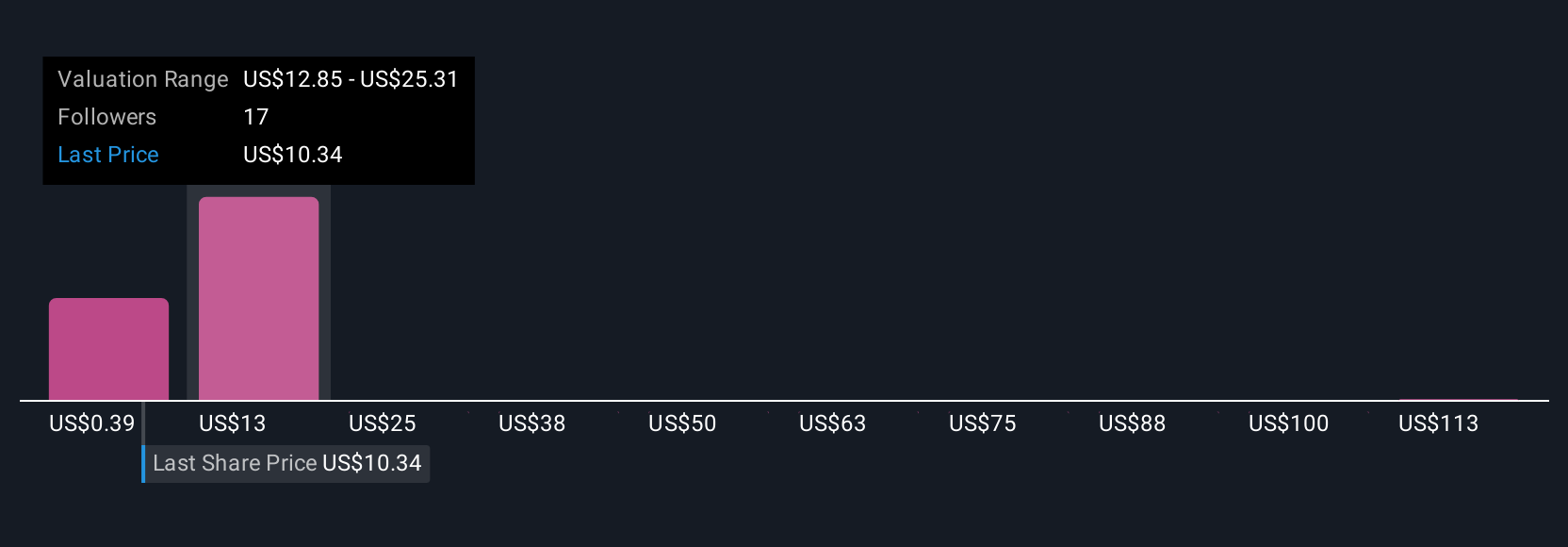

Upon reviewing our latest valuation report, WeRide's share price might be too optimistic.Exploring Other Perspectives

Explore 15 other fair value estimates on WeRide - why the stock might be worth less than half the current price!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

An investment holding company, provides autonomous driving products and solutions for mobility, logistics, and sanitation industries in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives