- United States

- /

- Auto Components

- /

- NasdaqGM:KDK

What Kodiak AI (KDK)'s $1.56 Billion Shelf Registration Could Mean for Future Expansion Plans

Reviewed by Sasha Jovanovic

- Kodiak AI, Inc. recently closed its shelf registration dated October 10, 2025, allowing it to offer up to US$1.56 billion in common stock and warrants.

- This move highlights Kodiak AI's potential focus on capital raising and future investment opportunities, which often signals new projects or expansion plans.

- We'll explore how this significant fundraising capacity could influence Kodiak AI's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kodiak AI's Investment Narrative?

For anyone considering Kodiak AI, the core belief centers on the long-term potential of autonomous trucking and the company’s ability to capture meaningful market share in this emerging space. The recent closure of a US$1.56 billion shelf registration stands out, suggesting management is preparing to unlock significant capital for ambitious next steps, possibly fresh investment, R&D, or acquisitions. However, with auditor concerns over Kodiak’s ability to continue as a going concern and steep net losses that have accelerated year-over-year, financial risks remain front and center. Until now, cash runway and capital constraints were among the most pressing risks; this fundraising move could ease those worries if Kodiak successfully raises funds, thereby improving its ability to support growth catalysts like expanded partnerships and deployments. Still, given the sharp share price drop and ongoing dilution, the impact of this shelf registration on near-term investor confidence is yet to be seen. In contrast, funding uncertainty is still a critical issue Kodiak shareholders should be aware of.

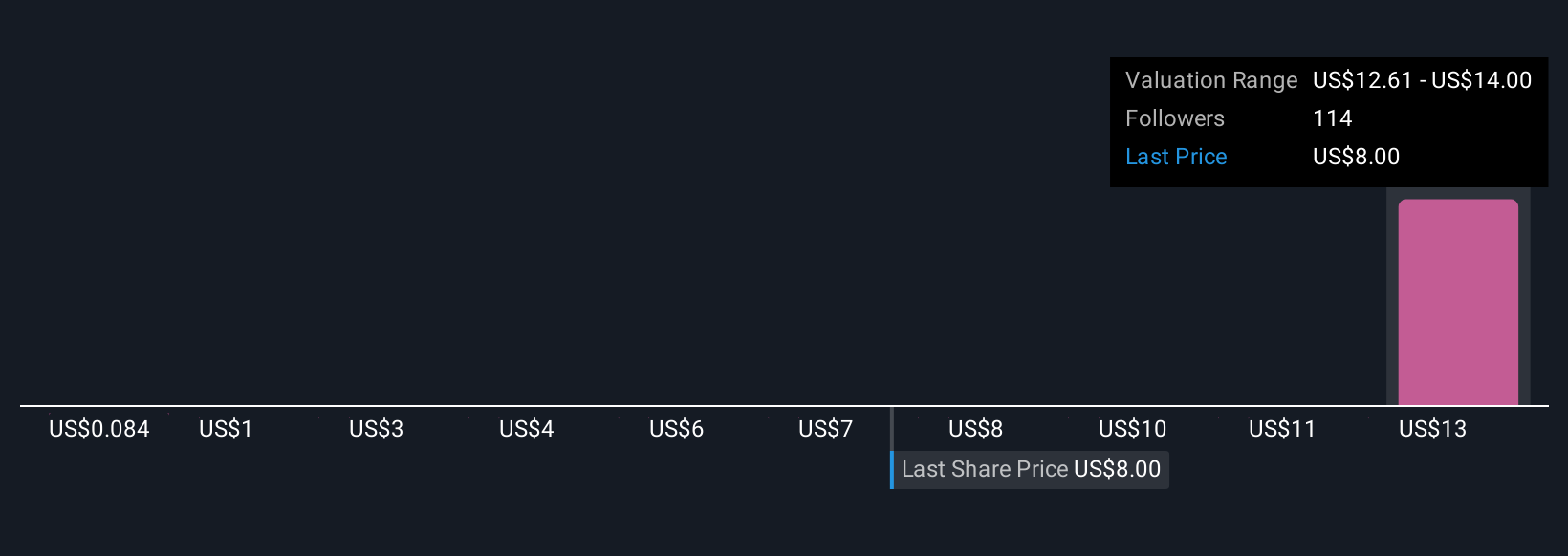

Our valuation report here indicates Kodiak AI may be overvalued.Exploring Other Perspectives

Explore 3 other fair value estimates on Kodiak AI - why the stock might be worth less than half the current price!

Build Your Own Kodiak AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak AI research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kodiak AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak AI's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KDK

Kodiak AI

Engages in the development of autonomous vehicle technology and related services.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026