- United States

- /

- Auto Components

- /

- NasdaqGS:PATK

Patrick Industries (PATK): Assessing Valuation After Latest Dividend Hike Signals Confidence

Reviewed by Simply Wall St

Patrick Industries (PATK) is increasing its quarterly dividend from $0.40 to $0.47 per share, a decision that highlights the company’s continued focus on rewarding shareholders. This move reflects confidence in its ongoing financial performance and balance sheet strength.

See our latest analysis for Patrick Industries.

Patrick Industries has enjoyed impressive momentum this year, with its share price climbing over 30% year-to-date and a strong 20.7% total shareholder return over the past twelve months. Even as its latest dividend boost makes headlines, this announcement follows a period of solid financial growth and investor interest. This reinforces a longer-term trend, as total returns have surged by nearly 195% over three years, underscoring the company’s durability and appeal.

If strong shareholder returns and dividend hikes appeal to you, now’s a great moment to broaden your horizons and discover See the full list for free.

With Patrick Industries’ recent run-up and a dividend hike now on the table, investors may be wondering if the current price offers real value or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 3.1% Undervalued

According to the most widely followed narrative, Patrick Industries’ fair value estimate sits marginally above the latest close. With shares last trading at $106.83 versus an implied fair value of $110.20, the valuation gap is slim, and debate around forward expectations is intensifying.

Ongoing innovation and product expansion, such as proprietary composite roofing systems, digital dashboards, integrated marine tower systems, and value-added content for utility vehicles, position Patrick to capture more content per unit. This drives both organic revenue growth and margin expansion through higher-value engineered offerings.

Want to know what’s fueling the bullish case? There’s a sharp focus on future profit margins, ambitious revenue forecasts, and a profit multiple that rivals sector leaders. Which financial assumptions make this price target possible? Click through and see for yourself.

Result: Fair Value of $110.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a prolonged slump in RV demand could easily challenge the current growth and profit outlook for Patrick Industries.

Find out about the key risks to this Patrick Industries narrative.

Another View: Market Ratios Suggest Overvaluation Risk

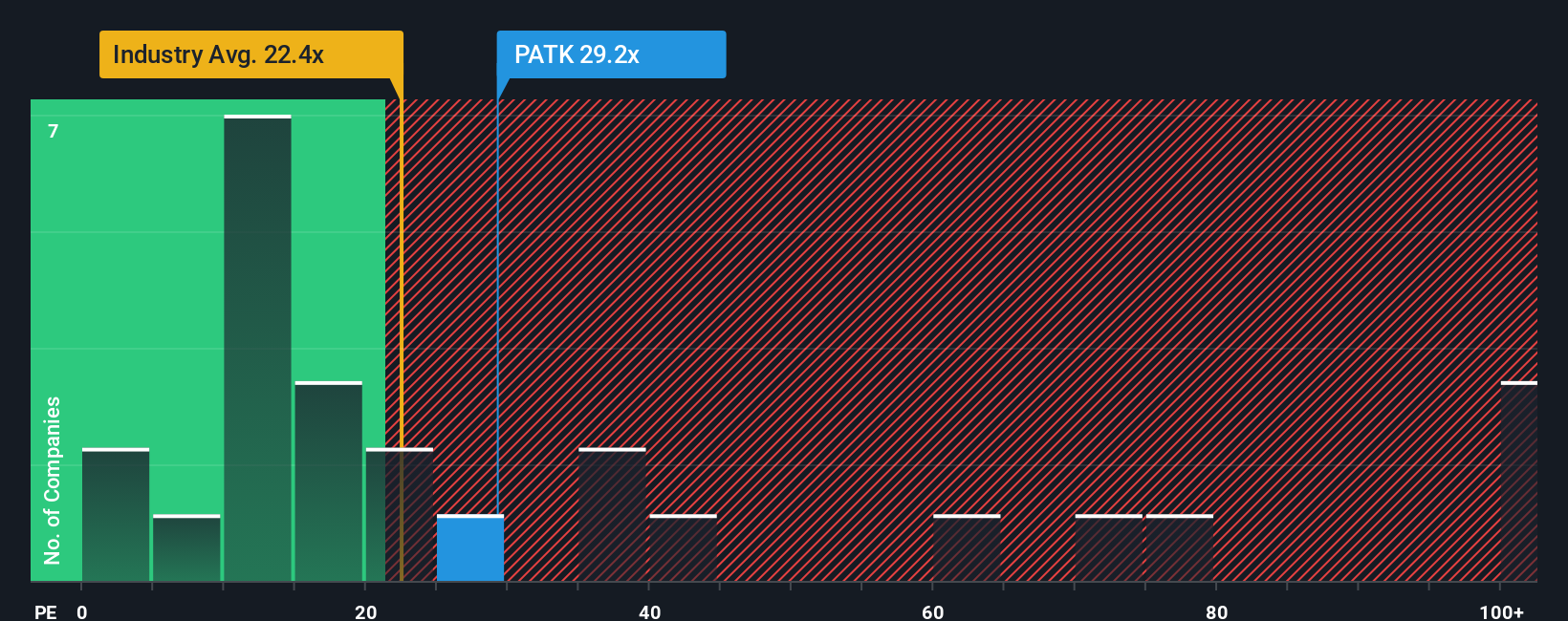

While the fair value narrative points to a modest upside, market valuation ratios paint a different picture. Patrick Industries trades at 29.5 times earnings, which is well above both its peer average of 18.7x and the US Auto Components industry average of 21.3x. Its current ratio also outpaces the fair ratio estimate of 18.1x, raising potential red flags for investors wary of paying a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Patrick Industries Narrative

Not convinced by the prevailing view, or do you prefer a hands-on approach? Dive into the data and craft your own story in just a few minutes: Do it your way

A great starting point for your Patrick Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to broaden your portfolio and tap into sectors where momentum and opportunity are accelerating. Let these powerful stock ideas guide your next move. Missing out could mean passing up tomorrow’s top performers.

- Uncover unique opportunities by targeting income with these 14 dividend stocks with yields > 3%, which offer attractive yields and financial stability.

- Ride the innovation wave by identifying future industry leaders through these 25 AI penny stocks, which are pioneering breakthrough technology.

- Capture strong upside potential by evaluating these 923 undervalued stocks based on cash flows that are trading well below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PATK

Patrick Industries

Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026