- United States

- /

- Healthcare Services

- /

- NasdaqGS:PFMT

US Penny Stocks: 3 Picks With Market Caps Over $100M

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory with major indices like the S&P 500 and Dow Jones Industrial Average hitting fresh records, investors are increasingly exploring diverse opportunities beyond traditional large-cap stocks. Penny stocks, though often seen as a relic of speculative trading, still hold potential for growth when backed by robust financials and sound business models. In this article, we examine several penny stocks that demonstrate strong fundamentals, offering investors a chance to discover under-the-radar companies with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.83945 | $6.1M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.80 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.233 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.39 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8899 | $80.04M | ★★★★★☆ |

| Information Services Group (NasdaqGM:III) | $3.11 | $173.23M | ★★★★☆☆ |

Click here to see the full list of 729 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Blade Air Mobility (NasdaqCM:BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation alternatives to alleviate congested ground routes in the United States and has a market cap of approximately $258.44 million.

Operations: The company's revenue is derived from two main segments: Medical, contributing $142.42 million, and Passenger services, generating $99.39 million.

Market Cap: $258.44M

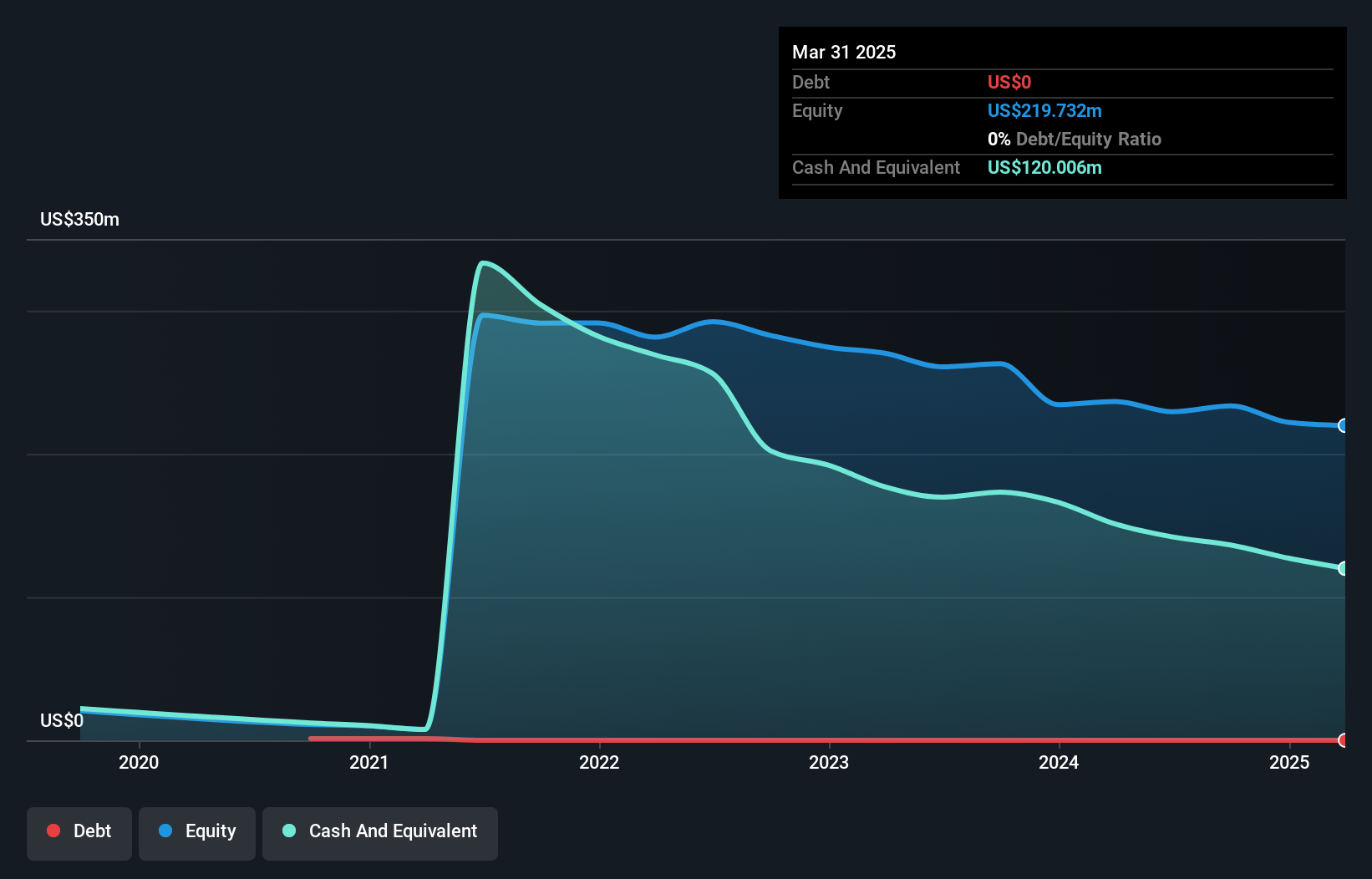

Blade Air Mobility, Inc. has shown revenue growth with US$194.34 million for the first nine months of 2024, compared to US$177.7 million the previous year, though it remains unprofitable with a net loss of US$17.51 million. The company is debt-free and its short-term assets exceed both short- and long-term liabilities, indicating strong financial positioning despite recent shareholder dilution by 4.9%. Strategic partnerships with Supernal LLC and Qatar Airways aim to enhance Blade's air mobility offerings and expand market reach in urban air transport solutions, potentially bolstering future revenue streams within the growing AAM sector.

- Dive into the specifics of Blade Air Mobility here with our thorough balance sheet health report.

- Explore Blade Air Mobility's analyst forecasts in our growth report.

Performant Financial (NasdaqGS:PFMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Performant Financial Corporation offers technology-enabled audit, recovery, and analytics services in the United States with a market cap of $248.18 million.

Operations: The company generates revenue from its Business Services segment, which amounts to $120.78 million.

Market Cap: $248.18M

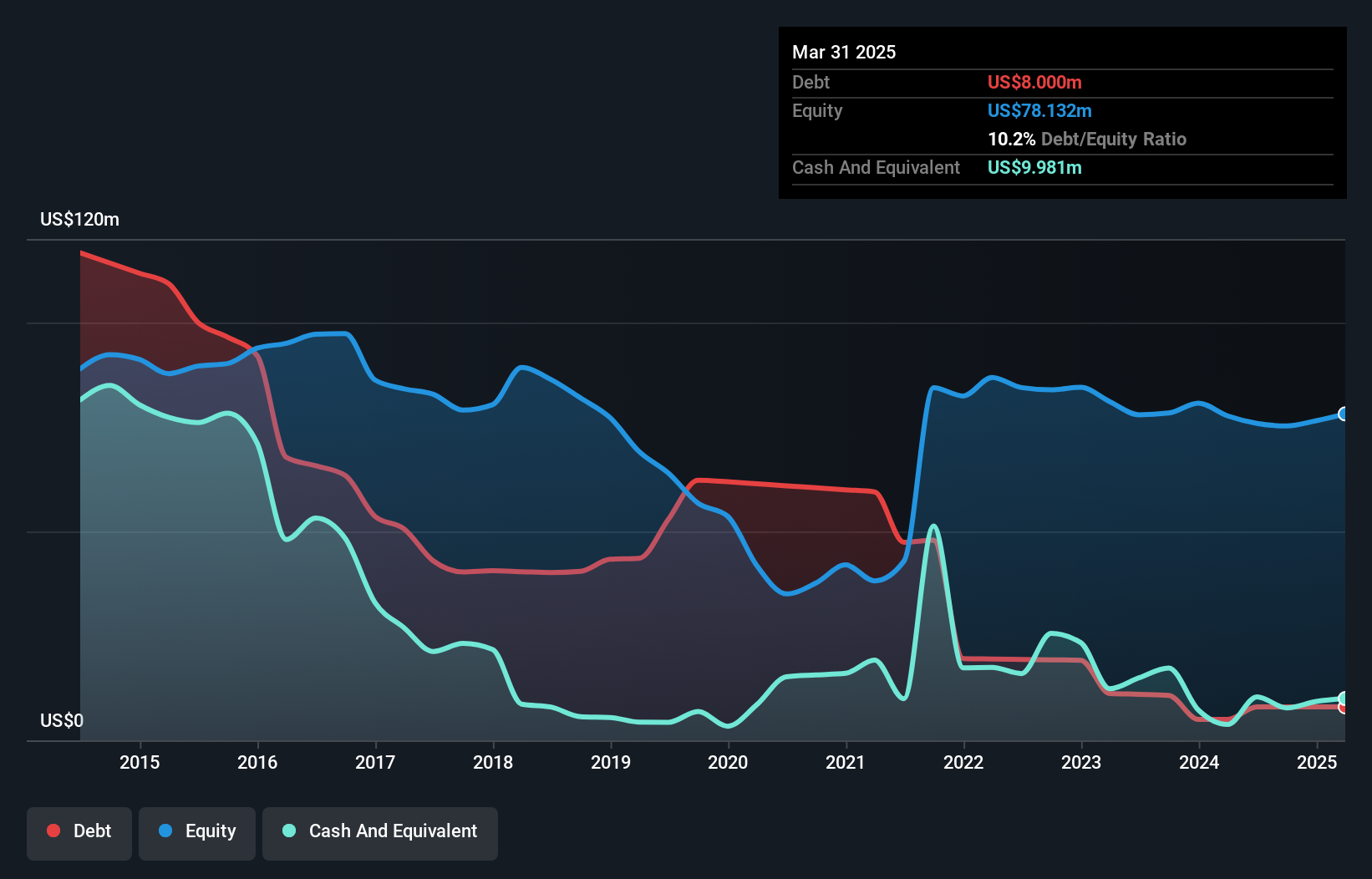

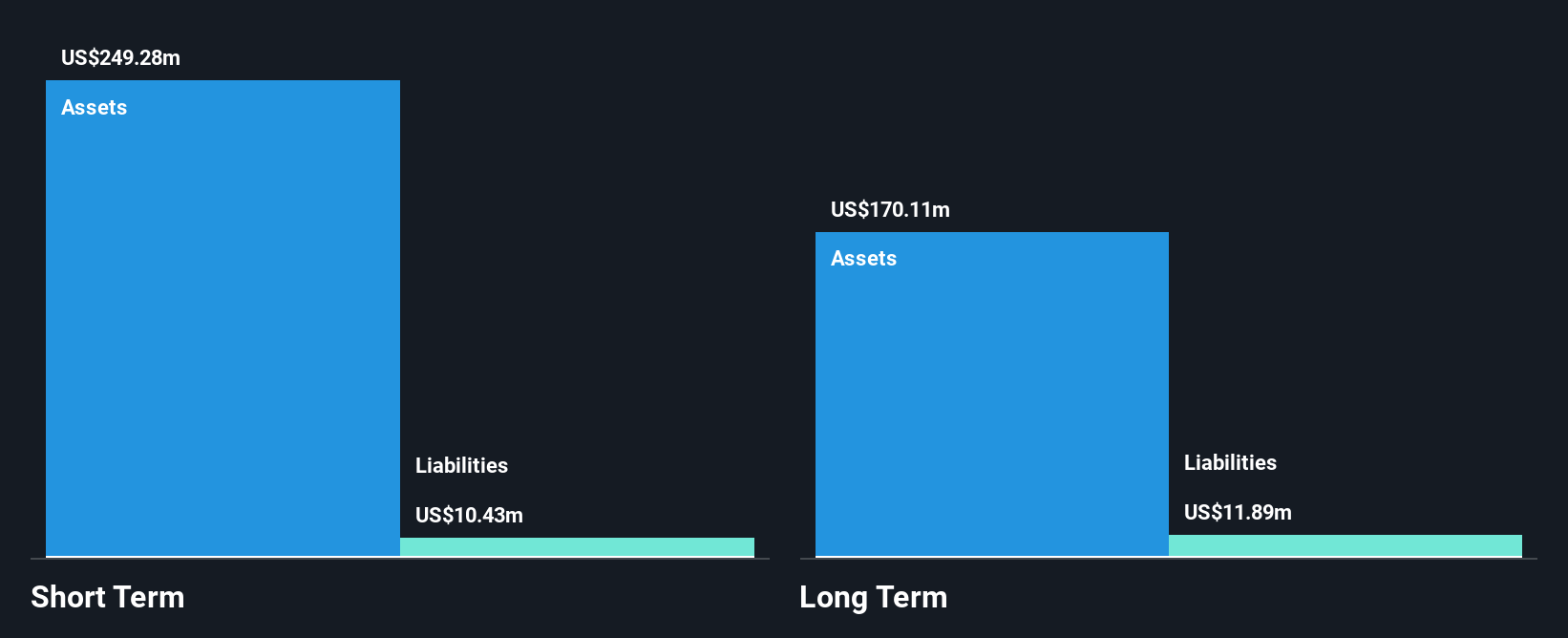

Performant Financial Corporation, with a market cap of US$248.18 million, continues to navigate its unprofitable status despite revenue growth in its Business Services segment, reporting US$31.52 million in Q3 2024 sales up from the previous year. The company maintains a satisfactory net debt to equity ratio and sufficient short-term assets to cover liabilities, but challenges persist as net losses widened to US$2.38 million for the quarter. Analysts predict significant stock price appreciation potential while Performant reiterates its 2024 guidance amidst healthcare market volatility, expecting revenues between US$117 million and US$122 million for the year.

- Click here and access our complete financial health analysis report to understand the dynamics of Performant Financial.

- Assess Performant Financial's future earnings estimates with our detailed growth reports.

Solid Power (NasdaqGS:SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. develops solid state battery technologies for electric vehicles and other markets in the United States, with a market cap of approximately $198.43 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, totaling $18.03 million.

Market Cap: $198.43M

Solid Power, Inc., with a market cap of approximately US$198.43 million, is navigating challenges as it remains unprofitable and has seen increased net losses year-over-year. Despite generating US$15.68 million in revenue for the first nine months of 2024, the company's earnings guidance projects annual revenues between US$16 million and US$20 million. The management team is relatively new, with an average tenure of 1.3 years, which may impact strategic execution. Solid Power remains debt-free with sufficient short-term assets to cover liabilities and a cash runway extending beyond a year if free cash flow trends persist.

- Take a closer look at Solid Power's potential here in our financial health report.

- Learn about Solid Power's future growth trajectory here.

Key Takeaways

- Investigate our full lineup of 729 US Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFMT

Performant Financial

Provides technology-enabled audit, recovery, and analytics services in the United States.

Excellent balance sheet and slightly overvalued.