- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

How Gentex's (GNTX) SEMA Launch of Slim Rearview Mirror Reframes Its Aftermarket Growth Narrative

Reviewed by Sasha Jovanovic

- At the recent SEMA 2025 show, Gentex showcased a new slim-profile, carbon-fiber automatic-dimming rearview mirror designed for the custom car market, in partnership with Ringbrothers, with availability expected in the first quarter of 2026.

- This move underscores Gentex’s growing emphasis on expanding its presence in the automotive aftermarket and leveraging collaborations to introduce advanced technologies tailored specifically for specialty and custom vehicles.

- We will now consider how Gentex's focus on aftermarket innovation, highlighted by its SEMA launch, could influence its investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gentex Investment Narrative Recap

To be a Gentex shareholder, you need to believe that the company's innovation in automotive vision and safety technology can drive growth, even as pressures like decontenting and cost sensitivity in key markets persist. The SEMA 2025 mirror launch highlights Gentex’s aftermarket ambitions, but is unlikely to move the needle on its most important short-term catalyst: accelerating content gains in mainstream OEM vehicle programs. It also does not materially alter the company’s biggest risk, structural feature removal trends among Chinese automakers.

Among recent announcements, Gentex’s third-quarter results are most applicable here. While sales grew to US$655.24 million, net income declined year-over-year, reinforcing the significance of sustained margin and content-per-vehicle improvements as a near-term driver for the stock following its aftermarket initiatives showcased at SEMA.

Yet, investors should also keep in mind the contrasting risk that despite these new launches, ongoing automotive feature decontenting in China could still materially...

Read the full narrative on Gentex (it's free!)

Gentex's outlook projects $3.0 billion in revenue and $529.5 million in earnings by 2028. This is based on a 7.4% annual revenue growth rate and a $134.7 million increase in earnings from the current $394.8 million.

Uncover how Gentex's forecasts yield a $30.06 fair value, a 30% upside to its current price.

Exploring Other Perspectives

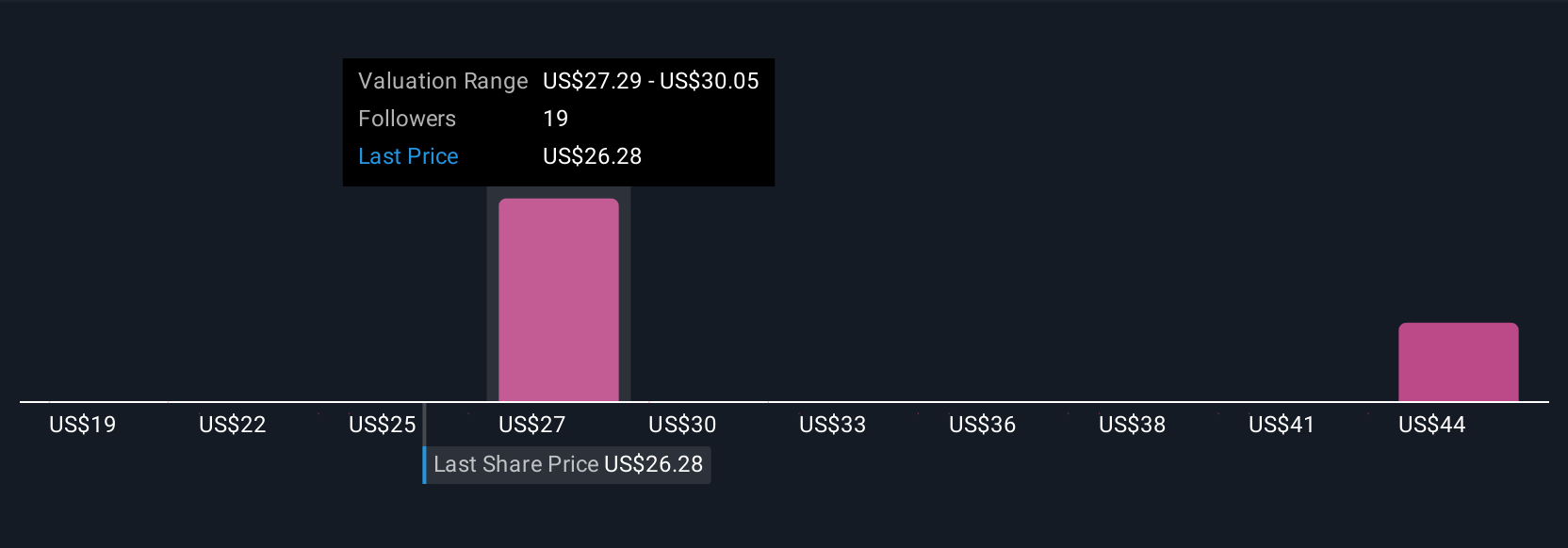

Four recent fair value estimates from the Simply Wall St Community range from US$19 to US$39.79 per share. With investor views so varied, it's important to weigh how Gentex’s efforts to offset risk from global decontenting and margin pressure could play out in shaping future returns.

Explore 4 other fair value estimates on Gentex - why the stock might be worth 18% less than the current price!

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives