- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Expands Supercharger Network with GM Alliance, Boosting EV Charging Access

Reviewed by Simply Wall St

Get an in-depth perspective on Tesla's performance by reading our analysis here.

Strengths: Core Advantages Driving Sustained Success For Tesla

Tesla's robust growth and profitability are evident, with record quarterly revenues achieved despite numerous challenges, as highlighted by CEO Elon Musk. Energy storage deployments reached an all-time high in Q2, contributing significantly to the company's profits. CFO Vaibhav Taneja noted a positive free cash flow of $1.3 billion in Q2, underscoring Tesla's strong financial health. Innovation remains a cornerstone, particularly in autonomy, which Musk identifies as Tesla's biggest differentiator. The company is also set to deliver a more affordable model early next year, broadening its market reach. Additionally, Tesla's expanding customer base, with over two-thirds of Q2 U.S. deliveries to first-time Tesla owners, showcases its growing brand appeal.

Weaknesses: Critical Issues Affecting Tesla's Performance and Areas For Growth

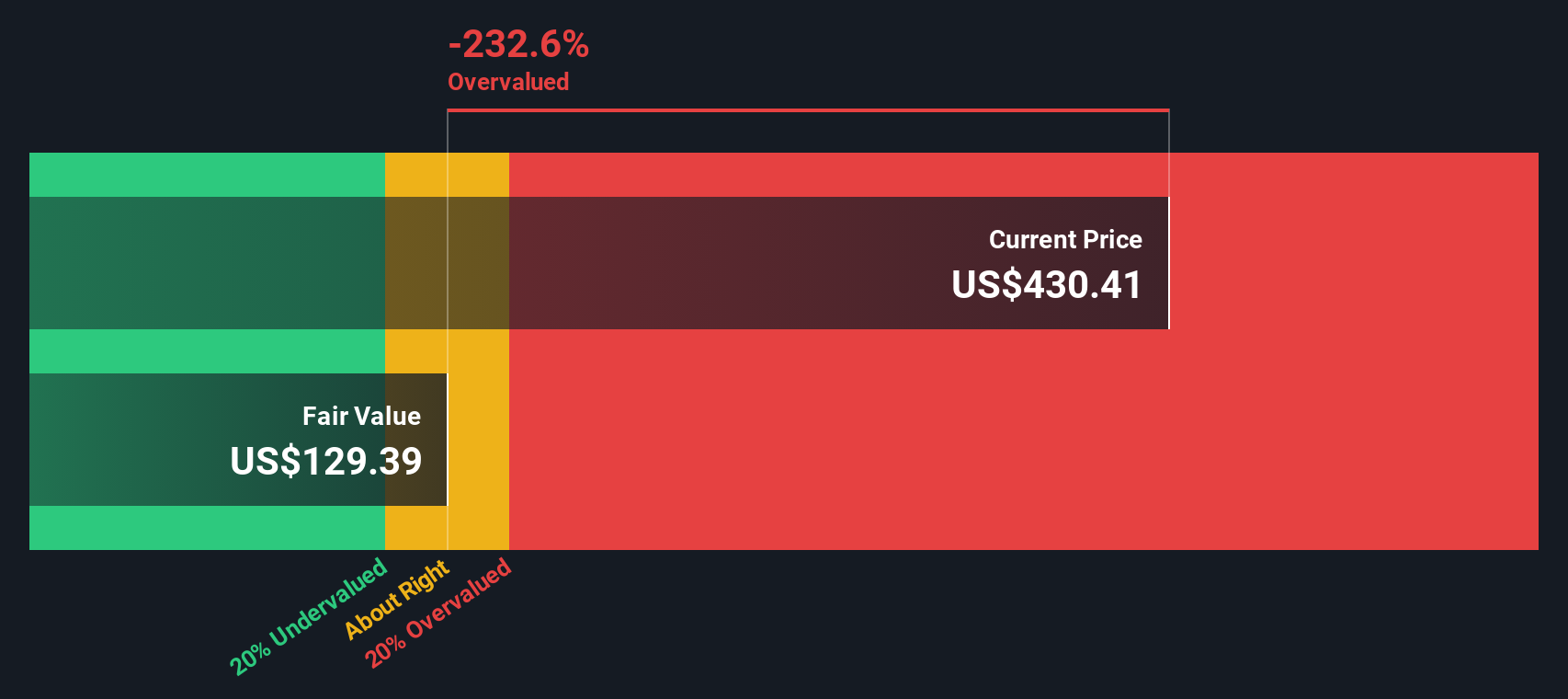

Tesla's valuation presents a significant challenge, as it is considered expensive with a Price-To-Earnings Ratio (61.4x), markedly higher than the global auto industry average (12.4x) and peer average (21.4x). The stock is trading above the estimated fair value of $145.67. Market competition is intensifying, with new entrants offering substantial discounts on their EVs, making it harder for Tesla to maintain its pricing power. Performance issues are also notable, with cost per vehicle decreasing sequentially when excluding the Cybertruck's impact, but near-term costs are expected to rise. Additionally, Tesla's current net profit margins (13%) have stagnated compared to the previous year, and its earnings growth over the past year (1.3%) is significantly below its five-year average of 56.2% per year.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Tesla is strategically expanding its operations, nearing completion of the South expansion of Giga Texas, which will house its largest training cluster to date. Production ramp-ups in the U.S. and the construction of the Megapack factory in China are set to double output, enhancing Tesla's market position. The energy storage backlog remains strong, and the expansion of the supercharging network aims to address range anxiety, a key concern for EV buyers. Furthermore, Tesla's revenue (14.1% per year) and earnings (16.6% per year) are forecast to grow faster than the U.S. market averages, indicating robust future growth potential. The company's seasoned management team and experienced board of directors provide a solid foundation for executing these strategic initiatives.

Threats: Key Risks and Challenges That Could Impact Tesla's Success

Competition remains a significant threat, with new EV models entering the market and aggressive pricing strategies from rivals. Economic factors, such as the impact of revenue per unit due to ongoing programs, are expected to persist into Q3, potentially affecting profitability. Regulatory issues also pose challenges, with adjustments needed in Tesla's import strategy from China to Europe. Additionally, potential tariffs on vehicles produced in Mexico, as suggested by political developments, could impact Tesla's cost structure and market dynamics. The company's high level of non-cash earnings further complicates its financial landscape, adding another layer of risk to its overall performance.

Conclusion

Tesla's strong financial health, driven by record quarterly revenues and significant contributions from energy storage deployments, underscores its capacity for sustained growth. However, the company's high Price-To-Earnings Ratio (61.4x) compared to the global auto industry average (12.4x) and peer average (21.4x), coupled with its stock trading above the estimated fair value of $145.67, suggests that investors are paying a premium for Tesla's future growth prospects. While strategic expansions and innovations in autonomy position Tesla well for future market opportunities, intensifying competition and regulatory challenges could impact profitability. Overall, while Tesla's growth potential remains promising, its current valuation reflects a high level of market optimism that must be carefully managed against these emerging risks.

Turning Ideas Into Actions

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with moderate growth potential.