- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

The Bull Case For Mobileye Global (MBLY) Could Change Following Surge in Technical and Quantitative Trading Signals

Reviewed by Sasha Jovanovic

- In recent days, Mobileye Global experienced a shift in investor sentiment as technical reversal indicators and quantitative models pointed to a possible bullish lean after a period of heightened volatility.

- Notably, anticipation of a potential Federal Reserve interest rate cut and the emergence of new institutional trading strategies have contributed to growing investor attention toward the stock.

- We’ll now explore how increased trading activity driven by technical signals could influence Mobileye Global’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mobileye Global Investment Narrative Recap

To be a shareholder in Mobileye Global, you would likely need to believe in the continuing adoption of advanced driver assistance and autonomous driving technologies by automakers and the company’s ability to secure new design wins. While recent technical signals and interest rate speculation have brought more attention to the stock in the short term, these developments may not materially affect the most important catalyst: Mobileye's ongoing OEM partnerships and volume ramp, nor do they address key risks like global trade uncertainties or OEM purchasing delays.

Among recent announcements, Mobileye’s selection by a leading automaker to supply Imaging Radar™ for an upcoming SAE Level 3 driving system stands out. This milestone underscores the relevance of technology adoption as a core catalyst, particularly as institutional models now flag short-term trading opportunities that may align with broader industry momentum toward automation. In contrast, investors should be aware of how potential trade frictions and tariff volatility could...

Read the full narrative on Mobileye Global (it's free!)

Mobileye Global's outlook anticipates $3.0 billion in revenue and $111.5 million in earnings by 2028. This scenario relies on a 15.6% annual revenue growth rate and a $3.1 billion increase in earnings from current earnings of -$3.0 billion.

Uncover how Mobileye Global's forecasts yield a $19.35 fair value, a 68% upside to its current price.

Exploring Other Perspectives

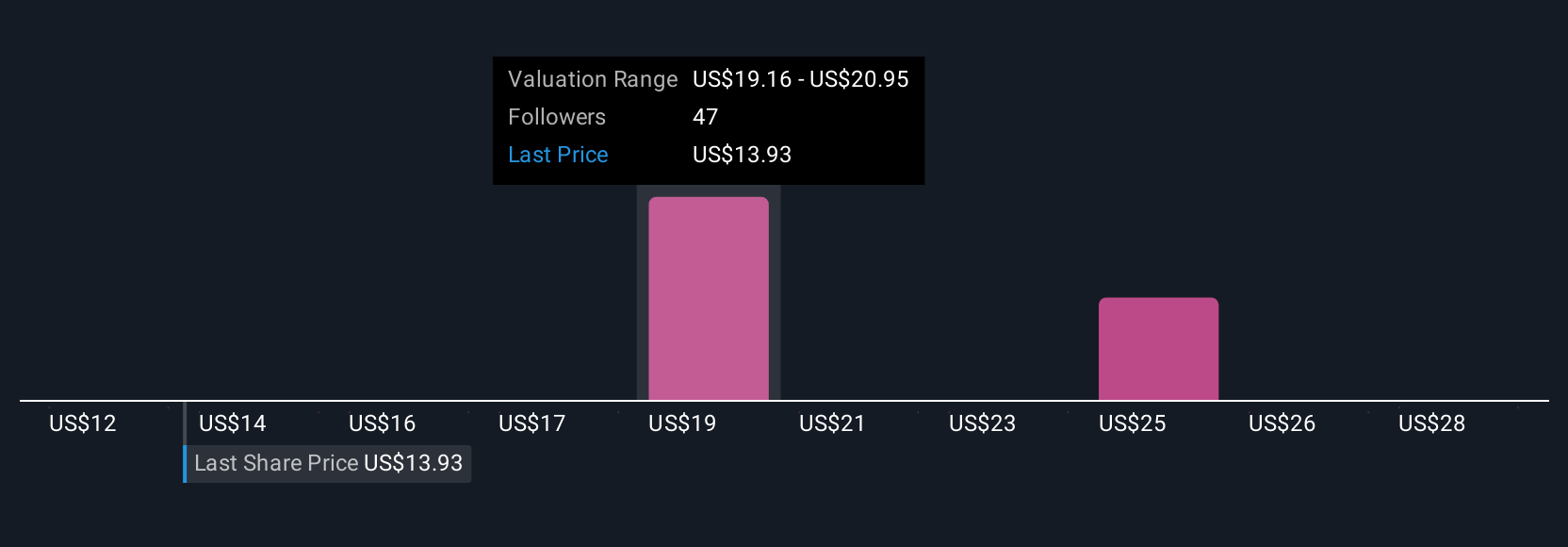

Four fair value estimates from the Simply Wall St Community range between US$12 and US$20.95 per share, reflecting a wide spectrum of views. While some participants anticipate upside from future OEM agreements, others highlight how global trade risks could shape Mobileye’s growth, inviting you to explore several alternative viewpoints.

Explore 4 other fair value estimates on Mobileye Global - why the stock might be worth just $12.00!

Build Your Own Mobileye Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobileye Global research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mobileye Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobileye Global's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026